- The La Place 2025 campaign has continued its expansion with more than 130 wines offered via the historic network.

- As the campaign unfolds against a backdrop of economic uncertainty, some estates have paused their involvement while others see it as an even more necessary tool to secure sales.

- We analyse the value and investment potential of some of the most important La Place releases.

The La Place 2025 campaign has continued its expansion with more than 130 wines offered via the historic network.

Firstly, what is La Place? Traditionally, La Place de Bordeaux (as it is called in full) was the centuries-old distribution system through which Bordeaux châteaux released their wines to international merchants. Over the past two decades, it has transformed into a global platform, with leading estates from Tuscany, California, Chile, and beyond joining to tap into its worldwide reach. For investors, La Place matters because it provides access to many of the world’s most sought-after wines at the moment of release – making it a barometer for both pricing trends and collector demand.

As the campaign unfolds against a backdrop of economic uncertainty, some estates have paused their involvement while others see it as an even more necessary tool to secure sales. We analyse the value and investment potential of some of the most important La Place releases.

La Place in 2025: what has changed

This year’s campaign unfolds against a backdrop of economic uncertainty, with the fine wine market still in the grip of a downturn that began in late 2022. Lower release prices have become more of an expectation, with the need to adapt to softer demand more noticeable than ever. Some estates have chosen to step back, pausing their La Place involvement for now, while others have come to view the system as key to securing global recognition and distribution.

What remains unchanged is the underlying pull of La Place: demand among producers to gain access to this international sales platform continues to grow, ensuring a steady stream of new entrants even as others bow out.

Departures and pauses

Not every name is present this year. Montes Muse, Destiny Bay, and Bibi Graetz’s ultra-limited Balocchi are no longer part of the roster. Certain wines are absent due to production constraints rather than strategy: Penfolds Bin 169 was not made in 2023, while Cloudburst skipped its 2022 Malbec. Within Bibi Graetz’s portfolio, the white Testamatta and Colore were made in such small volumes that they will not be offered via La Place.

Shifting timelines

Another notable trend is the shift in release windows. Several well-known estates have moved from September to March releases, including Hermitage La Chapelle, Napa’s Favia, Chile’s Viñedo Chadwick, and Jackson Family Wines’ Cardinale. This rescheduling might help reduce bottlenecks during the crowded September calendar.

New arrivals

Despite some exits, the list of debutants reinforces La Place’s increasingly diverse profile. New highlights include:

- Argentina (Mendoza): Zuccardi’s El Camino de las Flores

- Australia (Clare Valley): Jim Barry Florita

- Australia (Tasmania): Arras Grand Vintage

- France (Loire): Vincent Delaporte (Sancerre), Domaine Luneau Papin (Muscadet), Laurent Lebrun (Pouilly-Fumé), Sébastien Brunet (Vouvray)

- Spain (Ribeira Sacra): Cornamús (F. Algueira)

- USA (California): Flowers (Pinot Noir & Chardonnay)

Most in-demand La Place releases

Some La Place releases command attention year after year. These include the Super Tuscans, California’s cult labels, and Bordeaux/New World collaborations such as Seña and Almaviva. But where do their latest vintage releases sit in the current market and the overall brand performance?

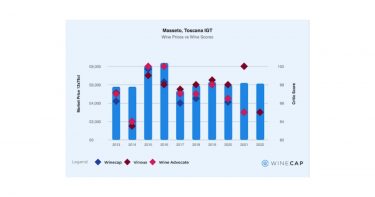

Masseto

Masseto was the first Italian wine to join La Place de Bordeaux back in 2009, offering its 2006 vintage through the international distribution system. It was also the first wine with no specific Bordeaux ties to join the platform, paving the way for other fine wines from around the world.

Earlier this month saw the release of its latest 2022 vintage at £6,140 per 12×75, down 1% on last year. The wine achieved 95 points from Antonio Galloni (Vinous) – his lowest score since the 2014. Still, he described it as ‘elegant and polished’ and ‘super refined’.

When it comes to value for money, the 100-point 2021 vintage makes a better buy. The lower-priced but higher-scored 2018 and 2017 vintages also offer better value. All of these vintages sit below the average brand price of £7,812 per case. Notably, our Masseto index has risen 67% over the past decade.

