- Bordeaux prices have hit support levels across top wines and prime vintages.

- First Growths lead the way in market stabilisation.

- The market’s most reliable signals of recovery – improved liquidity, narrowing spreads, and renewed price consistency – are beginning to appear in Bordeaux.

In July, WineCap reported that Champagne prices appeared to be stabilising. Our research into the ten most-searched prestige cuvées on Wine-Searcher found that 47 out of 50 wines had maintained price stability for at least three months – and 40 for six months or more. Since then, the Liv-ex Champagne 50 index has risen 1.6% on average.

Fast forward a few months, and signs of stabilisation have begun to emerge across the broader fine wine market. The Liv-ex 100 index, which represents the most sought-after fine wines globally, rose 2% over September and October. Gains were supported by sterling weakness, renewed buyer demand, and an improving bid:offer ratio, all suggesting that confidence is returning to the market.

Bordeaux, still the largest and most liquid segment of the fine wine world, also reflects this shift. Our latest research reveals that a growing share of Bordeaux’s top wines – from First Growths to leading Second Growths – have found support levels after a prolonged correction, suggesting the market may be nearing its floor.

Our methodology

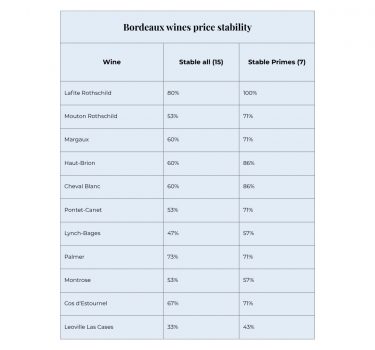

To identify whether Bordeaux prices are indeed hitting support levels, WineCap analysed two baskets of wines across fifteen physical vintages:

- First Growths + Cheval Blanc: Lafite Rothschild, Mouton Rothschild, Château Margaux, Haut-Brion, and Cheval Blanc – 75 wines across 15 vintages.

- Top Second Growths: Pontet-Canet, Lynch-Bages, Palmer, Montrose, Cos d’Estournel, and Léoville Las Cases – 90 wines across the same period.

Because of Château Latour’s unique release schedule and limited market volume since the 2011 vintage, it was excluded from the analysis. To ensure coverage of all recent prime vintages, we expanded our dataset to include the 2005 vintage alongside the 2008–2021 range.

Price stability was defined as a period of at least three months without meaningful movement – a signal that buying and selling pressure have reached equilibrium. This approach captures early indicators of market turning points, where sellers have adjusted expectations and buyers begin to re-engage.

First Growths: Signs of strength

Among the first group of wines, covering four of the First Growths and Cheval Blanc, 47 out of 75 wines (just over 60%) have kept their value firm. Lafite Rothschild is the standout performer, with 12 of its 15 vintages maintaining stable prices.

When isolating the prime vintages – 2005, 2009, 2010, 2016, 2018, 2019, and 2020 – the pattern becomes even clearer. Across these, 29 of 35 wines (83%) are price stable, including every single Lafite vintage in the set. Mouton Rothschild and Château Margaux, meanwhile, have maintained stability in five out of seven vintages (just over 70%).

The data further highlight the gap between prime and off-vintages. Among the less-heralded years of 2011–2014, only four out of twenty wines are stable, suggesting continued downward pressure where trading volume is lower. This divergence reinforces a key principle: in periods of market weakness, liquidity and confidence concentrate around the most established players.

Second Growths: Following the leaders

Second Growths often act as the market’s echo chamber. They don’t move first, but when they start to stabilise, it confirms that sentiment is improving and buyers are returning.

Among Bordeaux’s 90 elite Second Growths, 49 (55%) are now price stable. When focusing on prime vintages, that figure rises to 26 out of 42 (62%).

This suggests that the stabilisation process has been underway for several months, gradually filtering from First Growths down to the wider market. Historically, such a pattern has preceded broader upturns, as investors and collectors begin to seek relative value further down the classification ladder.

Château Palmer and Cos d’Estournel have led this segment, with 11 and 10 of 15 vintages respectively showing resilience. Both have five out of seven stable prime vintages, alongside Château Pontet-Canet. Lynch-Bages and Léoville Las Cases, meanwhile, have seen stability emerge more recently and across a narrower base of vintages.

Broader market context

The timing of this Bordeaux stabilisation coincides with modest gains across major Liv-ex indices, including the Bordeaux Legends 50 and Fine Wine 1000, both of which posted small rises in recent months.

Beyond wine-specific factors, macroeconomic influences have also played a role. Sterling weakness since late summer has improved overseas buying power, while rising global demand (reflected in a higher bid:offer ratio on Liv-ex) signals growing confidence.

In short, the market’s most reliable signals of recovery – improved liquidity, narrowing spreads, and renewed price consistency – are beginning to appear in key regions.

Taken together, the evidence suggests that prime-vintage Bordeaux First Growths have reached stability, while top Second Growths are close behind. In standout years such as 2005, 2010, 2016, and 2019, all tracked wines are now price stable, indicating strong market support.

Weaker vintages remain under pressure, but history shows that stabilisation at the top of the market often precedes wider recovery. With the Liv-ex 100 up 2%, the bid:offer ratio climbing, and sentiment improving, the fine wine market appears to be entering a new phase of balance. Indeed, these conditions may represent the most compelling entry point into Bordeaux since 2020.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.