- First Growth Bordeaux is historically the most significant fine wine market segment.

- The price-per-point metric allows for a comparison of wines based on their market price and perceived quality.

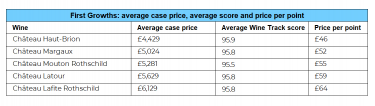

- Despite belonging to the same classification, the Bordeaux First Growth’s relative value differs substantially.

The price-per-point metric offers a powerful way to compare wines based on their market price relative to critic quality scores. By dividing the average case price by the average critic score, collectors and investors can identify which wines offer the best value, regardless of prestige or brand strength. This approach is especially insightful when analysing the First Growth Bordeaux châteaux, the most liquid and historically significant group within the wines of Bordeaux.

The First Growths – Château Lafite Rothschild, Château Mouton Rothschild, Château Margaux, Château Haut-Brion, and Château Latour – were formalised in the official Classification of 1855, a system that still shapes global perceptions of quality today. These Left Bank estates sit at the top of the Bordeaux hierarchy, alongside the region’s premier cru properties, commanding some of the highest prices in the fine wine market. Despite belonging to the same classification, their relative value differs substantially when measured through price per point.

Why First Growth Bordeaux dominates the fine wine investment market

First Growth Bordeaux occupies a unique position in the fine wine market, combining historic prestige with unmatched liquidity. Since the 1855 Classification, these estates have become global reference points for quality, consistency, and collectability. As a result, they are among the most actively traded wines on the secondary market, forming the backbone of indices such as the Liv-ex 50.

Liquidity is a critical consideration for collectors and investors alike. First Growth wines benefit from:

-

deep, global demand

-

consistent critic coverage

-

strong institutional recognition

-

regular market pricing across multiple vintages

This makes them easier to buy, sell, and value compared to wines from less-established regions or producers. Even during periods of broader market weakness, First Growths continue to trade, providing clearer price discovery and lower execution risk.

Importantly, this liquidity also makes First Growth Bordeaux particularly well-suited to price-per-point analysis. Because these wines trade frequently and attract consistent critical attention, their prices and scores offer a reliable dataset for assessing relative value. In contrast, rarer or less liquid wines may show distorted price-per-point figures due to limited availability or infrequent trades.

For this reason, First Growth Bordeaux remains the most analytically robust segment of the fine wine market – and a natural starting point for value-focused investors.

First Growth Bordeaux – price per point

An average case price of £4,429 makes Château Haut-Brion the most affordable of the First Growths. Meanwhile, it has the highest average Wine Track score of 95.9 points. While there is divergence in prices and scores on a vintage-specific level, Château Haut-Brion has the lowest price per point among the First Growths overall.

At the other end of the spectrum, Château Lafite Rothschild has the highest price per point of £64, owing to the highest average case price of £6,129 and a Wine Track score of 95.8.

Château Margaux, Château Latour, and Château Mouton Rothschild sit between these two extremes. Each offers exceptional critic scores and historic vintages, though their price-per-point efficiency varies depending on market cycles, En Primeur release prices, and vintage-specific trading volumes. Investors often compare these cru classé wines not only by absolute cost but by consistency of score relative to long-term performance.

Price per Point vs Prestige: When brand strength stops paying a premium

One of the most revealing aspects of price-per-point analysis is how it exposes the cost of brand prestige. While all First Growths command significant premiums, those premiums are not always matched by proportionally higher critic scores.

Château Lafite Rothschild is the clearest example. Its global brand recognition, particularly in Asian markets, has historically driven prices well above its peers. While Lafite consistently receives outstanding scores, its higher average case price results in the highest price per point among the First Growths. This reflects not weaker quality, but stronger demand driven by reputation and symbolism.

By contrast, Château Haut-Brion has historically benefited from a more restrained pricing profile. Despite delivering equally elite critic scores, it has avoided the same speculative price surges seen elsewhere, resulting in a lower price per point and reduced volatility.

From an investment perspective, this distinction matters. Wines with lower price-per-point metrics often:

-

experience smaller drawdowns during market corrections

-

recover more quickly following downturns

-

offer better risk-adjusted returns over long holding periods

This does not mean prestige-driven wines lack investment merit. Rather, it highlights that value and brand leadership do not always align. Investors allocating across First Growth Bordeaux may therefore choose to balance holdings – combining globally recognised icons with value-oriented performers to smooth portfolio volatility.

What does this mean for the First Growths’ performance?

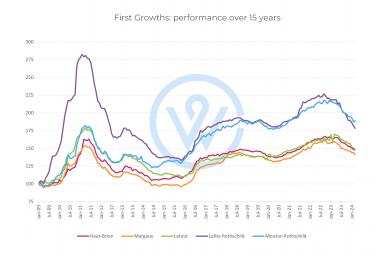

Historically, all First Growths have followed similar trajectories in terms of market highs and lows.

Key patterns include:

-

A dramatic surge during the China-led bull market (H1 2011)

-

A deep pullback in the years following

-

A recovery after the Brexit referendum, stabilising at higher levels

-

A recent decline in line with broader fine wine indices

The Liv-ex 50, which tracks the First Growths, is down 15.3% over the past year, mirroring the performance of the broader Liv-ex 1000 index.

Among the individual estates:

-

Lafite Rothschild saw the sharpest rise during the 2011 peak

-

It has also seen the largest recent fall (-19%)

-

Haut-Brion, despite never reaching the same peaks, has been more stable – dipping only 10% in the last year

This relative stability reinforces Haut-Brion’s status as a high-value First Growth brand. Its lower price per point and historically steadier performance make it appealing to collectors seeking reduced volatility without sacrificing Bordeaux pedigree.

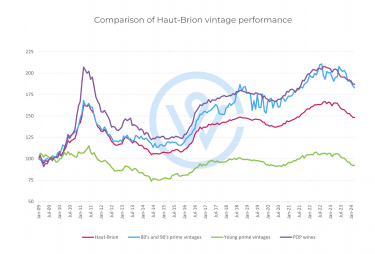

First Growth wines that offer value perform the best

In the case of Haut-Brion, value plays an important role in market performance. POP wines (those with a lower price per point) have outperformed the rest over 15 years. These include vintages 2002, 2004, 2006, 2007, 2008, 2011, 2012, 2013, 2014, 2017 and 2019 (the only prime vintage among the POP wines).

The second-best-performing index comprises older ‘prime’ vintages – wines with high scores pre-2000. However, this index has shown higher volatility due to the limited availability and trading volumes of these wines.

The index comprising younger ‘on’ vintages like 2015, 2016, 2018 and 2020 has underperformed the rest of the pack. However, these wines have also had less time in the market and their evolution is yet to be seen.

Historically, Bordeaux prime vintages often show accelerated growth after 10–15 years in bottle, meaning these more recent releases could see substantial performance shifts as they move further from their en primeur release period.

In conclusion, price per point offers an effective way to assess both value and quality, helping buyers look beyond brand prestige to uncover genuine opportunities. However, investors should also consider:

-

long-term market behaviour

-

storage and provenance

-

volatility of older vintages

-

the impact of global economic cycles

When combined with historical performance analysis, price per point becomes a powerful tool for building a balanced fine wine portfolio – identifying stable performers like Haut-Brion, premium prestige wines like Lafite Rothschild, and long-term growth opportunities across the First Growth category.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.