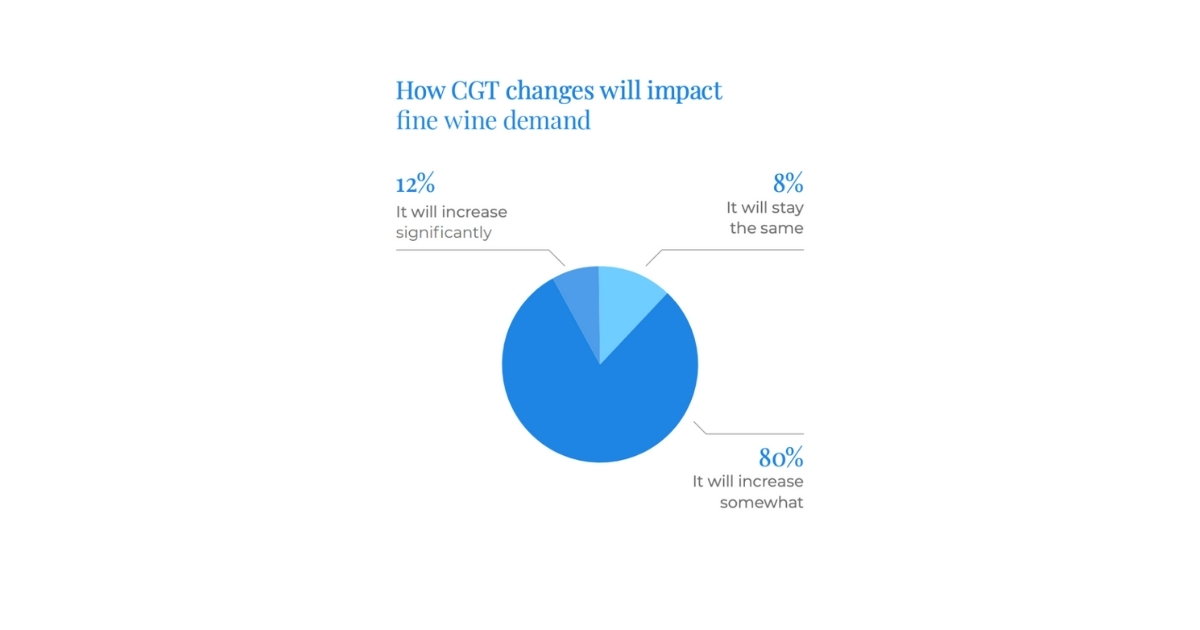

All you need to know about fine wine investment and tax: Why 80% of wealth managers expect demand to rise?

- Fine wine investment offers significant tax benefits.

- 80% of UK wealth managers believe demand for fine wine will rise due to its Capital Gains Tax exemption.

- Fine wine is also a suitable asset for lifetime gifting.

Fine wine has always held allure – whether for its rich history and cultural value, collectability, or as a tangible luxury asset. But in today’s financial landscape, its unique tax status in the UK is also becoming a key driver of demand.

Under HMRC taxation rules, most fine wines are classed as “wasting assets” – physical goods with a useful life of under 50 years – making them exempt from Capital Gains Tax (CGT). At a time when tax-free allowances are shrinking and effective rates are rising, this treatment is increasingly attractive.

According to the primary research conducted for our WineCap Wealth Report 2025, 80% of wealth managers believe demand for fine wine will rise, specifically due to its CGT exemption. Beyond portfolio diversification and inflation-resistance, fine wine offers a compelling investment case owing to its tax efficiency.

Why taxation matters in fine wine investment

When building a wine portfolio, most investors focus on selecting the right producers, vintages, and entry points. Yet, tax treatment can be just as important in shaping overall returns. Unlike stocks and bonds, fine wine occupies a nuanced space in UK tax law as both a chattel and a wasting asset.

By understanding these rules, investors can:

- Shield profits from unnecessary tax erosion.

- Structure transactions more strategically.

- Plan inheritance and succession more effectively.

- Reduce the risk of HMRC challenges.

CGT and fine wine

One of the most common questions investors ask is: “Do I pay Capital Gains Tax on fine wine?”

The General Rule

Most fine wine sales do not attract CGT, setting wine apart from property, art, or stocks. However, key exemptions and thresholds apply:

Wasting Asset exemption

- Wines with a useful life under 50 years are classed as wasting assets and are generally CGT-exempt.

- HMRC may challenge this in cases involving fortified wines or rare bottles intended for very long-term storage.

- Best practice: Retain expert evidence at purchase to support expected lifespan.

Chattels exemption

- Applies where a single bottle or set is sold for under £3,000.

- If profits from a non-wasting asset (e.g., certain collectible bottles) do not exceed £3,000, CGT will not apply.

- Where a “set” of bottles is sold to one buyer (e.g., a full case commanding a premium), the £3,000 limit applies to the total transaction, not each bottle.

