- William Kelley defines Bordeaux 2024 as the ‘weakest vintage of the last decade’.

- The vintage is characterised by challenges – weather and economic.

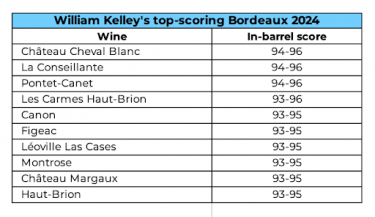

- Kelley’s top three wines achieved a barrel range of 94-96 points.

The Wine Advocate was among the first to release their Bordeaux 2024 En Primeur report last week, with William Kelley calling it the ‘weakest vintage of the last decade’. The report, titled ‘Ripeness is all’, highlights the challenging weather conditions and the growers ability to time the harvest, which played a crucial role in the making of the best wines.

The style of the vintage

For Kelley, 2024 is not a Left or a Right Bank vintage; he argued that it ‘can only be understood on a producer basis’.

For him, it is ‘more of a throwback, exhibiting flavors more familiar from the decade of the 1990s than more recent years’. The best wines show ‘the estate signature’ style and possess a ‘strong identity’.

Kelley explained that ‘the most compelling 2024s are intensely flavored middleweights with good structure and energy, exhibiting integrated acidity and ripe tannin’.

‘A handful of wines, often thanks to a riskily late harvest and generally from early-ripening sites, even possess a density and mid-palate amplitude that transcends the year and which will render them hard to identify in blind tastings a decade from now’, he continued.

To achieve these results, terroir was crucial: ‘better-drained, earlier-ripening plots fared best’ in a year defined by cold and rain. Sorting was important too but only for fully ripe grapes.

Vintage challenges

Bordeaux 2024 will go down in history as a challenging vintage – first, due to the weather, and second, the macroeconomic context, including the waning sentiment towards the En Primeur system.

When it comes to the weather, it was a year of negative records. Kelley noted that ‘March-May saw 35% more rainfall than the 20-year average, making 2024 the third wettest spring recorded, after 1979 and 2008’. This delayed flowering, leading to uneven ripeness within bunches, which could have only been mitigated by patience.

Rain and falling temperatures in September presented more obstacles – botrytis, and slower degradation of acidities and pyrazines. Many producers were quick to harvest – often underripe grapes; those that dared to wait gained ‘mid-palate amplitude and degrading pyrazines in the process, even if analytical maturity alone registered little change’.

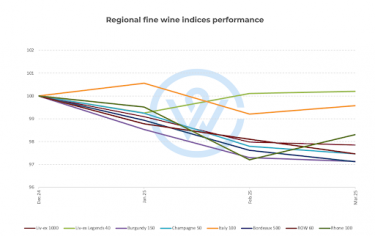

Now that the vintage is being released onto a downward market, Bordeaux is facing mounting pressure. In his report, Kelley wrote: ‘An excellent vintage at a very fair price might perhaps have been capable of reigniting some interest in en primeur, but it seems unlikely that 2024, beyond a handful of châteaux, will be able to achieve that.’

He concluded that ‘if Bordeaux rides high in good times, it is unavoidable that the region should also experience market lows particularly acutely. Bordeaux will be back, of course, it’s only a matter of time.’

Selectivity is key

Given this vintage background, strict selectivity when purchasing Bordeaux 2024 will be key. Beyond pricing, which has to be fair in the context of older vintages, critic scores play an important role.

Kelley’s highest score for this vintage was a barrel range of 94-96 points, which went to three wines: Cheval Blanc, La Conseillante and Pontet-Canet (released on 23 April).

Of the three, La Conseillante has been the best price performer on a brand level, rising over 70% in value over the past decade, and considerably outperforming the broader Bordeaux market.

For Kelley, these three wines were the ‘stars of the vintage’. For Cheval Blanc, he explained that ‘Pierre-Olivier Clouet and his team conducted an aggressive green harvest and also, exceptionally, used densimetric sorting to mitigate heterogenous maturity between and within bunches, accepting losses to rot in pursuit of full maturity.’

Sorting was also strict at Conseillante, which is ‘a blend of 80% Merlot and 20% Cabernet Franc that produced 22 hectoliters per hectare after extensive sorting’.

When it comes to Pontet-Canet, Kelley said that the final wine ‘underlines the fact that daring to harvest late paid dividends in this challenging vintage, wafting from the glass with aromas of cassis, black raspberries and plums mingled with accents of rose petals, licorice and exotic spices.’

See also our Bordeaux I Regional Report.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.