- Marchesi Antinori has taken full ownership of Napa Valley’s iconic winery Stag’s Leap.

- Stag’s Leap laid the foundation for the emergence of cult wines after winning the Judgement of Paris in 1976.

- Antinori’s innovations in the ‘Super Tuscan’ revolution of the 1970s and recent acquisition of Stag’s Leap position both for continued success in the fine wine investment market.

Marchesi Antinori, one of the oldest and largest wine companies in the world, has gained full ownership of the iconic Napa Valley estate Stag’s Leap. According to Wine Spectator, the current sale includes ‘the winery, the brand and inventory, and close to 300 acres of Napa vines, including the Fay and S.L.V. vineyards’. These sites hold a near-mythical status in American wine, making the sale one of the most significant winery transactions in recent Napa Valley history.

Antinori is no stranger to Stag’s Leap. The Italian family first acquired a minority stake in 2007, partnering with Ste. Michelle Wine Estates after the property was purchased from founder Warren Winiarski. With the latest agreement, Antinori now transitions from long-standing partner to full owner – deepening its commitment to Napa Valley and expanding a global portfolio that already includes Tignanello, Guado al Tasso, and its American estate, Antica Napa Valley.

A historic Napa Valley estate

Stag’s Leap Wine Cellars holds a unique position in American wine history. It is widely credited as one of the pioneering Napa wineries that shaped the modern era of California fine wine. But it was one wine in particular that changed everything: the 1973 S.L.V. Cabernet Sauvignon.

This vintage, the estate’s second commercial release and first made at the winery, famously won the Judgment of Paris blind tasting in 1976. By outperforming top French estates – including Château Mouton Rothschild and Château Haut-Brion – Stag’s Leap stunned the global wine community and forced critics to take New World wines seriously. It was a defining moment not just for Napa Valley, but for American fine wine as a whole.

The S.L.V. vineyard, along with the Fay Vineyard, remains central to the estate’s identity. Both sites are now fully under Antinori ownership, giving the Italian group complete control over the terroir that shaped one of the wine world’s most important breakthroughs.

The rise of Stag’s Leap in the fine wine market

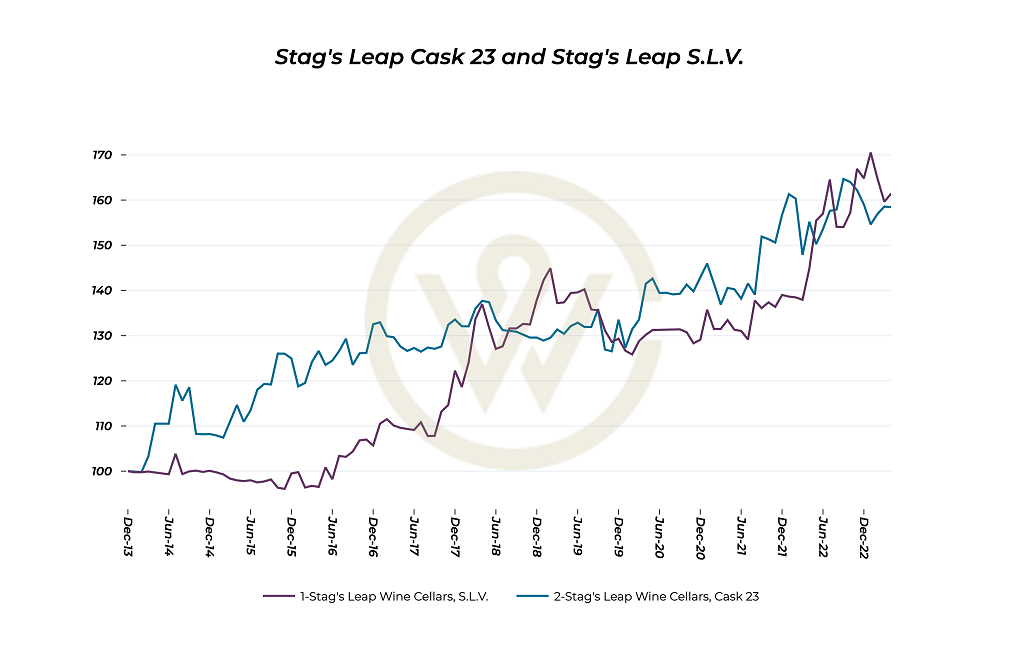

Over the last decade, Stag’s Leap has experienced substantial growth in the secondary market. Collectors have increasingly turned to the estate’s top wines – particularly Cask 23, S.L.V., and Fay – as demand for high-quality yet comparatively accessible Californian Cabernet Sauvignon continues to rise.

Several performance trends underscore Stag’s Leap’s strong market momentum:

1. Price appreciation

-

Cask 23 has increased 59% on average over the past 10 years.

-

S.L.V. Cabernet Sauvignon has risen 61% over the same period.

These gains reflect confidence among collectors who view Stag’s Leap as a historically significant winery with long-term growth potential.

2. Value for money

One of the brand’s greatest competitive advantages is its relative affordability compared to other Napa “cult” producers.

-

By contrast, Screaming Eagle Cabernet Sauvignon commands £472 per point.

This stark gap highlights why many fine wine buyers see Stag’s Leap as offering high quality without extreme price premiums, a factor that has contributed to its increased trading activity.

3. Standout vintages

The estate’s 2014 releases, in particular, have shown remarkable performance:

-

S.L.V. 2014 has surged 80.5% since release.

-

Cask 23 2014 has climbed 77.4% in the past two years alone.

Such growth places these wines alongside some of Napa’s strongest performers in recent market cycles.

Why Antinori’s ownership matters

While Stag’s Leap helped establish the reputation of California Cabernet Sauvignon, Marchesi Antinori played an equally transformative role in Italy during the 1970s. Its groundbreaking wines – including Tignanello, Solaia, and others – helped spark the Super Tuscan revolution, challenging traditional DOC rules and elevating Italian red wine to new global heights.

Together, the two wineries share several parallels:

1. Both reshaped their national wine identities

-

Stag’s Leap redefined American wine after the Judgment of Paris.

-

Antinori reshaped Italian wine through innovative vineyard and cellar practices.

2. Both expanded the definition of “fine wine” beyond Bordeaux

Their success helped diversify the global fine wine conversation – proving that excellence could emerge from Tuscany and Napa Valley as convincingly as from France.

3. Both maintain powerful global brands

Antinori’s Tignanello is now one of the world’s most traded luxury wines. Liv-ex ranked it the 49th most powerful wine brand, partly due to its attractive average case price of £1,076, making it the best-value Italian label in the top 100.

With Antinori’s full acquisition of Stag’s Leap, the synergy between these two historic producers may deepen even further.

What comes next?

It remains to be seen exactly how Antinori will integrate Stag’s Leap into its global strategy. However, its track record suggests a continued focus on:

-

Estate-driven expression

-

Investment in vineyard health and sustainability

-

International distribution strength

-

Long-term legacy building

For Napa Valley, the acquisition signals sustained interest from established European wine families, affirming the region’s global prestige. For Antinori, it represents a strengthening of its American footprint. And for collectors, the transition offers reassurance that Stag’s Leap – already a historic and fast-rising winery – may be entering an era of renewed energy.

Final outlook

With its deep heritage, exceptional vineyards, and growing market demand, Stag’s Leap stands poised for an exciting new chapter under Antinori’s full stewardship. For both producers, this union brings together centuries of winemaking knowledge with some of Napa’s most important terroirs. As the dust settles on the acquisition, one thing seems certain: both Marchesi Antinori and Stag’s Leap are positioned to reach even greater heights in the fine wine market in the years ahead.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.