- The 2023 Burgundy vintage is bountiful but heterogeneous in quality.

- Careful selection of reputable domains and top producers is necessary when making purchasing decisions.

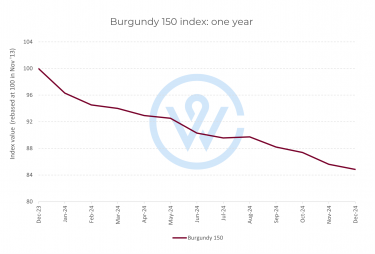

- In the secondary market, Burgundy prices have fallen 15.2% in the last year.

The Burgundy En Primeur 2023 campaign brings a vintage full of potential and expectations: potential due to the quality but mostly quantity of the vintage in a region defined by scarcity, and expectations for reduced pricing given producers’ desire to sell.

The campaign arrives at a pivotal moment for the region. Following years defined by scarcity, rising prices, and intense demand, Burgundy now presents a markedly different proposition: a large-volume vintage released into a softening market.

The 2023 Burgundy vintage is widely described as bountiful but heterogeneous. Production volumes exceeded the regional average by approximately 30%, offering a level of availability rarely seen in Burgundy. Yet quality varies significantly by site, grape variety, and producer, making careful selection essential.

This article explores the 2023 Burgundy En Primeur vintage, comparing reds and whites, assessing critical perspectives, and placing the campaign within its broader market context. For collectors and investors alike, the campaign presents both opportunity and complexity.

A bountiful but heterogeneous Burgundy vintage

The defining feature of the 2023 Burgundy vintage is quantity. After consecutive years of frost, hail, and drought-induced scarcity, growers welcomed yields well above average. However, volume alone does not define quality in Burgundy.

Weather conditions throughout the growing season were challenging. Episodes of heat, drought, and localized flooding tested vineyard management skills, and outcomes varied sharply depending on producer decisions.

As Sarah Marsh MW summarised:

“The 2023 Burgundy was a bounteous but heterogeneous vintage in which the white wines outshone the reds.”

This assessment has been echoed across early tastings and reports from critics including Jasper Morris MW and Neal Martin (Vinous).

Climatic conditions and alcohol levels in 2023

A key moment in the 2023 growing season was a late-season heat spike, which accelerated ripening across much of the Côte d’Or.

-

Chardonnay benefited from earlier harvests, preserving acidity and freshness before the most intense heat.

-

Pinot Noir, while generally successful, required precise yield control to avoid dilution and over-ripeness.

Alcohol levels across the vintage typically fall between 13% and 13.5%, reflecting healthy ripeness without excessive warmth. Where growers managed canopy and yields carefully, wines show clarity and balance rather than heaviness.

Reds vs whites: where the vintage excels

White wines: the clear winners of 2023

Across tastings, white wines consistently outperform reds in the 2023 vintage. Chardonnay handled the climatic challenges with greater resilience, producing wines marked by:

-

Fresh acidity

-

Mineral tension

-

Precise fruit expression

Cooler, high-quality sites performed particularly well. Standout appellations include:

-

Puligny-Montrachet Caillerets

-

Meursault Perrières

-

Chassagne-Montrachet higher-altitude parcels

Producers such as Jean Chartron, Violot-Guillemard, and Comte de Vogüé have received strong early praise for whites that combine structure with approachability.

Red wines: quality depends on discipline

The Pinot Noir wines of 2023 are more variable. Where yields were controlled and harvest timing was precise, reds show transparency and charm. However, less disciplined viticulture resulted in wines that lack concentration.

Critics note that the best reds favour elegance over power, making careful producer selection essential.

Notable successes include:

-

Bonnes Mares, noted for opulence and structure

-

Strong examples from Domaine Dujac and Domaine de la Vougeraie

Comparing 2022 vs 2023 Burgundy

Comparisons between the 2022 and 2023 Burgundy vintages are inevitable.

-

2022: Riper, more consistent, immediately impressive, smaller volumes

-

2023: Larger quantities, greater variability, more precision-driven wines

Several growers and critics have likened the 2022/23 pairing to classic contrasts such as 2015/16 or 2009/10 – where one vintage delivers power and the next refinement.

For buyers, this means 2023 should be approached selectively, rather than broadly.

Burgundy 2023 in market context

The Burgundy En Primeur 2023 campaign unfolds against a markedly different market backdrop than previous releases.

-

Burgundy prices have fallen 15.2% over the past year, the steepest decline among major fine wine regions.

-

Seven Burgundy brands dropped out of the Top 100 Most Powerful Wine Brands in 2024.

-

At the same time, Burgundy retains a 25–30% share of the global fine wine market, underlining its enduring importance.

In short, Burgundy remains a powerhouse – but no longer an automatic buy at any price.

Pricing strategies and producer behaviour

Recognising market conditions, many producers are adjusting their approach to pricing in 2023.

Key dynamics include:

-

Stable or reduced release prices from several domaines

-

A desire to maintain cash flow amid rising production costs

-

Awareness that buyers are comparing new releases with older vintages now available at lower prices

The large 2023 yields contrast sharply with expectations for significantly smaller 2024 harvests, reinforcing the value proposition of the current campaign.

Competition from the secondary market

A critical factor shaping the Burgundy En Primeur 2023 campaign is competition from the secondary market.

As prices have softened, older, well-stored Burgundy wines from strong vintages have re-emerged at attractive levels. For buyers, this creates a choice:

-

Purchase 2023 En Primeur at adjusted pricing

-

Acquire proven older vintages with established track records

This dynamic increases pressure on producers to price realistically and rewards buyers willing to compare value across vintages.

How buyers should approach Burgundy En Primeur 2023

The 2023 campaign is not one for indiscriminate buying. Instead, success depends on selectivity and discipline.

Key considerations include:

-

Producer reputation and vineyard management

-

Performance of specific sites rather than appellations alone

-

Quality of whites versus reds

-

Pricing relative to older vintages

-

Long-term positioning rather than short-term hype

For collectors, the vintage offers opportunities to secure high-quality white Burgundy and select red wines at more accessible price points than seen in recent years.

Burgundy’s long-term position in fine wine

Despite short-term market adjustments, Burgundy’s long-term fundamentals remain intact:

-

Unmatched vineyard specificity

-

Strong global demand for top domaines

-

Cultural and historical prestige

-

Continued scarcity at the very top end

The Burgundy En Primeur 2023 campaign reflects a region in transition, adapting to climatic realities and market forces while retaining its core appeal.

Final thoughts on Burgundy En Primeur 2023

The 2023 Burgundy vintage offers a rare combination of volume, selective quality, and evolving pricing strategies. While the wines are not uniformly great, the best examples – particularly among the whites – deliver precision, energy, and strong value relative to recent campaigns.

For informed buyers, the current market environment creates a strategic window to engage with Burgundy thoughtfully, balancing new releases against opportunities in the secondary market.

As Burgundy continues to navigate climatic and economic challenges, its enduring prestige remains undiminished but success now depends more than ever on careful selection.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today