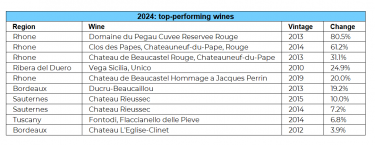

- The biggest price risers in 2024 reveal a strong preference for older vintages.

- The best-performing wine came from the Rhône, having risen 80.5% in value year-to-date.

- Tuscany, Ribera del Duero, Bordeaux and Sauternes also featured in the rankings.

The biggest price risers in 2024 reveal a strong preference for older vintages, underlining the importance of time in achieving wine investment returns.

The Rhône leads performance

Although Rhône prices declined 9.9% on average this year, the region gave rise to some of the best-performing wines.

Domaine Pegau Châteauneuf-du-Pape Cuvée Réservée Rouge 2013 led the charge with an impressive 80.5% rise. Other regional standouts, including Clos des Papes Châteauneuf-du-Pape Rouge 2014 (61.2%) and Château de Beaucastel Rouge 2013 (31.1%), highlighted the enduring demand for Châteauneuf-du-Pape from highly rated mature vintages.

Highlights from Spain and Italy

While the Rhône claims several top spots, other regions also showcase the profitability of mature vintages. From Spain, the 2010 Vega Sicilia Unico achieved a notable 24.9% increase. Known for its high quality and limited production, Vega Sicilia continues to represent Spanish winemaking at its finest, cementing its status as a blue-chip investment wine.

Italy made a strong appearance with the 2014 Fontodi Flaccianello delle Pieve, which has risen 6.8% in value. This Tuscan gem, crafted from 100% Sangiovese, reflects the growing international appeal of Italy’s finest wines. Collectors are increasingly drawn to Italy not only for its iconic producers but also for its remarkable balance of accessibility and age-worthiness.

Bordeaux’s resilience

No fine wine discussion is complete without Bordeaux, and 2024 is no exception. While price growth among Bordeaux wines in this dataset may be more modest, the region’s consistency remains its hallmark. The 2013 Ducru-Beaucaillou saw a solid 19.2% increase, while the 2012 Chateau L’Eglise-Clinet also featured among the top performers.

Two Château Rieussec vintages, the 2015 and 2014, reflected Sauternes’ consistent market performance, although the category is often overlooked.

The allure of maturity

The unifying thread across these top-performing wines is their maturity. Each wine has benefited from time in the bottle, allowing its market value to increase. Mature vintages offer an enticing combination of drinking pleasure and investment potential, a dual appeal that drives demand among collectors and investors alike.

This preference for older wines reflects a broader trend within the fine wine market: a growing appreciation for provenance and readiness to drink. As global markets for fine wine continue to mature, buyers are prioritising wines with a proven track record, both in terms of quality and price appreciation.

What this means for investors

The list of the best-performing wines of 2024 shows the importance of patience and long-term approach when it comes to investing. Additionally, diversification across regions and styles can help mitigate risk and enhance returns.

The performance of these wines provides a clear takeaway: older vintages remain at the forefront of the fine wine market.

For more read our latest report “Opportunities in uncertainty: the 2024 fine wine market and 2025 outlook”.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.