- Australia and China have agreed to a suspension of their ongoing dispute over the steep tariffs imposed on Australian wine since November 2020.

- The tariffs had a profound impact on demand and price performance of Australian wine.

- Australia’s best price performers have risen over 40% in value in the last year.

Australian wine tariffs under review

In a significant shift that could redefine trade relations between Australia and China, the two nations have agreed to a suspension of their ongoing dispute over the steep tariffs imposed on Australian wine since November 2020. This development comes ahead of Australian Prime Minister Anthony Albanese’s forthcoming trip to Beijing, marking a potential thaw in the trade tensions that have severely impacted Australia’s wine industry.

While the Chinese government has consented to an expedited five-month review of the punitive duties, which have plummeted Australia’s wine exports from over $1 billion to a mere $12 million, there remains a cautious optimism. Despite this progress, industry experts predict that even if the tariffs are promptly revoked, the Australian wine sector, which has undergone substantial restructuring in response to the lost Chinese market, would still require approximately two years to recuperate and effectively redistribute its current surplus.

Impact on Australia’s wine investment market

The Chinese tariffs, ranging from 180% to 200% on Australian wine imports, had a profound impact on Australia’s budding secondary market. The country has historically been the second most important fine wine player from the New World after the U.S., enjoying greater demand than South Africa, Chile or Argentina.

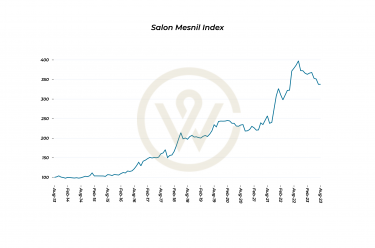

After a record-breaking year of trade in 2020, Australia’s investment market shrank in 2021. The number of different Australian wines traded on Liv-ex declined 32.2% year-on-year, as demand decreased.

Fewer wines from Australia made it into the rankings of the most powerful brands in the world. Australia’s leading label, Penfolds Grange, dropped in the 2021 Power 100 rankings, from fifth in 2020 to 45th place in 2021. In last year’s edition of the rankings, the wine fell further – from 45th to 55th place, while Henschke exited altogether. Part of the reason is that Penfolds has historically been heavily reliant on the Chinese market. In an attempt to rebuilt tariff-hit business, earlier this year Treasury Wine Estates, owner of Penfolds, announced the introduction of its first China-sourced premium wine.

Australian wine price performance

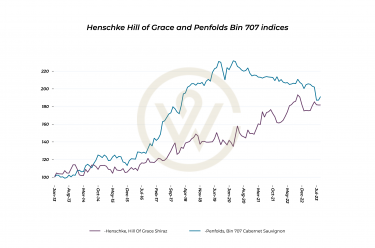

Since the tariff introduction, prices for some of the top wines have dipped, creating pockets of opportunity. For instance, the average price of Henschke Hill of Grace is down 4% in the last year; similarly, Penfolds Bin 707 is down 9%. While their trajectories are different, the long-term growth trend remains, with over 90% rise in the last decade.

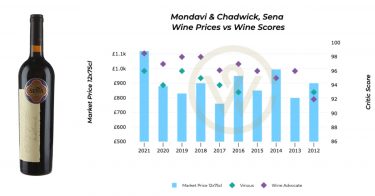

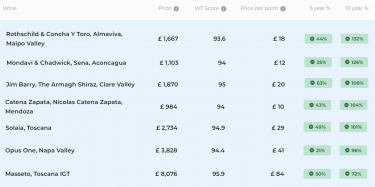

Some Australian brands have seen impressive price performance despite the ongoing trade tension. The table below shows the five best performers on Wine Track in the last year, which have risen between 31% and 41% on average. Clarendon Hills Brookman Syrah leads the rankings, with an average price per case of £1,042. Two Hands Aphrodite has been the second-best performer, up 39%.

The cautious optimism for Australian wine will likely affect its secondary market performance. As demand rises, so will prices. It remains to be seen if a potential tariff suspension will bring back the momentum to a region that has quietened down in the last three years but nonetheless remains an important New World representative.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.