- The 2024 Burgundy vintage is low volume with a classic profile

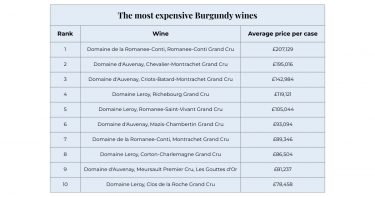

- Informed selection of reputable domaines and appellations is essential when making purchasing decisions.

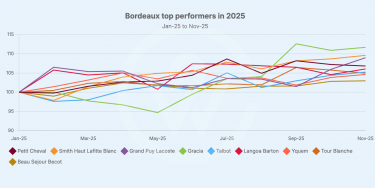

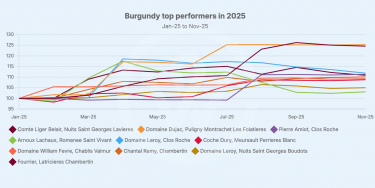

- Burgundy wines showed signs of bounce in Q3 after steady price decline

- The region remains a major player in the fine wine market despite shifts in Power 100 index

The 2024 Burgundy vintage is characterised by scarcity, precision, and classical elegance. A challenging growing season resulted in sharply reduced yields across the region, notably in red Burgundy wines. However, careful vineyard and winery management produced wines, albeit in smaller volumes, of exceptional quality, balance, and typicity. This is especially evident from Grand Cru and Premier Cru holdings.

This year’s En Primeur campaign unfolds against a complex market environment backdrop: previous vintages are still competing on the secondary market and fine wine pricing is showing cautious signs of stabilisation. This environment is offering collectors and investors opportunity and selectivity from the year’s best Burgundy wines.

This report examines the 2024 Burgundy vintage. It compares reds and Burgundy white wine, highlights standout domaines and appellations, and positions the campaign in a wider market context. This overview provides insights for both investment potential and enjoyment.

2024: Scarcity, vibrancy, and intensity

The defining characteristic of the 2024 Burgundy vintage is that of reduced volumes owing to a difficult growing season. Yields saw significant losses across the region, especially for red Burgundy wines. However, diligent work in the vineyard and winery resulted in wines that display a modern character with an old-school profile. The vintage is widely regarded as a year for admirers of classic, timeless Burgundy wines after a run of (with the exception of 2021) hot summers.

Chablis producer, Samuel Billaud, described the year as “a combination of 2014 (freshness and vibrancy) and 2021 (concentration and intensity of fruit).”

Climatic conditions and alcohol levels in 2024

Cool, wet conditions in spring led to coulure, resulting in reduced yields for Bourgogne red Burgundy wine. Chardonnay was not as badly affected. Spring and summer rain meant mildew and disease also posed a threat, which vignerons tried to deal with through repeated vineyard treatments where possible. Chablis was the worst affected, with yields often under 10hl/ha (usually 50hl/ha). The Côte de Nuits hovered around 15hl/ha. In the Côte de Beaune, red Burgundy grapes yields were at around 50% of typical levels. Chardonnay fared better at about 40hl/ha. Some areas, like the Mâconnais, had normal yields for Mâcon Burgundy. Lower-lying vineyards suffered more than mid-slope holdings. Localised hailstorms also added stress to vineyards. A clement late summer and a cool, dry north wind helped salvage the harvest.

- Chardonnay’s greatest terroirs benefited from the cool, accentuating typicity and depth.

- Pinot Noir’s low yields ultimately meant good phenolic maturity and intense ripeness.

Domaines demonstrated meticulous vineyard management and rigorous sorting to mitigate the impact of mildew. Potential alcohol levels across the vintage largely fell short of 13% abv. Some winemakers mitigated this with selective chaptalisation by half a degree. Both tartaric and malic acidities were higher than the previous year. During élevage, this resulted in softer, creamier acidity in fresh, zippy wines.

Reds vs white Burgundy wines: the essence of vintage quality

Like the previous vintage, 2024 was the year of Chardonnay, but Pinot Noirs also displayed grace, character, and balance. Many commenters noted that modern vineyard and winery methods had made finessed red Burgundy wines possible in conditions that would have written off Pinot Noir even just 25 years ago. The consensus was that the style for both reds and whites was traditional and classic, with a modern elegance.

Burgundy white wine featured:

- Fresh acidity

- Restrained, concentrated citrus

- Precise minerality and structure

Grand Crus and Premier crus benefited from the cool weather conditions more than the Villages sites located on lower slopes. Standout appellations include:

- Puligny Montrachet wine, such as Les Caillerets

- Chablis Grand Cru Les Preuses

- Chevalier Montrachet Grand Cru

Burgundy Pinot Noir is one of the recent best Burgundy years for:

- Small quantities

- Concentrated fruit

- Elegant, precise profiles

The vintage’s Pinot Noir yields were greatly reduced by the weather, but the wines were classic, expressive, and understated. Carefully timed harvest and stringent sorting resulted in reds with transparency, a core of red fruit, and supple tannins.

