- AI integration has been a significant driver of market activity in 2024.

- US dollar surged following President Donald Trump’s re-election, but subsequent tariff announcements led to market volatility.

- Fine wine solidified its status as the most popular collectible asset in 2024.

The global investment landscape in 2024 has been shaped by the interplay of technological innovation, geopolitical shifts, and a growing appetite for alternative assets. From the rapid integration of AI and rising interest in collectibles to the continued emphasis on sustainability and diversification, investors have navigated an evolving landscape with a focus on innovation, stability, and resilience. Below we examined the big investment themes that defined the year that was.

AI adoption and mergers and acquisitions

The rapid adoption of AI has been a significant driver of market activity in 2024. Major corporations across various sectors have invested heavily in AI infrastructure to enhance operational efficiency and innovation. This surge in AI integration has led to increased capital expenditures, with leading tech firms projected to spend over $200 billion on AI-related infrastructure, doubling their 2021 spending.

The growing demand for AI expertise has spurred a wave of mergers and acquisitions among asset managers. A survey by PwC revealed that 81% of global asset managers and institutional investors are considering strategic partnerships or acquisitions of AI-capable businesses by 2028.

Sports investing gains momentum

Investing in sports has emerged as an attractive avenue, with major leagues’ valuations outpacing the S&P 500 by up to five times. Relaxed ownership rules and the rapid growth in valuations have drawn interest from top firms. Investment options include equity ownership in teams or franchises and credit through loans or structured equity for team or stadium development. However, the sector’s illiquidity and lack of extensive historical performance data require higher return expectations and a thorough understanding of investment projections.

Currency volatility amid political developments

The U.S. dollar exhibited notable volatility throughout the year, influenced by political developments and economic policies. Following President Donald Trump’s re-election, the dollar initially strengthened against major currencies, driven by investor optimism over proposed tax cuts and infrastructure spending. However, subsequent announcements of tariffs on imports from Canada, Mexico, and China led to market jitters, causing fluctuations in the dollar’s value.

Global market adjustments

Trump’s policies, including tax cuts and increased tariffs, impacted global markets. U.S. Treasury 10-year bonds surged in yield, anticipating higher budget deficits and inflation, potentially decreasing the likelihood of Federal Reserve rate cuts. Sectors like defense, mining, and international firms earning in dollars were poised to benefit from the currency strength, while renewable energy companies and the automotive industry have faced challenges.

Emphasis on diversification and alternative investments

In response to market uncertainties, there has been a heightened focus on diversification and alternative investments. Strategies such as incorporating real assets like real estate, commodities, and infrastructure into portfolios have been recommended to hedge against inflation. Additionally, interest in private credit has surged due to its attractive returns, with institutional investors seeking to capture higher yields and diversify portfolios with liquid alternatives and hedge funds.

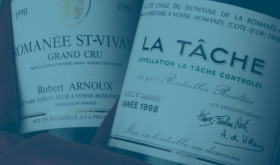

Fine wine – the most popular collectible

Fine wine has solidified its status as the most popular collectible asset in 2024, driven by its unique blend of stability, sustainability, and market appeal. A remarkable 92% of wealth managers anticipate demand for fine wine to increase over the next year, reflecting its growing allure.

Several factors have contributed to fine wine’s investment appeal including supply and demand, and tax efficiency. Investor confidence in the market’s liquidity has also surged by 32% in 2024, bolstered by advanced technologies that improve trading experiences and ensure security. Fine wine is increasingly viewed as a socially and environmentally conscious investment, with 68% of wealth managers citing sustainability as a key motivation for their clients to invest in this asset. Finally, fine wine continues to offer a stable alternative amid economic volatility. These attributes position fine wine as a cornerstone in the broader trend toward alternative investments.

Environmental, social, and governance (ESG) considerations

Sustainable investment considerations have remained a focal point, with changing regulatory disclosures and a growing emphasis on ESG factors. The EU continues to lead in the sustainable funds market, accounting for 84% of global assets in this sector. However, amid allegations of greenwashing and stricter regulations, there has been a notable decrease in funds incorporating ESG-related terms into their names, particularly in the United States.

In summary, 2024 has been characterized by technological advancements, strategic corporate activities, and a cautious yet opportunistic investment approach amid political and economic uncertainties.

See also: Special report – 2023’s big investment themes: fine wine and beyond

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.