Fine wine has long been celebrated as both a pleasure to own and a source of steady, inflation-beating returns. But how much difference can the choice of region, producer, and timing make over the long term?

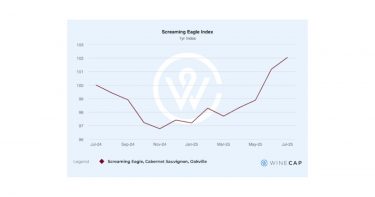

Using Wine Track data, we’ve taken a decade-long view – from 2015 to 2025 – to see exactly how a £1,000 investment in some of the world’s most sought-after wines would have performed. The results reveal disparities between regions and labels, driven by factors such as scarcity, critical acclaim, brand momentum, and the fluctuations of global demand.

In some cases, your £1,000 would have barely kept pace with inflation. In others, it could have doubled, tripled, or even more – often in places you might not expect. What’s more, because fine wine is a cyclical market, today’s leaders aren’t always tomorrow’s winners, and periods of market correction can present some of the best opportunities for future growth.

This analysis explores several key regions, showing not just the percentage returns but also what your £1,000 investment would be worth today, and what you could have bought then compared with now.

Bordeaux: a decade of divergence

In 2015, a £1,000 investment in a top Bordeaux could have taken very different paths over the following decade. If you had chosen Château Figeac, your £1,000 would now be worth £2,310 – more than doubling your money thanks to a +131% average return over the past decade. This performance has been fuelled by Figeac’s promotion to Premier Grand Cru Classé A and consistently high-scoring vintages.

Château Les Carmes Haut-Brion in Pessac-Léognan has been another star performer, climbing 163% over the past ten years. This is a rare combination of strong brand momentum, critical acclaim, and relative scarcity, making it one of the most compelling growth stories in the Bordeaux market.

By contrast, the First Growths have had a more subdued performance. Looking at the current average market prices for the several blue-chip Pauillac labels and their second wines, the past decade has been anything but uniform:

- Château Lafite Rothschild sits today at around £5,106 per case, up just 6% over the last decade. This reflects both its lofty 2015 starting point and the cooling of the top-tier Bordeaux segment in recent years. However, some vintages have outperformed the overall brand.

- Château Latour is similar, with a 10-year rise of 4%, now averaging £4,960 per case.

- Château Mouton Rothschild fared better, with a 22% decade-long gain to £4,496 per case, thanks partly to strong demand for key vintages in the late 2010s.

The best relative value in the First Growth orbit has often been found in their second wines:

- Carruades de Lafite rose 46% to £2,042,

- Les Forts de Latour gained 29% to £1,622, and

- Le Petit Mouton surged 86% to £2,032, driven by rising brand recognition and a shift toward buyers seeking prestige at lower entry points.

This ‘second wine premium’ over the decade illustrates a key point for investors: sometimes the best relative value comes not from the pinnacle labels, but from their immediate tier below. These wines benefit from the halo effect of the grand vin’s reputation while offering lower starting prices.

However, the current context matters. The performance of the Liv-ex 50 (First Growths) and Bordeaux 500 (broader region) shows how the 2022 peak has given way to a sharp correction, with prices now trending towards 2015 levels. This is classic market cyclicality: those who bought during the previous trough and held through the rally have realised strong gains; those entering now may be positioning themselves at the start of the next upswing.

Burgundy: the market reset

If Bordeaux’s decade has been a story of cyclical swings and selective outperformance, Burgundy’s has been one of explosive gains followed by a sharp correction. The Liv-ex Burgundy 150 index more than quadrupled between 2015 and its 2022 peak, fuelled by surging global demand for small-production, high-prestige domaines. Since then, prices have retraced significantly, but remain far above their 2015 levels, underscoring the long-term wealth-generating power of the region’s top wines.

At the very top sits Domaine de la Romanée-Conti, Romanée-Conti Grand Cru, whose sky-high starting point means it was always going to operate in a different financial stratosphere to most wines. Over the past decade, prices have risen by 147%, elevating the wine’s average price per case to £213,303.

