- There have been some notable releases in a quieter En Primeur campaign.

- All of the top releases have represented the best entry point into their respective brands in the last decade.

- Critics have emphasised selectivity in a challenging vintage.

One month in since the start of the Bordeaux 2024 En Primeur campaign, which seems to be nearing its end, we look at critic scores and price trends to evaluate the best releases.

What the critics are saying

After the Wine Advocate’s William Kelley called Bordeaux 2024 ‘the weakest vintage of the last decade’, other critics have echoed his concerns with greater nuance.

For Jane Anson, ‘the vintage was better than expected […] and clearly better than, for example, 2013 – and 2021 in the best cases.’

Meanwhile, Antonio Galloni (Vinous) observed: ‘The 2024s are all over the place in terms of quality and style, so readers will have to be selective. Within that context, the very best wines have a lot to offer.’ His ‘magnificent eight’ were Beychevelle, Clos Puy Arnaud, Cos d’Estournel, Jean Faure, Larcis Ducasse, Lascombes, La Conseillante and Rauzan-Ségla.

Neal Martin concluded his report, arguing that 2024 is ‘the ideal vintage for a reset’. He noted that ‘given the obstacles placed along the growing season, any 2024 that scores above 90 points is a success’. Martin’s highest barrel range was 96-98 points for La Mission Haut-Brion Blanc. Among the reds, his top wines with 95-97 points were Lafite Rothschild, Trotanoy, Lafleur and Vieux Château Certan.

The state of the market

As Bordeaux continues to lose market share to other regions, and fine wine prices overall are in a correction phase, releasing En Primeur has only worked with heavy discounts. We spoke with leading producers on how they determine their release prices, with strategies ranging from consulting négociants and importers, and weighing in volumes and vintage quality.

In his report, Martin speaks of the following reality: ‘There is no saviour riding over the horizon, no emerging country of insatiable Bordeaux-lovers, all against a backdrop of a vine-pull scheme […] and the fact that Bordeaux is wrestling with an image crisis.’

The solution? He goes back to the beginning of his career, when ‘off-vintages in the mould of 2024 would be discounted, and […] nobody lost face, including the grandest châteaux, and crucially, it kept the primeur system flowing, bottles passing through the distribution chain to the all-important final consumer’.

Within this context, we look at the releases that have worked so far – where pricing has aligned with trade and consumer expectations, and has offered a window for long-term profitability.

Best En Primeur releases to date

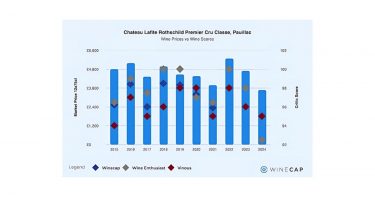

One of the standout releases of the campaign has been First Growth Château Lafite Rothschild.

The 2024 vintage emerged as the most attractively priced Lafite in recent memory. In fact, only one other vintage from the past 40 years comes within 25% of its release price. Even lower-rated vintages like 2013 and 2007 – both released before the transformative investments that elevated Lafite’s quality – now trade at considerably higher levels.

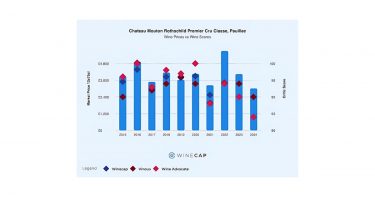

Much like Lafite, the 2024 Mouton Rothschild represents a rare opportunity. It is the best-priced Mouton vintage currently available on the market. Adjusted for inflation, only one other vintage in the last two decades compares in affordability.

Moreover, Mouton has been the best-performing First Growth over the last five years, while also being Wine-Searcher’s most searched-for wine globally.

History shows that these ‘less celebrated’ vintages often outperform their more hyped counterparts. For both Lafite and Mouton, vintages such as 2007, 2008, 2013, and 2014 have significantly outpaced the more acclaimed 2009, 2010, or 2016 in price performance.

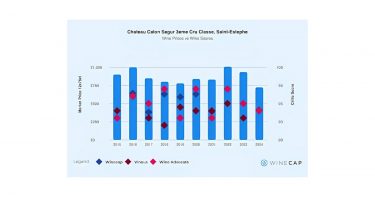

Another notable performer is Calon Ségur. While it may have flown slightly under the radar, its 2024 release represents the best entry point into the brand in over a decade. Calon has built a strong reputation among critics, frequently earning 95+ scores from Wine Advocate and Vinous.

Its investment credentials are equally impressive: between 2015 and 2023, Calon prices surged more than 80%. Even with recent market dips, our Calon Ségur index remains 75% higher than it was ten years ago – making it one of Bordeaux’s most dynamic performers.

Looking for more? Read our Bordeaux Regional Report.