- Bordeaux’s rising stars have outperformed the wider market, with prices rising faster than the broader Bordeaux indices.

- Targeted investment and stylistic shifts have transformed estates like Rauzan-Ségla, Beau-Séjour Bécot, and Pichon Comtesse into modern benchmarks.

- Critical acclaim has surged, with 95–100 point scores cementing their reputation.

Defining a ‘rising star’

Bordeaux is a region where history runs deep, but tradition does not always guarantee progress. Over the last decade, a handful of estates have managed to transcend their classifications and reputations through bold investment and stylistic reinvention. At WineCap, we define a rising star as a château that:

- Commits capital to long-term improvement – from vineyard mapping and replanting to new cellars and eco-conscious viticulture.

- Delivers a clear stylistic shift – moving toward balance, finesse, and terroir transparency.

- Achieves consistent critical acclaim – with 95-100 point scores becoming the standard.

- Outperforms the broader market – delivering secondary market returns ahead of the broader Bordeaux indices.

These factors create estates that not only excite drinkers but also offer compelling opportunities for collectors and investors.

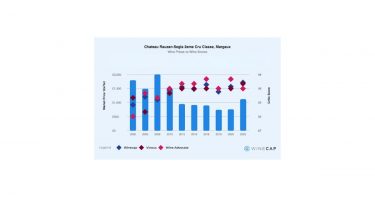

Rauzan-Ségla (Margaux, 2ème Cru Classé)

The transformation: Rauzan-Ségla has benefitted from Chanel’s ownership since the 1990s, but the past ten years have marked a decisive leap forward. Under winemaker Nicolas Audebert, the estate has embraced intra-parcel vinification, gentler extraction, and more sustainable vineyard practices. These refinements have elevated Rauzan-Ségla from ‘solid Second Growth’ status to a Margaux benchmark.

Critical acclaim: Since 2015, Rauzan-Ségla has routinely scored in the 95-98 point range from Wine Advocate, Vinous, and Jane Anson. The 2018 and 2020 vintages are considered modern icons.

Market performance: As the chart illustrates, critic scores have risen progressively and significantly. Still trading at a discount to First Growth Margaux, Rauzan-Ségla represents both relative value and rising prestige.

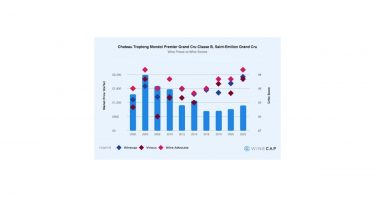

Troplong Mondot (Saint-Émilion, Premier Grand Cru Classé B)

The transformation: Troplong Mondot was once synonymous with high-octane, heavily extracted Saint-Émilion. The 2017 ownership change brought in Aymeric de Gironde (ex-Cos d’Estournel MD), who executed a dramatic stylistic shift: earlier harvests, lighter extraction, larger oak formats, and lower alcohol levels. The result is fresher, more terroir-driven wines.

Critical acclaim: William Kelley (Wine Advocate) called the changes a ‘wholesale stylistic revolution’. From 2018 onwards, scores have remained in the 95–97+ range, showing critics’ approval of the new direction.

Market performance: The market has embraced the transformation. Prices for Troplong Mondot have outpaced the broader Saint-Émilion index, rewarding early believers in the estate’s rebirth.

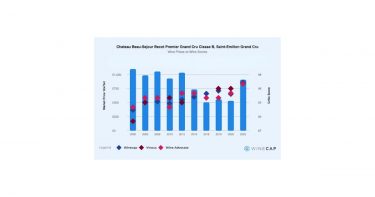

Beau-Séjour Bécot (Saint-Émilion, Premier Grand Cru Classé B)

The transformation: A generational change in 2017, with Juliette and Pierre Bécot taking over Beau-Séjour Bécot, brought a new vision. The appointment of consultant Thomas Duclos in 2018 marked a stylistic reset: higher Cabernet Franc usage, limestone expression, and precision over power. Parcel-by-parcel vinification and lower new oak usage have further refined the profile.

Critical acclaim: Antonio Galloni (Vinous) awarded the 2022 vintage a perfect 100 points, calling it ‘a benchmark wine’. Last year, he ranked it among the ‘most improved’ estates in Bordeaux, noting that ‘Juliette Bécot and Julien Barthe have raised the bar here meaningfully over the last handful of years’. William Kelley (Wine Advocate) has praised the château’s run of form since 2018, consistently awarding 95–98 points. Jane Anson describes Beau-Séjour Bécot as ‘one of the Right Bank’s most exciting transformations’.

Market performance: The correlation between rising scores and rising prices is clear. Once overlooked in Saint-Émilion, Beau-Séjour Bécot is now in the same conversation as Canon and Figeac, while still offering relative value.

Beauséjour Duffau-Lagarrosse (Saint-Émilion, Premier Grand Cru Classé B)

The transformation: Known for its legendary 1990 vintage, Beauséjour struggled with consistency until a new era began. In 2021, ownership passed to Joséphine Duffau-Lagarrosse and the Clarins family, ushering in major investment and a vision for precision-driven winemaking. A new winery project is underway, and viticultural improvements have already shown results.

Critical acclaim: Recent vintages have gained strong momentum, with the 2022 praised by Wine Advocate as a turning point. Jane Anson has written about the estate’s ‘rebirth’, noting how the new regime is restoring its rightful status among Saint-Émilion’s elite.

Market performance: Anticipation of quality improvements has translated into rising secondary market demand. Prices, once stagnant, now track sharply upward, reflecting buyer confidence in the new ownership.

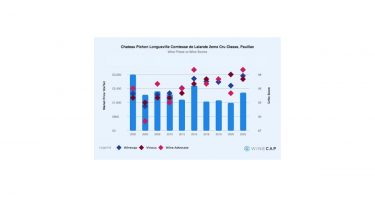

Pichon-Longueville Comtesse de Lalande (Pauillac, 2ème Cru Classé)

The transformation: Under Nicolas Glumineau since 2012, Pichon Comtesse has become the textbook definition of a rising star. Investment in geological surveys, vineyard restructuring, and higher Cabernet Sauvignon content has redefined the wine’s character: elegant, structured, and deeply Pauillac.

Critical acclaim: The 2016 vintage earned multiple 100-point scores, confirming Pichon Comtesse as a ‘Super Second’ capable of challenging First Growths. Recent vintages (2019, 2020, 2022) have sustained that trajectory, with critics routinely scoring in the 97-99 range.

Market performance: Prices have risen in lockstep with quality. Today, Pichon Comtesse trades at levels that rival the First Growths, a clear signal of market recognition.

Rising stars in the broader Bordeaux market

Wine Track data shows a clear trend: Bordeaux rising stars have not only achieved higher critic scores, they have also outperformed the wider Bordeaux market in price growth over the past 10 years. Investors who identified these estates early have benefited from both quality recognition and rising demand.

While Bordeaux’s classification system is famously rigid, the market rewards progress. The stories of Rauzan-Ségla, Beau-Séjour Bécot, Beauséjour Duffau-Lagarrosse, Pichon Comtesse, and Troplong Mondot prove that the Bordeaux hierarchy is not fixed. Strategic investment and stylistic courage can turn once-overlooked châteaux into modern icons.

Estates that invest in vineyards, rethink style, and deliver critically acclaimed wines are being re-rated by both critics and investors. In turn, investors who make informed decisions could benefit from the brands’ improved quality and growing reputation.

Looking for more? Read our Bordeaux Regional Report.