Among the biggest long-term winners is Domaine René Engel, Vosne-Romanée Premier Cru Aux Brûlées, which has climbed 1,482% in the past decade. That’s enough to turn £1,000 into a staggering £15,820 today. Engel’s cult status has only intensified since the sudden passing of Philippe Engel in 2005, leaving the estate without a clear successor, and its eventual sale to François Pinault, who renamed it Domaine d’Eugénie.

Meanwhile, Domaine Leroy Richebourg Grand Cru has appreciated by 507% over the same period, due to a combination of biodynamic viticulture, minuscule yields, and demand consistently outstripping supply.

The sheer magnitude of these returns reflects Burgundy’s unique market dynamics:

- Scarcity at every level – often just a handful of barrels per cru.

- Global demand from Asia to the Americas.

- Producer-led brand power that eclipses even vintage variation in driving prices.

Yet the post-2022 decline in Burgundy shows that even this hallowed region is not immune to market cycles. For investors, today’s lower prices could represent a rare opportunity to enter or rebalance Burgundy holdings – though the barriers to entry at the very top remain as formidable as ever.

Champagne: the market fizzes with potential

Champagne has traditionally been viewed as a steady, blue-chip corner of the fine wine market: less volatile than Burgundy and Bordeaux, yet capable of delivering strong long-term growth. Over the past decade, the Champagne 50 index has shown a clear upward trajectory, punctuated by a sharp rally between 2019 and 2022 before a mild correction.

The most eye-catching long-term gains have come not only from the established houses but also from small-production grower-producers like Egly-Ouriet, Brut Millésime Grand Cru, which has surged 633% in the last decade. That growth has been fuelled by a wave of sommelier-driven interest in terroir-driven Champagne and limited allocations reaching the market.

Prestige cuvées from major houses have also rewarded patient investors. Salon Le Mesnil-sur-Oger Grand Cru has delivered a 298% return, while Billecart-Salmon Le Clos Saint-Hilaire climbed 203%.

A particularly notable outlier is Cédric Bouchard, Rosé de Saignée Le Creux d’Enfer, with an extraordinary 418% return – turning £1,000 into £5,180 – reflecting the explosive demand for rare, artisanal Champagne in recent years.

Champagne’s appeal lies in its dual identity: both a luxury good for immediate enjoyment and a serious investment asset. With the market cooling slightly from 2022 highs, current conditions may offer attractive entry points for those looking to secure allocations before the next phase of appreciation.

Italy: quiet consistency and standout performers

Italy’s fine wine market has been a story of steady, broad-based growth over the past decade, delivering consistent returns and avoiding some of the more extreme volatility seen in Burgundy or Champagne.

At the very top of the performance table sits G.B. Burlotto Barolo Monvigliero, with a remarkable 1,162% return over the last ten years. In Tuscany, Soldera Casse Basse, Brunello di Montalcino Riserva has been a powerhouse, rising 280% over the decade. The modern Tuscan icon Masseto has also posted a healthy 79%, taking £1,000 to £1,790.

Italy’s appeal lies in its combination of relative affordability, quality across multiple regions, and improving international distribution. While Piedmont’s and Tuscany’s top names have led the charge, there’s also significant breadth in the country from Abruzzo, Veneto, and beyond, giving investors multiple entry points into a market with both stability and pockets of spectacular growth.

Lessons from a decade of fine wine investing

Looking back from 2025, one reality stands out: fine wine is not a single market, but a patchwork of micro-markets, each with its own rhythm, risks, and rewards.

For investors, three lessons are clear:

- Selection is everything – Even within a single region, the difference between a modest gain and a market-beating return can be measured in multiples.

- Cycles create opportunity – Market peaks and troughs are inevitable; buying quality during a correction often positions you for the next rally.

- Diversification pays off – Spreading capital across regions and producer tiers balances the potential for growth with the stability of blue-chip holdings.

As the market sits in a post-2022 cooling phase, parallels with earlier cycles suggest that this may be a moment for strategic accumulation. History shows that the investors who pair patience with informed selection tend to enjoy the richest rewards – sometimes quite literally.