- Our special report reveals how US wealth managers and financial advisers perceive fine wine as an investment.

- Almost all (92%) US wealth managers expect demand for fine wine to increase.

- Fine wine is ahead of jewelry (78%) and antique furniture (78%) in joint second.

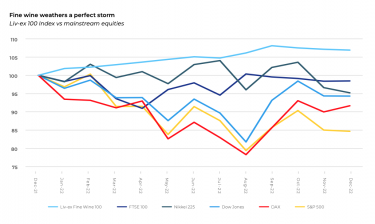

In recent years, fine wine has grown in popularity among affluent and high-net worth individuals in the US, driven by a greater recognition of the role it can play in delivering stability, attractive returns, and diversification to investment portfolios.

To date, there has been limited research into how fine wine is perceived by the key gatekeepers to sophisticated private investors, namely wealth managers and financial advisors.

Our special US report, Fine Wine: The Journey from Passion Asset to Mainstream Asset Class, seeks to bridge this gap by drawing on independent primary research among 50 US-based wealth managers and financial advisors.

Fine wine demand to increase

Our findings revealed that fine wine will attract most demand from investors over the coming year amongst all leading passion assets, with almost all (92%) of the surveyed expecting demand to increase.

This placed fine wine comfortably ahead of jewelry (78%) and antique furniture (78%) in joint second. Other well-established passion assets such as classic cars (64%) and art (54%) placed much lower in sixth and ninth place.

Fine wine’s place in a portfolio

The report found that fine wine is already featuring prominently in many wealth managers’ client portfolios. US wealth managers and advisors estimated that almost half (45%) of their high-net-worth (“HNW”) client base invest in fine wine with an average portfolio allocation of around 13%.

Fine wine’s growing prevalence among HNW client portfolios provides compelling evidence, if any is needed, that it has graduated to a genuine alternative asset, a highly effective portfolio diversifier, operating alongside other popular alternatives such as hedge funds, real assets, and private capital as well as mainstream assets such as fixed income and equities.

The report further provides in-depth research on the most common reasons for US investors to consider fine wine, and catalysts for further growth.

Please fill in the form below to download your complimentary copy of the report.