For centuries, property has been hailed as the sturdiest of investments. After all, what could be more solid than bricks and mortar? But with the five or six figure price tags, near-constant renovation or service work and gut-wrenching taxes, is it really such a wise investment? In this article, we compare the performances, costs and returns of fine wine against property to see which one works out better for investors.

What returns could investors expect?

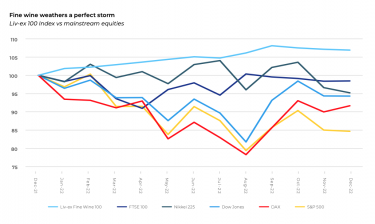

Investors in fine wine have reaped significant returns, especially over the past years. The Liv-ex Wine 1000, which tracks the overall performance of fine wines, shows how the asset has grown in value by 45% over the past five years alone[1] (at the time of writing). And since the index was created in 2004, fine wines have steadily risen to almost five times their original price. Over the past year, fine wine investors have enjoyed returns of 13.6% on average[2]. While past performance is no guarantee of future returns, fine wine has a strong track record of delivering smooth and stable value for investors.

Property market values are a little more complicated to measure, as they are influenced by politico-economic factors. For example, the 2020-2021 UK Stamp Duty cuts impacted price movements significantly. However, we can still compare returns.

Most real estate investors will opt for a Buy-to-Let property. Depending on the area they select, rental profits generally range from between 3% to 8% each year. 2022 research from Zoopla reveals that UK rental yields are the highest in East Ayshire, Scotland. Here, investors pick up average yields of 8.5%[3]. By contrast – and perhaps surprisingly – the location with the lowest rental yields is the London Borough of Kensington and Chelsea. Despite the average property values of £1.7 million, investors reap just 3.3% profits[4]. Even the highest yielding rental properties are not delivering the superior returns of fine wine.

Comparing like-for-like, the average rental yield for a UK property today is 4.7% annually[5]. By contrast, wine investors have enjoyed returns of 13.6% on average over the past year[6].

Costs associated with buying and selling

Unless you chose to buy into a fund, purchasing the investment-grade wine of your choice can take a little longer than trading stocks and shares on the public markets. However, reputable online services like WineCap make the process simple and straightforward.

Signing up to the WineCap platform and linking your desired investment amount takes just a few moments. From there, investors can effortlessly view, track, and purchase the finest wines available. They can even benefit from state-of-the-art analysis tools, and experts are on hand to recommend the best brands. Selling wine with us is just as painless. We are extremely well positioned to trade wine, reaching keen audiences and investors across the globe. When investors sell fine wine, WineCap charges a brokerage fee of 10%.

Buying a property, on the other hand, is almost always a drawn-out and complicated procedure. Investors looking for a buy-to-let will need to visit multiple different properties and locations, requiring time and planning. They’ll also need to deal with estate agents, surveyors, conveyancers, lawyers, banks and possibly mortgage brokers, adding around £5,000 to the cost[7]. Plus, if tenants are already living in the property, it problematic for investors who want to renovate or increase rents.

Selling a property means going back through the same laborious process, especially if the new buyer is part of a chain. It also occurs additional costs such as estate agents fees, EPC energy certificates, conveyancing fees and removal services, adding around £6000 in total[8].

Buying and selling a property comes with a lot more hassle and fees than fine wine. When fine wine is sold using online services like WineCap, a one-off 10% brokerage charge applies. By contrast, when buying and selling a property, investors are inundated with charges and requirements, adding thousands to the bill.

Inflation-hedging and interest factors

Fine wine is famously inflation-resistant. Over centuries it’s demonstrated that returns are not corelated to the wider financial markets, and over the last years it’s become even more stable than gold. As a scarce and depleting asset, fine wine investments are a promising hedge against inflation.

However, the same cannot be said for buy-to-let mortgages. Unless investors can purchase property outright, they are likely to get hit with annual interest rates of around 5%[9]. Considering that the average property in the UK comes to £296,000[10], mortgage holders will pay out £14,800 each year. What’s more, since 2017, buy-to-let tax relief has been gradually decreasing in the UK. As of 2022, it became zero. Property investors will be feeling the rising interest more than ever.

Inflation and interest rates are closely linked. When inflation rises too much, central banks will attempt to “cool” the economy by raising interest. At the moment, we are in a high inflation environment, and so interest rates are unlikely to drop back to pre-pandemic levels for the foreseeable future. This is bad news for landlords and property investors, but it doesn’t negatively impact fine wine holders.

When it comes to inflation-hedging and interest, fine wine investments have the edge over property. Unless the investor can pay for the entire estate without any mortgage, they will be hit with higher rates and less tax perks.

Ongoing maintenance costs

Some investors already have a temperature-controlled cellar at home. But for those that don’t, there are storage facilities available. Ensuring that the bottles are stored in the right conditions is crucial for maintaining and increasing value.

While storage costs vary from place to place, it’s usually between £10 and £40 for a case of twelve for a year. Some facilities may include insurance, or investors may prefer to purchase it themselves. Investors may also wish to have the wine delivered to a new location, which adds to the overall cost.

If you would like to talk to an expert about fine wine and the maintenance costs, we’d be happy to help.

Investing in property also comes with maintenance charges, which are often far more troublesome and costly. The estate may need renovation, cleaning, plumbing work, building work, decorating and more. Those planning to rent out also need to stay on top of regulations, such as fire safety measures. Many investors will employ a property manager to ensure that day-to-day issues are dealt with quickly, which is a drain on profits.

In addition, properties such as flats often require quarterly service charges, to pay for the communal maintenance, cyclical charges (like repairs) and reserve funds. Most service charges are between £1,000 to £2,000 a year.

Both fine wine and property investments come with maintenance charges. However, the cost of storing, insuring, or transporting fine wine is usually much less than the costs associated with properties.

Tax considerations

One of the major advantages of fine wine investments is the generous tax status. Under the UK HMRC, fine wine usually falls under the category of “wasting chattel”. This means that since it needs to be consumed within the next 50 years, it is exempt from Capital Gains Tax (CPT). Investment-grade wine which valued at less than £6,000 is also usually free from CPT. You can read more about the taxation rules of fine wine with our comprehensive guide.

However, the same cannot be said for almost all property investments. Property investors in the UK must normally pay stamp duty, capital gains tax and income tax. Buy-to-let investors will need to pay more in stamp duty than other homebuyers, as they have an additional 3% surcharge. And foreign property investors may face yet more taxes from both their own state and the one they are buying in.

Depending on the type of service property investors want to offer renters, they may also take on the Council Tax as well.

Property investors will probably need to pay stamp duty, CPT and income tax. Meanwhile, nearly all fine wine investments are exempt.

Is fine wine the new property?

In the current environment, fine wine has many desirable qualities and benefits over traditional property investments. While wine does have some associated costs, they are usually much lower and more straightforward than buying property. And, unlike property investments, the returns on fine wine are not directly impacted by tax, interest rates or inflation.

Perhaps most importantly of all, fine wine tends to preserve or increase in value during a recession. It is not linked to the wider economy and government intervention in the same way that the housing market is. On the contrary, in the aftermath of the 2008 housing collapse, fine wine rallied[11].

So, is fine wine the new property? We think it’s better.

[1] Source: Liv-ex

[2] Source: Liv-ex

[3] Source: Zoopla

[4] Source: Zoopla

[5] Source: Joseph Mews

[6] Source: Liv-ex

[7] Source: KFH

[8] Source: HOA

[9] Source: Money Supermarket

[10] Source: ONS

[11] Source: Liv-ex