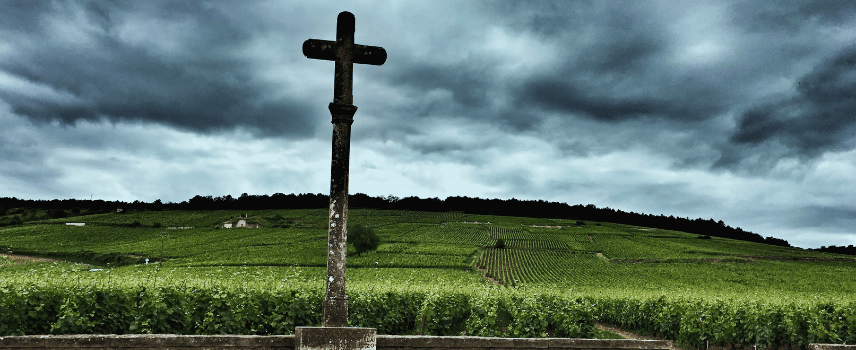

One of Burgundy’s most sought-out producers is Domaine de la Romanée-Conti (DRC). It was the Benedictine monks who were the first to recognise the Côte d’Or’s potential as a winegrowing area. They divided up and organised the parcels of land that produced the finest grapes.

This piece of land was originally called ‘Le Cloux des Cinq Journaux’, then ‘Le Cros de Cloux’. After changing ownership many times after the monks tended the vines there, the plot was renamed as ‘La Romanée’ by the Croonembourg family. However, it wasn’t until 1760 that this legendary site was given its name that remains to this day. Louis-François of Bourbon – the Prince Le Conti – named it ‘Romanée-Conti’ when he purchased the 4.46 acre plot.

It is rumoured that the prince acquired the land as he discovered that his rival – Madame de Pompadour – who was also vying for the affection of the king, Louis XV, planned on buying the vineyard. The prince hired an agent to carry out his wishes and hoarded all the domaine’s wines for himself, throwing elaborate parties for his distinguished guests.

Domaine de la Romanée-Conti’s wines are some of the most eye-wateringly expensive in the world. Even having the means to purchase them doesn’t necessarily translate into being able to buy them as production levels are so low that only approximately 500 cases of La Romanée-Conti are made each year.

One villain – having discovered just how much the wines were retailing for – hatched a plan in 2010 to hold DRC’s co-owner and head winemaker, Aubert de Villaine, to ransom.

Having made detailed drawings of the vineyard and, shockingly, having poisoned two of DRC’s vines with herbicide already, the crook sent a ransom letter, addressed to Villaine. In it, they demanded €1.3 million from the estate, otherwise they would poison the remainder of the historic vines.

It transpired that the culprit wasn’t as cunning as you’d have thought. Villaine enlisted the help of private investigators who delivered the ransom money to the specified location and a certain Jacques Soltys retrieved a parcel full of false notes and was met by police who were lying in wait.

After such an ordeal, things returned to normal at the estate. The grapes were picked, fermented and transformed into the 2010 vintage that, unsurprisingly, was proclaimed to be one of the all-time greatest years.

Search for all of DRC’s wines and find out their performance on Wine Track.