- Market confidence is returning, with fine wine prices posting their first quarterly gain since the downturn began.

- Selective regions are leading the rebound, with Champagne, Tuscany, and California showing the strongest signs of growth.

- Stabilisation signals a turning point, as price declines slow and demand strengthens.

After two years of subdued performance, the fine wine market may finally be entering a new phase. Signs of stabilisation are emerging across key benchmarks, and selective pockets of growth suggest that investor confidence is beginning to return. While the broader market remains uneven, improving bid activity, regional resilience, and a shift in sentiment all point to a turning point — one that could lay the foundation for the next cycle of fine wine appreciation.

Confidence returns: Benchmark momentum

One of the clearest signals of renewed optimism comes from the bid:offer ratio — a measure of market confidence based on the proportion of active bids to offers on the secondary market. This ratio has been steadily rising, reflecting stronger buying interest and a more balanced trading environment. The shift is also visible in performance indices: the Liv-ex 100, which tracks the world’s most sought-after investment-grade wines, rose by 1.1% in September, offsetting earlier summer losses and delivering its first quarterly gain since the downturn began.

This rebound was mirrored across broader indicators. The Liv-ex 1000, which captures a wider cross-section of the market, slipped 0.5% over the quarter but also gained 0.4% in September — a sign that the market’s base may be firming. Even the First Growths Index, a bellwether for Bordeaux’s top estates, recorded a 0.7% gain in September. Though it remained slightly down for the quarter, the performance underscores a market that is recalibrating.

Where growth is emerging: key regional categories

The nascent recovery is not evenly distributed. Instead, certain regions and categories are emerging as clear leaders — offering clues about where value-seeking investors are positioning their capital.

Champagne: Resilience meets renewed demand

Champagne has once again proved its resilience. The region held near-flat over Q3 and remains one of the strongest performers of 2025, buoyed by rising demand from Asia and the US. This sustained appetite reflects Champagne’s unique position in the market: a luxury category with strong brand recognition, limited supply, and consistent global demand. For investors seeking stability and long-term performance, Champagne continues to justify its reputation as a defensive yet rewarding allocation.

Italy: Tuscany outpaces Piedmont

Italian fine wine remains a story of two regions. Tuscany has seen the most notable improvement, with the Italy 100 index climbing as buyers return to iconic Super Tuscans and Brunello producers. Piedmont, by contrast, still faces a softer bid environment, suggesting that investors are prioritising wines with immediate liquidity and strong global followings. The divergence illustrates a broader theme in today’s market: capital is flowing toward estates with established demand and clear brand equity.

California: Opus One leads a rebound

California has also been a bright spot. Opus One — one of the region’s most recognisable labels — has seen its strongest bid activity since January 2024. Over recent weeks, Liv-ex reported a surge in demand, with the US accounting for 40% of bid volume, closely followed by Asia at 39%. The UK and EU trail at 14% and 7% respectively, but this transatlantic interest highlights growing enthusiasm for top-tier Californian wines. As collectors seek quality and scarcity beyond Europe, California’s flagship estates are once again capturing attention.

Sector performance: Signs of a bottom forming

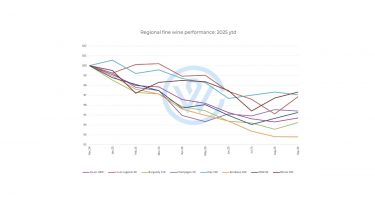

While some areas continue to lag, the broader data suggests that the worst of the correction may be behind us. Regional indices delivered a mixed performance in Q3, but declines moderated significantly, and September brought widespread gains.

Bordeaux remains the weakest performer in aggregate — the Bordeaux 500 fell 1.7% — but even here, signs of improvement are visible. Half of the region’s sub-indices gained in September, including those tracking First Growths, Second Wines, and leading Right Bank labels. Burgundy, too, was only marginally lower (-0.2%), with top domaines maintaining impressive resilience despite broader headwinds.

Together, these indicators suggest a market that may be finding its floor. Price declines have slowed, buyers are becoming more active, and selective demand is driving performance in certain regions and producers. This kind of stabilisation typically precedes a period of gradual re-pricing — and potentially, recovery.

The next phase: Selectivity, scarcity, and strategy

The third quarter of 2025 was a transitional one for fine wine. With mainstream assets recovering and investor sentiment stabilising, the asset class is beginning to reassert itself as a reliable store of value and a portfolio diversifier. The coming quarters are likely to be defined by three key drivers:

- Scarcity: Limited-production wines from renowned estates continue to attract demand, particularly as global supply chains tighten and yields remain historically low.

- Selectivity: Investors are becoming more discerning, focusing on regions and producers with strong fundamentals rather than chasing broader market exposure.

- Reputation: Brand equity and consistent critical acclaim remain decisive factors, with top names enjoying disproportionate interest as confidence returns.

While the pace of recovery will vary by region and price tier, the data points to a market that is stabilising and, in some segments, already turning higher. For investors with a medium- to long-term horizon, the current environment offers attractive entry points into historically strong-performing categories.

Looking for more? Read our latest quarterly report: Q3 Fine Wine Report

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.