The US buyer whose recent purchase of Château Lascombes – that topped the list as the most expensive acquisition in the Médoc ever – has been revealed as Lawrence Family Wine Estates.

This is the US investor’s first acquisition in Bordeaux and, indeed, its first ever purchase in Europe. The family’s existing portfolio of brands include sought-after Napa names such as Heitz Cellars, Burgess and Stony Hill Vineyard.

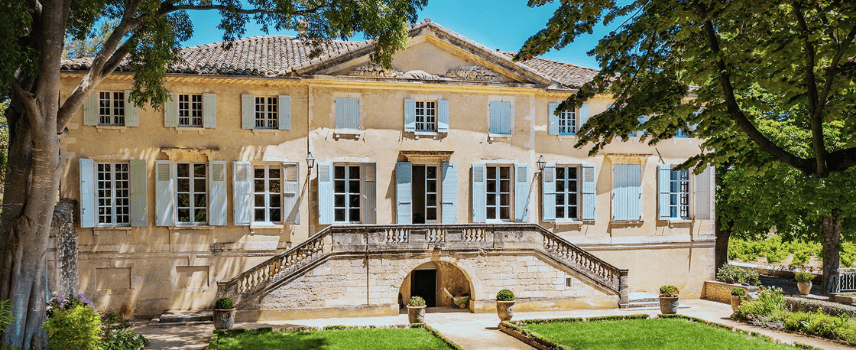

While the full details of the sale haven’t been disclosed, it is a strategic and important one. Château Lascombes is a leading Second Growth located in the Margaux appellation. This top estate rubs shoulders with the four other leading Margaux châteaux including, Châteaux Rauzan-Ségla, Rauzan-Gassies, Brane Cantenac and Durfort-Vivens. What sets Lascombes apart is its size: the estate is the largest in the appellation and spans just over 110 hectares with an additional 10 hectares in neighbouring Haut-Médoc.

The French press reported the acquisition as the largest sole financial transaction in the Médoc’s history. However, what is interesting from the Lawrence Family Wine Estates’ press release is that, and there is little detail, a minority stake in Château Lascombes is to continue to be held by its previous owners, Mutuelle d’Assurance du Corps de Santé Français (MACSF)

Since its foundation in the 17th Century, the estate has changed hands a number of times. Most recently, in 2001, the USA’s Colony Capital bought it for $67 million and then sold it in 2011 to MACSF for an estimated €200 million.

Commenting on its recent acquisition, Gaylon Lawrence, owner of Lawrence Family Wine Estates’, said: ‘We are honoured to become the new stewards of such a historical estate. This Château has some of the greatest vineyards in Margaux and our family looks forward to caring for Château Lascombes for many generations to come’.

Currently, Lascombes represents great value when compared to other Second Growths. Its average price on Wine Track is £689, compared to Château Cos d’Estournel at £1,580, Château Montrose at £1,300 and Château Léoville las Cases at £1,980. Could this new purchase and the recent investment in new winemaking facilities be the beginning of a change in its price point, just like the ones we’ve seen in recent years at Châteaux Figeac and Canon?

Discover the other high profile acquisitions in the world of fine wine in our recent article.