After a long correction, Champagne is showing early signs of recovery. Discover which brands are stabilising and why now may be the time to invest in Champagne.

- In June 2025, the Liv-ex Champagne 50 index saw its first monthly rise in a year, suggesting stabilisation across top brands like Dom Pérignon, Krug, and Taittinger.

- Our analysis of 50 flagship vintage Champagnes shows widespread price flatlining, indicating consolidation.

- With rising demand seen in its market share, Champagne may offer early-cycle upside potential for fine wine investors looking for value and brand prestige.

After more than a year of price corrections, Champagne’s investment market may be turning a critical corner. June brought a notable shift: the Liv-ex Champagne 50 index was the first regional fine wine index to post positive month-on-month growth, rising 0.8%. Though modest, the move could signal a broader turning point when seen in the context of individual brands’ performance within the region.

Champagne’s market performance

Over the past five years, Champagne’s market performance has resembled a game of two halves. From March 2020 to October 2022 – a span of 31 months – prices rose steadily, climbing 93.9% to reach a record high. In the 31 months since that peak, they have steadily declined, falling 34.7%. The index is now trending at 2021 levels. However, following a period of consolidation, June marked its first monthly gain in a year, with a modest rise of 0.8%.

Coinciding with the broader Champagne market recovery, several of the region’s most iconic wines are beginning to show signs of renewed investor confidence.

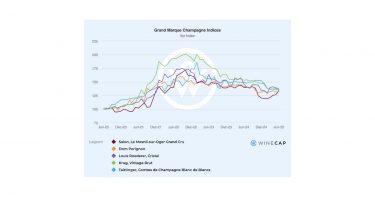

To validate this emerging trend, WineCap analysed the ten most recent vintages of the five most-searched Grand Marque Champagnes (often considered some of the best Champagne for fine wine collectors):

- Dom Pérignon: 2015, 2014, 2012, 2010, 2009, 2008, 2006, 2005, 2004, 2003

- Cristal: 2016, 2015, 2014, 2013, 2012, 2009, 2008, 2007, 2006, 2005

- Salon Le Mesnil: 2013, 2012, 2007, 2006, 2004, 2002, 1999, 1997, 1996, 1995

- Krug Vintage: 2011, 2008, 2006, 2004, 2003, 2002, 2000, 1998, 1996, 1995

- Taittinger Comtes de Champagne: 2013, 2012, 2011, 2008, 2007, 2006, 2005, 2004, 2002, 2000

Of these 50 reference-point wines:

- 43 have seen arrests to their price declines

- 40 have remained stable for at least six months

Aggregate brand indices are flatlining – a classic sign of consolidation.

Dom Pérignon led the stabilisation trend, with its index bottoming out in November 2024, while Krug and Taittinger have more recently entered plateau territory, indicating synchronisation across the broader Champagne landscape.

Demand for Champagne is back on the up too. Just in Q2 (see our Q2 Fine Wine Report), the region experienced a full cycle, with US demand temporarily retreating on tariff threat in April, to climb back up over May and peak in June. Year-to-date, the region’s market share on Liv-ex is above 2024 levels.

Early signals for a recovery cycle

This alignment of brand-level stability and regional index uplift could mark the beginning of a new investment cycle for Champagne. It’s a phase where prices consolidate before potentially trending upward, as supply scarcity and brand equity reassert themselves.

Investor sentiment is beginning to reflect this reality. Liv-ex data shows Champagne’s market share by value has risen to 12.4% year-to-date, up from an annual average of 11.8% in 2024. This re-engagement suggests confidence in Champagne’s medium-term upside potential.

Champagne’s investment appeal

Champagne’s investment appeal lies in its accessibility and worldwide distribution. Despite economic difficulties, Champagne is still seen as a celebratory tipple, enjoying consumption as well as investment interest. The region today features more than just brand prestige – its fundamentals are strong, with critical acclaim, ageing potential, scarcity, and collector loyalty.

With prices now having corrected to more attractive entry points, many of the region’s flagship wines offer value relative to their historic highs.

If current trends hold, Champagne may become the first major fine wine region to re-enter growth territory, outpacing peers who are still midway through correction. For investors seeking diversification or cyclical opportunity, the signs are clear: Champagne may be popping again soon.

See also: Champagne Investment Report

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.