As a perfect storm of pandemics, war, inflation, climate change and unsteady politics collide, many investors are feeling the impact in their portfolios. With currencies, bonds and even equities zig-zagging downwards, it can be a stressful time.

For investors in fine wine, however, the tumultuous environment provides an opportunity not just to preserve wealth but to enhance it. In this article, we’ll uncover three essential rules to help maximise returns and avoid pitfalls.

1. Avoid emotional investing with a steadfast strategy

While most wine investors are deeply passionate about the industry, for the best returns it’s important to avoid emotions when trading.

When an asset is plunging, many investors fear that it will lose even more value unless they sell quickly. This reaction can lead to terrible investment decisions, like selling at the lowest possible prices. Likewise, when other assets are growing, many investors want to jump on the bandwagon to boost their returns. This fear and euphoria style is known as “emotional investing” and it costs investors around 3% of their returns each year[1]. During high-stress periods, like recessions or market downturns, emotional investing losses can increase to 6% or 7%[2]. Market noise and herd behaviour can ramp-up the emotional pressure exponentially.

To avoid suffering from needless losses, investors should try to stay cool when a market storm is brewing. In the words of world-leading investor, Warren Buffet, “To be a successful investor you must divorce yourself from the fears and greed of the people around you, although it is almost impossible.” Experts agree that the best way to do this is to create a risk-adjusted strategy, diversify and – no matter how you may be feeling that day – don’t deviate from the plan.

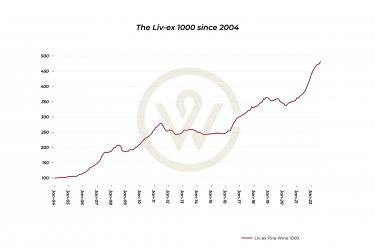

It can also help to remember that investments in fine wine have proved to be resilient against market shocks over the long-term. The Liv-ex Wine 1000, for example, has grown in value by 50.8% over the past five years. And since its inception in 2004, prices are up nearly five-fold.

Source: Liv-ex

What’s more, according to 2021 data from Knight Frank, the average fine wine investment has returned a staggering 127% over ten years. Sticking to the strategy almost always pays off.

2. Remember fine wine can be a useful shield in recessions

It can be easy to get caught up in the mayhem of the outside markets, especially when there is so much noise and uncertainty. But investors should remember that fine wine is an alternative asset – and so it’s unlikely to be impacted.

Alternative assets are investments which derive their returns away from the public stock markets. Many will even increase in value during recessions. For example, while stock markets tumbled during the pandemic, fine wine enjoyed significant growth. Over the past two years, the Liv-ex Fine Wine 1000 has performed exceptionally well, delivering returns of 34.9%[3].

Other alternative assets include crypto assets, private equity, private debt, derivatives, collectables and precious metals like gold. Examples of less mainstream assets include litigation finance, art, domain names, whiskey, comic books, music royalties and of course, fine wine. These investments can help shield investors’ wealth from market shocks.

At the high-end, fine wine derives its value from two key streams: intrinsic factors and a self-contained marketplace.

Intrinsic factors include things like the quality of the vineyard, year of production, storage, or label. While the self-contained market is made up of a niche group of collectors and investors. These are often extremely wealthy and passionate people, who are probably less affected by inflation or interest hike scares. It’s also a global market, rising above any one region.

One of the superpowers of fine wine is that it’s a famously recession-resistant asset. During market downturns, it can be helpful to have a few premium bottles in a wealth portfolio.

3. Take advantage of fine wine’s inflation-shielding properties

Across the world – and especially in the UK – inflation is reaching record highs. In September 2022, the Consumer Price Index (a measurement of the change in prices) hit a whopping 8.8%[4]. What this means for investors is that debt, cash, and cash-like assets will erode in value faster than normal. But that’s not all.

To slow the economy and prevent lenders from abandoning their investments, central banks usually raise interest rates too. This can have a ripple effect across the markets, sometimes causing businesses to buckle and mortgages to falter. Many of the traditional “60% equity, 40% bonds” investment portfolios may suffer from losses during these turbulent times. Fine wine, however, is different.

This is because the value of fine wine – unlike debt, equity, and even property – is not directly impacted by inflation. As a sought-after and tangible asset, fine wine retains its worth. This makes it an excellent diversifier for investors, who are looking to shield their wealth from inflation.

The fine wine market is over-brimming with potential

The fine wine market is an exciting and vibrant space. Filled with passionate investors and recession-resistant bottles, it’s over-brimming with opportunities.

If you’re interested in finding out more about how you can diversify your wealth and shield against inflation, we’d love to hear from you. We offer complimentary 30-minute consultations where you can ask questions and discover more.

[1] Source: Oxford Risk and Financial Times

[2] Source: Oxford Risk and Financial Times

[3] Source: Liv-ex

[4] Source: UK ONS