Alongside ‘provenance’, ‘scarcity’, and ‘vintage’, another key influence on wine investment potential is ‘producer and brand reputation’. These words encompass tradition, track record, trust, and market recognition, and there’s little that more instantly communicates these features than a wine label.

WineCap spoke with prestigious Bordeaux châteaux and learned about the importance of connection to heritage behind the vast array of wine labels found in the leading wine investment region.

- Classic châteaux images inspire confidence with age-old legacy.

- Colour is a strong signal of recognisable brand association.

- Historic tales showcase links to the region’s heritage.

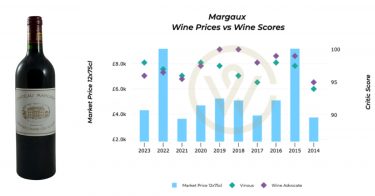

Classic Left-bank style: Château Margaux, First Growth

One label that has barely altered over time is that of Château Margaux. Displaying an image of the house’s legendary neo-classical château, after rebranding in recent years, the label’s font harks back to the style used by the estate in the late 1800s

Philippe Bascaules, managing director, commented to WineCap on the pedigree of the overall design and the value of immediate recognition. ‘The label of the bottle of Château Margaux is very old. It was designed at the beginning of the 19th century. It’s just the image of the château, which became our logo. I think it’s probably one of the most famous wine labels.’

Regal opulence, eastern allure: Château Ducru-Beaucaillou, Second Growth

Combining Western and Eastern finesse, the label of Château Ducru-Beaucaillou displays an oblique line illustration of the majestic estate set against a luxuriant golden-hued backdrop.

‘This label was created by the Johnstons, who owned the estate at the end of the 19th century, and, except for only slight changes, it has never changed,’ Bruno Borie, co-owner and manager of the Sant-Julien château, told WineCap. ‘It has always been this beautiful yellow, orange, and gold. I think the inspiration was the Venetian Palladian palaces that were painted in this beautiful yellow colour. Also, the late 19th-century Nathaniel Johnston married Princess Mary of Caradja from Istanbul, and she was a princess from a Greek family installed in Turkey who were very close to the sultan. Mary probably introduced this beautiful yellow colour, which was eastern – Orientalism was a style that was very fashionable at the end of the 19th century.’

Borie added that the label’s hue was possibly also influenced by contemporary trade with the Far East. “I don’t know if it was the intention, but I think that they were already shipping to Asia in those days, and gold was the colour of the Chinese Emperor.”

Borie noted the prominence of the house labelling. ‘When you are in front of a shelf or when you are in a restaurant, you immediately recognise that Ducru-Beaucaillou label. It’s a unique label that you need probably half a second to find.’

On the secondary market, the wine’s value has risen 50% over the last decade.

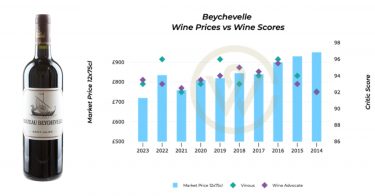

Historic story: Château Beychevelle, Fourth Growth

Breaking from the tradition of displaying a grand Bordeaux estate on the label, Château Beychevelle features an arresting black-and-white illustration of a vessel on a river. The boat is adorned with a griffon-like figurehead that looks ahead confidently as it floats on the calm river waters. Its sail is lowered and bears a cluster of grapes, while a pennant flag flutters gracefully from the mast.

The depiction honours the estate’s 17th-century foundations, when the first Duke of Épernon – a renowned and admired French admiral – owned the Gironde River château. His presence commanded such high regard that ships sailing by on the river would lower their sails in respect. This historic tale inspired both the estate’s emblem and name Beychevelle, from the Gascon phrase ‘Bêcha vêla,’ translating as ‘lower the sails’.

‘You don’t see a building, you don’t see a chateau or a gate, which is very common on wine labels,’ managing director of the Saint-Julien house, Philippe Blanc, told WineCap. ‘You’ve got this white corner cut label with a boat, which is quite rare and is very definitely recognisable as Beychevelle. Some people think the boat is a Viking boat, but it’s not. It’s a local boat going along the River Gironde and lowering its sail to show respect to the Duke.’

Over the past 12 months, the average case price of Chateau Beychevelle has dipped in value by 7%, but in the past 10 years, it has increased by 55%.

Bold and colourful: Château Lafon-Rochet, Fourth Growth

When Saint-Estèphe producer Château Lafon-Rochet transformed the appearance of its buildings from muted grey to vivid colour, the influence extended beyond its premises to its label.

Today, featuring a striking mustard-yellow backdrop, the house’s label displays a front-facing illustration of the elegant château, with diagonal vineyard lines in the foreground adding a sense of dynamism.

‘The label’s colour was inspired by my father,’ said general manager Basile Tesseron. ‘He disliked the grey façade and experimented with painting the château yellow, green, and red – one colour per year.’

In the end, yellow came out on top. ‘In 2000, he decided that if the château would stay yellow, the label should match. It may be bold, but now it’s unmistakably ours.’

The wine investment performance of Lafon-Rochet has been equally unmistakable – up 65% over the last decade, outperforming all the First Growths.

Dignity and blossoms: Château La Conseillante

The elegant grayscale label of Pomeral house, Château La Conseillante, quietly communicates family prestige. It features a shield-shaped emblem carrying the letters “L” and “N” for founder Louis Nicolas, which is framed by intricate, stylised berries and florals.

‘The inspiration is very simple – it’s the original logo of Louis Nicolas,’ general manager Marielle Cazaux told WineCap. ‘In French, we call it the ‘armoirée’.’

The classic design of the label is further enhanced by the bottle’s violet neck foil, which, as Cazaux said, subtly mirrors the floral violet notes often found in wine’s aromas and flavours.

Château La Conseillante prices have seen an increase of 81% over the last ten years.

See also our Bordeaux I Regional Report.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.