Current allowances and rates

- Annual CGT allowance: £3,000 (individuals) / £1,500 (trusts).

- Gains above allowances taxed at: 18% (basic rate), 24% (higher rate).

Income Tax and fine wine

For most investors, Income Tax is not a concern. However, frequent trading could blur the line between investing and business activity.

- If HMRC deems an individual a ‘trader’, profits may be taxed as income (up to 45%).

- Occasional investors are safe, but high-volume sellers should seek specialist advice.

Inheritance Tax (IHT) and gifting

Unlike CGT, fine wine offers no special IHT reliefs. Upon death, portfolios are valued at market price and added to the estate:

- IHT rate: 40% on estate value above £325,000 (nil-rate band).

- Potentially higher thresholds: up to £500,000 if leaving a home to direct descendants, or £1 million for married couples/civil partners, depending on eligibility.

Fine wine, however, can be well-suited to lifetime gifting strategies – particularly where gifts qualify under Wasting Asset or Chattels Exemptions. As with all tax-sensitive decisions, individual advice is essential.

Best practices for tax-efficient fine wine investment

To optimise returns and reduce risk, investors should:

- Keep meticulous records: purchase dates, prices, provenance, storage, lifespan assessments.

- Support claims with expert evidence: especially for lifespan-based exemptions.

- Seek independent tax advice: rules vary, and personal circumstances matter.

- Plan long-term: consider inheritance and succession early.

- Work with specialists: firms like WineCap provide research, portfolio monitoring, and guidance aligned with tax efficiency.

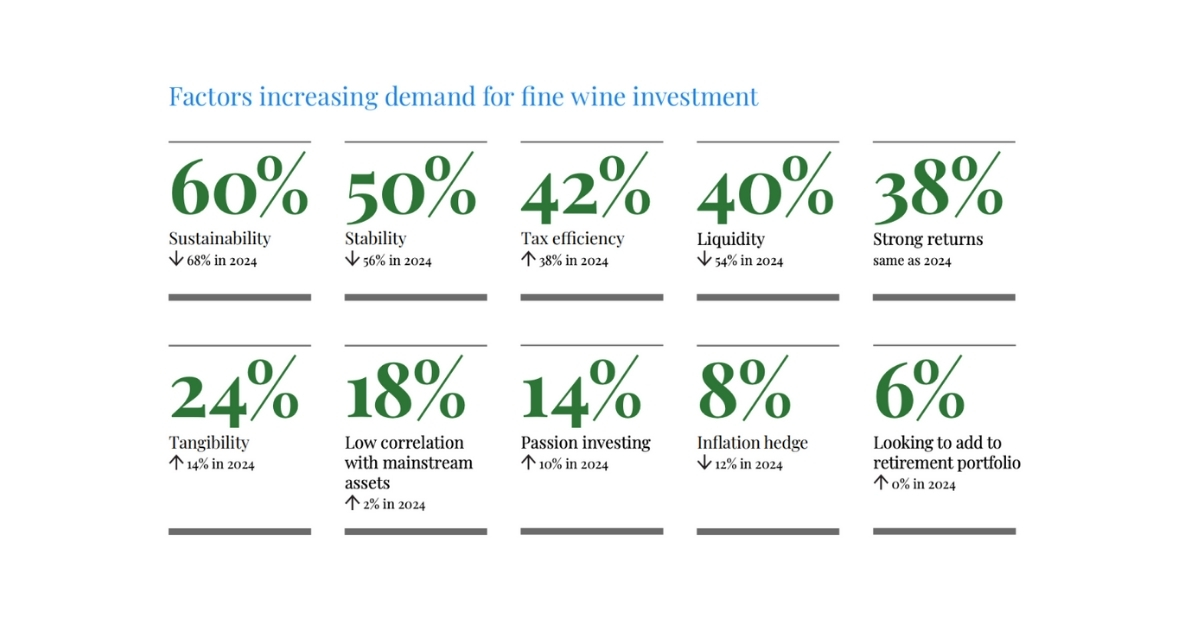

Investor sentiment: Beyond tax efficiency

While tax advantages are increasingly influential, they are not the sole driver. According to WineCap Wealth Report 2025, sustainability (60%), stability (50%), and tax efficiency (42%) are among the strongest forces shaping fine wine demand.

This blend of financial resilience, cultural heritage, and tax efficiency makes fine wine a unique and attractive addition to diversified portfolios.

While UK tax rules provide significant advantages – especially via CGT exemptions – structuring portfolios correctly and planning for inheritance remain essential. By combining careful portfolio building with tax-aware strategies, investors can unlock fine wine’s full potential as a stable, inflation-resistant, and tax-efficient asset class.

At WineCap, we offer the insights and expertise to help investors navigate both the markets and the tax landscape with confidence.

Read our up-to-date Fine Wine Taxation Guide.