Our Q4 report, analysing the trends that shaped the fine wine market over the past three months, is now available to download. The report also provides a summary of the year in fine wine and a look ahead to 2023, accounting for the macroeconomic environment and core factors such as inflation, currency moves, new releases, supply, and levels of demand.

Fine wine shows remarkable resilience in 2022

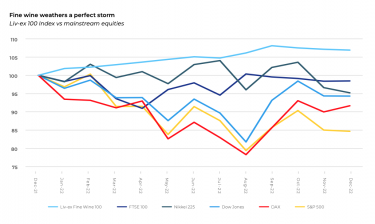

The fine wine market remained bullish in the face of severe headwinds, which only started to impact its performance in the final quarter. 2022 brought a perfect storm of pandemic, war, inflation, climate change and unsteady politics, which led currencies, bonds and equities spiralling downwards. But fine wine did not experience any of the volatility that affected mainstream markets. Instead, all major fine wine indices finished the year with increases. Rare Burgundy and vintage Champagne enjoyed soaring demand and peaking prices.

What to expect in 2023

If 2022 was all about Burgundy and Champagne, 2023 is likely to see the return of more subdued market players, which offer value and quality. Stability will be a key theme in the new year as the economic outlook remains uncertain.

Although fine wine might experience a temporary drift following its bull run, many wines continue to set trading records. Among them in Q4 were some of the critics’ ‘wines of the year’ such as Talbot 2019 and Lynch Bages 2014. Bordeaux remains the market’s driving force, with heightened demand across both ‘on’ and ‘off’ vintages. But demand is also getting broader, with more wines considered investment-worthy than at any other point in history, be it grower Champagne, the Rhône, Italy, California or further afield.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by fine wine. Download our brand new report below for your summary of the past quarter in fine wine.