The following article is an extract from our Burgundy regional wine investment report.

- Burgundy is the region with the highest average bottle prices.

- It is the best-performing fine wine region, considerably outperforming industry benchmarks.

- This article analyses its historic performance, the drivers behind its success, and what this might meant for the future of the region.

Burgundy has earned an unrivalled reputation in the global fine wine investment market. Renowned for its scarcity, terroir-driven wines and uncompromising quality, the region has become the outright leader when it comes to average bottle price, long-term performance, and collector demand.

While Burgundy produces both red wine and white wine, it is red Burgundy, made primarily from Pinot Noir, that has driven much of the region’s explosive growth in value. Today, Burgundy wine prices sit comfortably above those of Bordeaux, Italy, and Champagne, cementing the region’s status as the most valuable fine wine category in the world.

Burgundy’s investment market explained

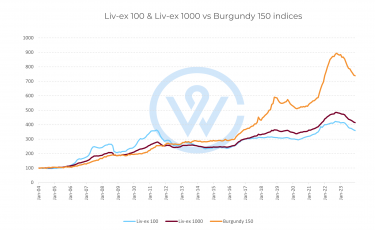

The strength of Burgundy wine prices is best illustrated by the Liv-ex Burgundy 150 index, which tracks the prices of the last ten vintages from 15 of the most actively traded Burgundy producers. This index is widely regarded as the benchmark for Burgundy’s performance in the secondary market.

Since its inception, the Burgundy 150 index has risen by more than 650%, making it the best-performing Liv-ex regional index. It has consistently outperformed Bordeaux, Italy, and Champagne over the long term.

While the index represents only a narrow pool of highly sought-after wines – largely Premier Cru and Grand Cru bottlings – it provides a clear indication of the broader direction of Burgundy wine prices. Importantly, during its decades-long ascent, the index has experienced only one major drawdown of around 15%, reinforcing investor confidence in Burgundy’s long-term trajectory.

Understanding the cost of Burgundy wine

One of the defining features of Burgundy wine cost is its structural scarcity. Unlike many regions where estates can expand vineyard holdings or increase production, Burgundy’s vineyards are rigidly fixed by centuries-old boundaries.

The most valuable wines originate from the Côte de Nuits – home to legendary appellations such as Gevrey-Chambertin, Vosne-Romanée, and Chambolle-Musigny – and the Côte de Beaune, which produces both exceptional red wine and some of the world’s most prestigious white wines.

Within these sub-regions, the hierarchy of Premier Cru and Grand Cru vineyards plays a decisive role in pricing. Grand Cru sites represent less than 2% of Burgundy’s total vineyard area, yet they command the highest Burgundy wine prices due to their historical reputation, proven longevity, and intense global demand.

Historic performance of Burgundy prices

Early growth: 2006–2008

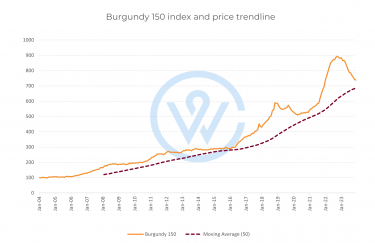

The first major re-rating of Burgundy wine prices occurred between 2006 and 2008, when the Burgundy 150 index doubled in value. This period marked the “awakening” of Burgundy as a serious investment category.

A new generation of wealthy collectors entered the market, empowered by greater access to information online. Influential critics such as Robert Parker and Allen Meadows brought unprecedented attention to individual vineyards and producers, while major auction houses increased their focus on Burgundy fine wine.

Bordeaux’s boom and Burgundy’s pause: 2008–2011

Following the global financial crisis, Burgundy briefly fell into the shadow of Bordeaux. The opening of the Chinese market triggered explosive growth in Bordeaux wine prices between 2008 and 2011, diverting capital away from other regions.

However, this shift proved temporary. When Bordeaux peaked in 2011 and subsequently declined, investors began searching for alternatives with stronger fundamentals and greater scarcity—leading many directly to Burgundy.

Renewed momentum: 2016–2018

From 2016 to late 2018, the Burgundy 150 index doubled once again. This surge reflected Burgundy’s growing liquidity and its recognition as a high-return, low-correlation investment asset.

During this period, Burgundy wine prices benefited from broader participation in the market, improved transparency, and rising international demand. The perception of Burgundy shifted decisively – from a niche collector’s region to a cornerstone of fine wine investment portfolios.

Correction and recovery: 2019–2022

After nearly 15 years without a meaningful downturn, Burgundy experienced a period of correction in 2019 and 2020. This pullback was driven partly by profit-taking and later exacerbated by the Covid-19 pandemic.

However, Burgundy rebounded rapidly. In 2021 and 2022, rising at-home consumption, increased online wine trading, and strong global liquidity pushed prices sharply higher. The Burgundy 150 index reached an all-time high of 909.4 in October 2022, underscoring the region’s resilience.

Market contraction and Opportunity: 2023 Onwards

The broader fine wine market entered a period of contraction in 2023, influenced by geopolitical tensions, lingering post-pandemic effects, high inflation, and rising interest rates. Burgundy was the hardest-hit region, largely due to its elevated price levels.

Despite this correction, the long-term trend in Burgundy wine prices remains firmly upward. Periods of consolidation are historically advantageous for buyers, often offering greater availability and more attractive entry points – particularly for blue-chip Premier Cru and Grand Cru wines.

Why Burgundy continues to command premium prices

Several structural factors underpin Burgundy’s long-term value:

-

Extreme vineyard fragmentation, limiting production volumes

-

Pinot Noir’s sensitivity to terroir, amplifying vineyard differentiation

-

Global demand growth for authentic, terroir-driven red wine

-

A rigid classification system, reinforcing scarcity and prestige

While regions such as Beaujolais offer outstanding value, Burgundy’s top wines remain in a class of their own when it comes to price performance and investment demand.

Final thoughts

Burgundy’s leadership in fine wine investment is no accident. Its combination of limited supply, historic vineyards, global prestige, and exceptional long-term price appreciation has positioned it as the most valuable wine region in the world.

For investors seeking exposure to fine wine, understanding Burgundy wine cost and pricing dynamics is essential. While short-term fluctuations are inevitable, Burgundy’s structural fundamentals suggest that its role at the pinnacle of the fine wine market is set to endure.

To find out more about the investment market for Burgundy wines, read the full report here.