- According to Jeb Dunnuck, ‘2023 is a good to very good, but not a great year for Bordeaux’.

- He described most wines as ‘ripe yet not massive with more focused, linear profiles on the palate’.

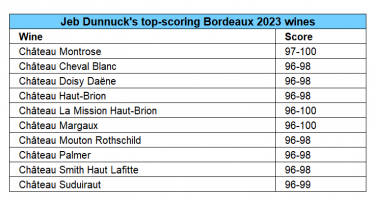

- Château Montrose received his highest barrel range of 97-100 points.

According to Jeb Dunnuck, ‘2023 is a good to very good, but not a great year for Bordeaux’. In his latest report, the critic delves into the growing season that shaped the vintage, comparisons with previous years, the En Primeur tastings and the current market for buying the new releases. Below we summarise his key findings.

A heterogeneous vintage

An erratic growing season led to a divergence of styles between sub-regions and even neighbouring châteaux. Bordeaux 2023 witnessed ‘an incredibly successful flowering, huge mildew pressure in the spring, a slightly uninspiring summer that lacked sunlight, sporadic and very localised storms, and a heatwave at the end of August and September that sped up ripening and, according to many, saved the vintage’.

In terms of vintage comparisons, ‘some of the wines have a certain 2019-like sunny, easygoing style, while others can have a cooler, more structured, almost austere profile similar to 2020’. The common themes, according to the critic, are the ‘fully ripe aromatics and more focused, linear profiles on the palate’.

A Left Bank vintage?

Jeb Dunnuck pointed out that ‘at a high level, the Merlot is much riper and more opulent, and the Cabernets are slightly fresher and vibrant’. He suggested that the Left Bank had the upper hand in 2023, saying that ‘while there are unquestionably impressive wines from the Right Bank, the top Médoc and Graves seem to have another level of harmony and overall balance’.

In terms of overall quality and style, Dunnuck argued that Bordeaux 2023 ‘surpasses 2014, 2017, and 2021 yet is a solid step back from the incredible trio of 2018 through 2020, and most likely will be surpassed by 2022 as well’.

Jeb Dunnuck’s favourite Bordeaux 2023 wines

Dunnuck found potential for perfection in three wines, awarding a barrel range of up to 100 points. Château Montrose got his highest score (97-100), and he noted that ‘it has some similarities to the 2010 (or 2016?) and might end up being the wine of the vintage’.

Among the First Growths, only Château Margaux came close to perfection, with the critic saying that ‘it is clearly one of the greats in the vintage, and it actually reminds me a touch of the 1996, if not better’.

Regarding the 2023 Château La Mission Haut-Brion, Dunnuck remarked that ‘the overall balance paired with opulence here is something to behold, and it’s incredible to find this level of quality in the vintage’.

Should you buy Bordeaux 2023 En Primeur?

Dunnuck outlines four main reasons why you should buy a vintage En Primeur: ‘1) If it is a great vintage; 2) If the wines are expected to increase in price; 3) If quantities are limited; and 4) If you are buying wines in formats other than 750-milliliter bottles’.

He defined 2023 as a ‘a borderline case’. While ‘it’s not a truly great vintage […] there are a handful of gems in the vintage that will rival the best from 2016, 2018, 2019, and 2020,’ the critic said.

In terms of pricing, he observed that it seemed to ‘be coming back to 2019 levels’, still he reckoned that ‘the time of substantial early gains from purchasing En Primeur has largely sailed’.

Our En Primeur offers only highlight wines that present great value for money in the context of the market prices for vintages currently available on the market. These are wines that hold significant potential for future price appreciation, and where the scores match the price.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.