- Fine wine prices continued to decline in H1 2025 against a challenging global economic backdrop.

- A small group of wines outpaced the broader market by a wide margin, with the best-performing wine rising over 36%.

- In a recalibrating market, scarcity, selectivity, and substance will continue to define success.

The global fine wine market continued its cautious descent through the first half of 2025, extending a downward trend that began in earnest in late 2022. From Champagne to California, regional indices recorded further losses – a sobering contrast to the post-pandemic surge that peaked in September 2022. What followed has been nearly 18 months of persistent price softening.

Yet even in this declining market environment, select wines showed resilience and in some cases, delivered double-digit growth. A small group of wines outpaced the broader market by a wide margin, with the best-performing wine rising over 36% in H1 alone. These rare outliers were not driven by hype or thematic rotation, but by a return to fundamentals: scarcity, maturity, critical acclaim, and name recognition. In a soft market, selectivity became strategy, and quality, its own form of currency.

The macroeconomic backdrop: volatility returns

H1 2025 unfolded against a challenging global economic backdrop, with fine wine caught in the crosscurrents of:

Reignited trade tensions

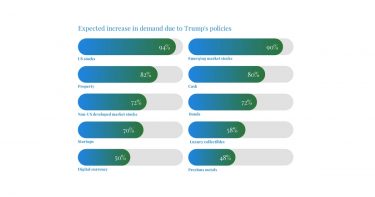

The surprise announcement of 200% US tariffs on EU wine imports in March rattled the industry. While the final figure was scaled back to 20% and implementation delayed by 90 days, the initial shock had an immediate effect. US demand plummeted initially, and confidence took time to recover – despite evidence of resilient buying behaviour by Q2.

Subdued Asian demand

In Asia, sentiment remained quiet. Many buyers – particularly in Hong Kong and mainland China – adopted a wait-and-see posture, citing political and market uncertainty. The result was lower volume and thinner trading conditions for key regions like Burgundy, Bordeaux, and Champagne.

Monetary pressures impact

Persistent interest rate pressure globally has reduced the appeal of illiquid assets such as wine. With safer yields available in cash or bonds, some collectors have hesitated to commit fresh capital or have chosen to sell.

A tepid Bordeaux En Primeur campaign

The Bordeaux 2024 En Primeur campaign, already burdened by a slow market and a hesitant consumer base, failed to inspire broad demand. Pricing fatigue, underwhelming back-vintage performance, and merchant overstocking created difficult conditions even for well-scored wines.

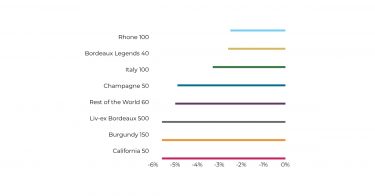

Liv-ex indices reflected the climate:

-

- Liv-ex 50 (tracking First Growth performance): -6% in H1, now back to 2016 levels.

- Liv-ex 100 (Liv-ex benchmark index): -4.9% in H1, now back to 2020 levels.

- Liv-ex 1000 (broadest market measure): -4.7% in H1, now back to 2020 levels.

Amid these headwinds, investment allocations required precise selection more than ever.

Regional performance – H1 2025

Though every major region ended H1 in negative territory, the magnitude of decline varied, offering insight into what categories still command investor attention and which ones may face longer-term repositioning.

The best-performing region: the Rhône

The Rhône 100 index emerged as the most defensive performer in H1, down just 2.5%. This may come as a surprise, given Rhône’s traditionally lower liquidity compared to Bordeaux or Burgundy. Yet in periods of risk aversion, the region’s combination of world-class producers (e.g. Jean Louis Chave, Guigal), lower pricing, critical appraisal, and hence good value for money have made it an increasingly attractive hunting ground for value-driven buyers.

Several Rhône wines appeared in the H1 top 10 performance list, including Chave’s Hermitage Rouge 2021 (+36.8%) and Guigal’s Côte Rôtie Château d’Ampuis 2018 (+20.0%) – reinforcing Rhône’s reputation as a quiet outperformer in challenging times.

The worst-performing regions: Bordeaux, Burgundy and California

Three major regions – California, Burgundy, and the broader Bordeaux 500 – each fell 5.6%, making them the weakest performers year to date.

- Burgundy’s fall reflects an overdue correction after its dramatic run-up in 2021–2022. Though top-tier names (like DRC and Clos de Tart) remain in demand, the broader category has struggled under inflated pricing and speculative fatigue.

- Similar to Burgundy, California, particularly its cult Cabernet segment, has suffered from reduced international demand.

- Bordeaux’s broader weakness may be attributed to the underperformance of back vintages. However, its Legends 40 sub-index, focused on top estates with market longevity, proved more resilient (-2.6%).

H1 2025 top performers: the outliers that defied the trend

While most indices slipped, a handful of wines delivered double-digit returns.

Insights from the standouts

The Rhône leads with Chave’s Hermitage

Despite the Rhône 100 index declining 2.5%, Jean Louis Chave’s 2021 Hermitage Rouge rose 36.8% – a stark outperformance driven by limited availability and increased global recognition of its collectible status.

Sweet wines surged

Both Château d’Yquem 2014 and Château Suduiraut 2016 featured in the top ten, defying the quiet backdrop for Sauternes. This suggests renewed collector interest in undervalued dessert wines, particularly when linked to exceptional vintages.

US cult wines hold their own

Screaming Eagle 2012 proved resilient, with a 24.4% rise in value since the start of the year. Despite the California 50 index falling 5.6%, high-end Napa commands global attention in top-tier vintages.

Champagne’s prestige cuvées still sparkle

While the Champagne 50 index fell 4.9%, Pol Roger Sir Winston Churchill 2015 bucked the trend with +24.4%, showing how top releases can outperform broader categories when aged and ready to drink.

Key takeaways for investors

Market-wide corrections are not uniform. Even in downturns, well-selected wines can deliver strong returns.

Rarity and recognisability drive results. Names like DRC, Yquem, Chave, and Screaming Eagle continue to act as safe harbours.

Blue-chip vintage selection matters. Wines from ‘off’ vintages like Canon 2014 offered some of the best entry points and upside surprises.

Sweet wines are staging a quiet comeback. This suggests contrarian plays may have room to run in H2.

Selectivity as the strategy for H2 2025

The first half of 2025 has confirmed what seasoned collectors already know: not all wines move with the market. Even as regional indices declined across the board, a handful of exceptional bottles bucked the trend, delivering standout returns through a combination of rarity, critical reputation, and maturity.

In today’s climate, the challenge isn’t access to wine but making the right decisions. Broad market exposure has offered little protection. Instead, performance has come from targeted allocations, where deep knowledge of producers, vintages, and release histories gives investors the edge.

Looking ahead to H2, the outlook is cautiously constructive. While macroeconomic headwinds remain – from tariffs and interest rates to uneven global demand – opportunities still exist for those willing to look beyond the indices.

In a recalibrating market, scarcity, selectivity, and substance will continue to define success.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.

*UK

*UK *US

*US *UK

*UK *US

*US