‘A new benchmark’

James Suckling has released his report on the Bordeaux 2022 vintage ahead of the upcoming En Primeur campaign. The critic claimed that in the 40 years he has tasted Bordeaux in-barrel, he had ‘never come across anything like the 2022 vintage’.

2022 will stay in memory as one of the hottest years on record, featuring severe droughts and heatwaves. Despite the challenges, Suckling suggested that 2022 ‘gives us hope that both man and nature can adapt to these circumstance and produce outstanding wines, both red and white’.

He further observed that dryness and heat no longer mean bold ripeness in the resultant wines. Most winemakers have prioritised freshness and lower alcohol, ‘picking their grapes at optimal ripeness, with this “al dente” fruit giving a crunchy and clean character to the wines, with fine yet structured tannins’.

Suckling found the young wines to be ‘dynamic and fascinating’ and noted that ‘there was high quality from top to bottom’ – a sign of a great vintage.

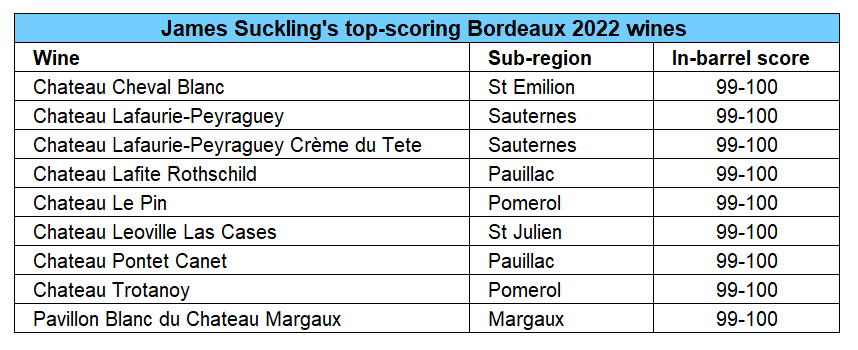

Top-scoring wines

Suckling found nine candidates for perfection in Bordeaux 2022, awarding them a barrel range of 99-100 points.

Cheval Blanc stood out as his potential ‘wine of the vintage’, which ‘soars to new heights with its brightness and weightlessness’.

The critic was also full of praise for two Sauternes from Château Lafaurie-Peyraguey, calling the Crème du Tête ‘magical. The new 1929?’

Only one First Growth made the list, Château Lafite Rothschild, which Suckling described as ‘a classical Lafite that reminds me of something like the 1986 […] but it’s so today with its purity and precision’.

A white wine also featured among the top-scoring – Pavillon Blanc du Château Margaux. According to him, this ‘feels like a great Montrachet’ and is ‘one for the cellar’.

The question of pricing

Suckling’s verdict on the 2022 vintage is that the quality of the wines is ‘exceptional’ but ultimately ‘the market will decide’ the success of the new releases. ‘High interest rates, volatile stock prices and recent bank failures’ are some of the factors that will influence purchasing of young Bordeaux.

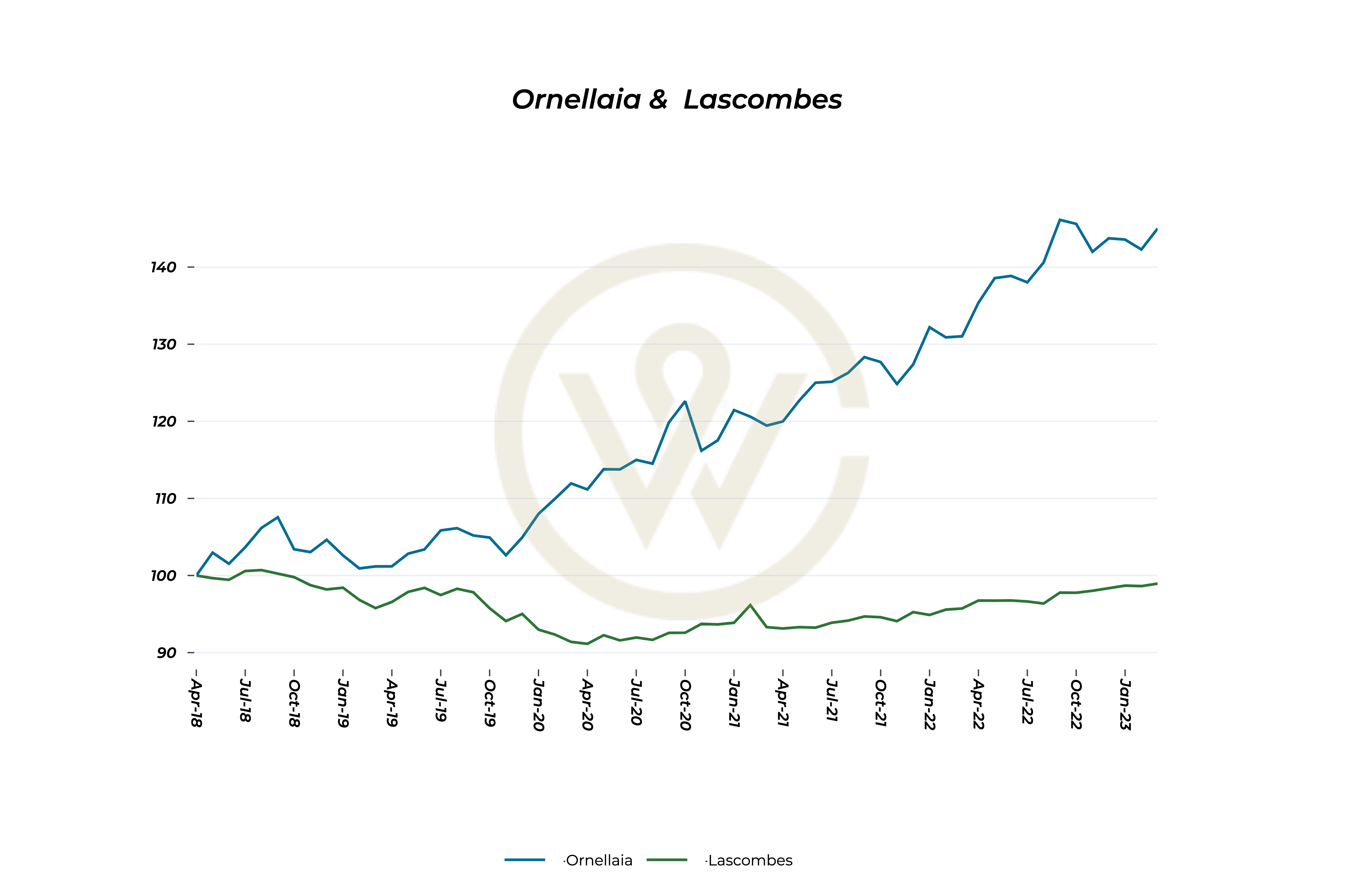

While the excitement of the new is guaranteed, high release prices might make older vintages look more attractive – especially if they offer value, and faster returns on investment.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.