Notable successes include:

- Gevrey Chambertin Les Dix Climats

- Volnay 1er Cru Clos des Chenes

Overall, producers such as Samuel Billaud, Domaine Drouhin-Laroze, Pierre-Vincent Girardin, Domaine Y. Clerget, and Simon Colin have been praised for fresh, chiselled Burgundy wines with dynamism and terroir transparency.

Comparing 2023 vs 2024 Burgundy

Comparisons between the 2023 and 2024 Burgundy vintages are inevitable.

- 2023: Large quantities, wide variability, precision-driven wines

- 2024: Low volumes (notably of Burgundy red wine grapes), classic, elegant wines with concentrated fruit

Several growers and critics have noted similarities between 2024 and great Burgundy vintages for key characteristics: 2014 for its Burgundy quintessence and 2021 for its intense fruit.

Buyers should approach 2024 with a focus on appellation and domaine, rather than a broad perspective.

Burgundy 2024 in market context

The Burgundy En Primeur 2024 campaign unfolds against a unique market backdrop.

- The volumes of 2023 and 2024 mean that there is the potential for competition from previous vintage stock

- Following a 5-year steady decline in prices, in Q3 2025, Burgundy showed signs of stabilisation with a slight bounce in prices

- Out of the leading fine wine regions, Burgundy wines had the most movement in the Power 100 index, with ten brands dropping out and nine entering

- Most climbers are mid-range wines priced under £2,000 in a movement towards prioritising Burgundy to enjoy, not solely as an investment asset

- Top tier in the Classification Report dominated by Burgundy

- The region retains a 25–30% share of the global fine wine market, underlining its enduring importance

- Burgundy continues to demonstrate resilience driven by scarcity and long-term demand

Overall, the best Burgundy wine still constitutes a market juggernaut, but demand is price sensitive. Burgundy vs Bordeaux wine (the dominant fine wine region) comparisons will be accentuated by the En Primeur pricing approach. Commentators and producers alike project Burgundy prices to be reasonable despite a low-volume vintage.

Pricing strategies and producer behaviour

Understanding market conditions, many producers are flexible about their 2024 pricing approach.

Key influencers include:

- Lower yields by themselves do not automatically justify higher release prices

- Pricing impacted by values of back vintages of Burgundy wines

- Producers face margin pressure, but stock inactive in the supply chain has no advantages

- Burgundy learned that Bordeaux En Primeur overpricing in recent years reduces incentive for early buying

- Low yields mean the best 2024 wines could be fiercely contested

More limited 2024 yields compared to 2023, sensible pricing, and lessons from Bordeaux hint that demand will be robust for the scarcest, highest-quality wines.

Competition from the secondary market

A key influence on the Burgundy En Primeur 2024 campaign is competition from the secondary market.

Well-stored top rated Burgundy wines from recent strong vintages are maturing well and available at attractive prices. Additionally, market softening has made buyers and investors less willing to purchase at any price. The options are to:

- Secure 2024 En Primeur at fair pricing (“fair” meaning Bordeaux vs Burgundy En Primeur pricing referenced above)

- Choose established older vintages with track records

This landscape puts pressure on producers for reasonable pricing and rewards buyers who carefully assess value across multiple vintages.

How buyers should approach Burgundy En Primeur 2024

With such low yields and varied performance across appellations and even plots, the 2024 campaign demands a selective and discerning approach rather than indiscriminate buying.

Essential takeaways:

- Reduced volumes

- Pressure to price according to market

- Classic styles (reds and Burgundy whites)

- Grand Crus and top Premiers Crus across regions in Burgundy benefited most from the cool, precise vintage

- Signs of gradual market uptick

Whether or not 2024 is one of the best Burgundy vintages is not of prime importance. What is critical is that, with its classic styles, low quantities, and appearance at a time when the market hints at upward correction, 2024 could present competitive opportunities for selective investors.

Burgundy’s enduring strength

Despite short-term market shifts, Burgundy’s long-term fundamentals remain robust:

- Exceptional vineyards

- Strong global demand

- Enduring, prestigious cultural and historical legacy

- Consistent scarcity at the very top tier of Burgundy wines

The 2024 En Primeur campaign puts in relief a region responding to market and climate pressures while maintaining the qualities that make good Burgundy wine such a consistently prized segment.

Final thoughts on Burgundy En Primeur 2024

The 2024 Burgundy vintage offers a rare combination of low volumes, selective quality, and evolving pricing strategies at a moment when the fine market has signalled a bounce following pricing decline.

The finest Burgundy wine examples – particularly among the best white Burgundy – display precision, vitality, and strong value.

Jasper Morris MW says …”a miserable growing season does not have to translate into miserable wines”, adding, “Do not boycott 2024 – there are many delicious wines which merit attention”

Neal Martin (Vinous) says: “2024 is an endlessly fascinating vintage that will enamour the small number who imbibe the fruits of much labour.”

For informed investors, the present market conditions create a strategic window to engage with wine from Burgundy thoughtfully, balancing new releases against secondary market opportunities.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today