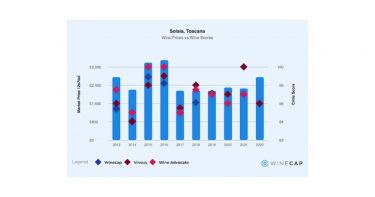

Solaia

Another notable Super Tuscan follows a similar trajectory. Solaia 2022 was released at £3,300 per 12×75, flat on the 2021, which has since fallen in value. Comparing critic scores for the two weighs in favour of last year’s release, which earned 100 points from Galloni. The lower-priced 2018 Solaia also looks more attractive.

Over the past decade, our Solaia index has risen an impressive 113%. Even with the current market downturn, Solaia values have held relatively steady – up 3% in the last six months.

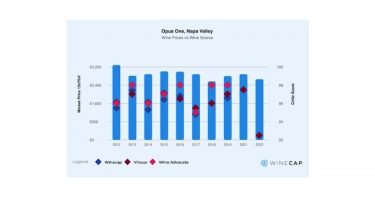

Opus One

Moving past the Super Tuscans, the 2022 vintage of the USA’s most popular wine, Opus One, was released earlier this month at £2,820 per 12×75. The wine received 92+ points from Galloni, 96 points from Jane Anson and 95-97 points from Lisa Perrotti-Brown MW. Higher-rated vintages like 2018 and 2019 look better poised for investment.

The overall performance trajectory of Opus One has been positive: the brand is up 4% in the last six months, 18% in the last five years, and 95% in the last decade.

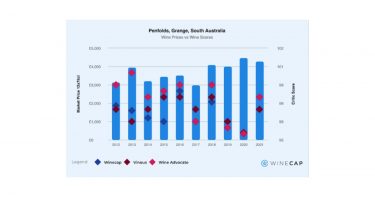

Penfolds Grange

Penfolds, Australia’s leading wine brand, released its 2021 vintage slightly below 2020 but above most readily-available older vintages. The new release achieved 98 points from Jane Anson and Erin Larkin (Wine Advocate). Still, buyers will find better value in 2015 and 2016 – two of the most sought-after Penfolds Grange vintages.

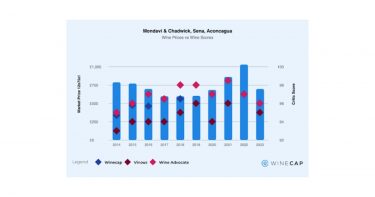

Seña

The 2023 vintage of Seña, which received 95 points from Joaquin Hidalgo (Vinous) and Jane Anson, was released at £720 per 12×75, down 36% on last year. Still, the 95-point 2018 and 96-point 2019 remain available at lower prices.

In the last six months, our Seña index has risen 2%; over the past decade, it is up 70%.

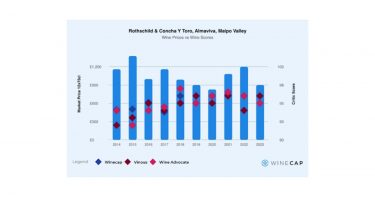

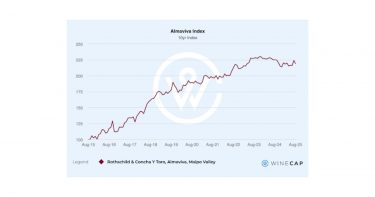

Almaviva

Almaviva, the most popular Chilean wine brand, also offered its 2023 vintage via La Place this September, at £924 per 12×75 case. The new vintage was awarded 96 points from Joaquin Hidalgo, placing it on par with the 2021 and 2019 vintages. The 2023 Almaviva has been one of the better value La Place releases, although from its back vintages, 2020 and 2019 look equally or even more attractive.

In terms of overall brand performance, our Almaviva index is up 141% in the last decade. The brand’s average price per case now stands at £1,565.

The 2025 La Place campaign inevitably reflects the global economic climate as well as the challenges and the resilience of today’s fine wine market. A cautious economic backdrop and softer demand have prompted some estates to step aside and others to lower prices, yet La Place continues to expand in scope and influence.

The arrival of new producers from Argentina, Australia, the Loire, and California highlights its ongoing globalisation, while established icons like Masseto, Solaia, Opus One, and Almaviva still command worldwide attention. The key for buyers remains having a selective and comparative approach. While new releases carry prestige and immediate buzz, back vintages often provide stronger value and proven performance.

Want to learn more? See also: Is buying early always the best investment?

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.