- The Bordeaux 2013 vintage saw a tepid response at release due to challenging weather conditions that impacted its quality and quantity.

- The vintage provided a low entry point into top Bordeaux brands, and interesting investment opportunities.

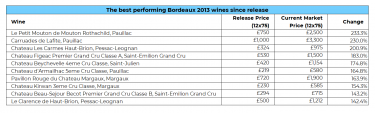

- Ten years on, some wines have risen over 200% in value, including second wines Petit Mouton and Carruades de Lafite.

As the 2013 Bordeaux vintage sees its tenth anniversary, critics are once again turning their attention to these wines. Our retrospective provides a glimpse into the market performance of the vintage, and the best-performing wines today.

Bordeaux 2013: a difficult year for winemaking

Bordeaux’s 2013 vintage was met with lukewarm reception upon release, primarily due to adverse weather conditions that took a toll on both its quality and quantity. Coming on the heels of two poorly priced campaigns did not help either.

A wet winter transitioned into an equally damp spring, delaying budburst and resulting in many grapes suffering from coulure. Unpredictable temperature fluctuations, frost, and an extraordinarily rainy May led to a disrupted flowering in June, further complicating the growing season.

July brought extreme heat, one of the hottest in over six decades, culminating in torrential rainstorms that significantly reduced yields in the Médoc and Pessac-Léognan appellations. August continued the trend with destructive hailstorms in the Entre-deux-Mers region. Consequently, growers were forced to discard damaged and unripe berries, causing further reductions in yield.

A mixed bag

Despite the less-than-ideal weather conditions, certain areas and grape varieties fared better than others. Saint-Estèphe, for instance, benefited from a drier growing season, resulting in some of the most successful wines of that year. Late-ripening varieties like Cabernet Sauvignon also made the best of the limited summer weather. However, earlier-ripening varieties like Merlot struggled due to the damp, cold start to the year.

In general, the 2013 vintage yielded smaller quantities of wine with dramatic variations in quality. The best reds were light, with lower alcohol content and a fresh fruity character, whereas the less successful examples were marked by overextraction and astringent tannins. Whites performed better overall, the best of which possessed aromatic freshness.

In terms of style, Bordeaux 2013 significantly deviates from the richer, sunnier vintages of recent years. It has produced lighter-bodied wines imbued with a tangy acidity, making them more suitable for short- to medium-term drinking rather than long-term cellaring. Many of the wines are now ready to drink.

A lower entry point into the market for Bordeaux

The inconsistency in quality led to a range of price points in the market. This presented an opportunity to acquire Bordeaux wines at lower prices than usual, especially those from estates with a proven track record of producing high-quality wines in challenging years.

This made the vintage an interesting entry point for those looking to invest in Bordeaux without the high initial price that other ‘on’ vintages command – a trend identified among buyers in Asia, and particularly for the First Growths and their second wines.

This has stimulated investment interest in the vintage, and some Bordeaux 2013 wines have seen considerable price appreciation, delivering over 200% returns in less than a decade.

A vintage for second wines

Four second wines are among the best performing Bordeaux 2013s. The second wine of Château Mouton Rothschild, Petit Mouton, leads the way with a 233% rise since release. The wine offered a low entry point into the brand at £750 per case; by comparison, this year’s 2022 vintage was released for £2,196 per 12×75.

The second wine of Château Lafite Rothschild has been the second-best performing label, up 230% in value since release.

Pavillon Rouge du Château Margaux and Le Clarence de Haut-Brion also feature among the biggest risers, with increases of 163.9% and 142.4% respectively.

Bordeaux 2013 – an unexpected opportunity

A decade on, the Bordeaux 2013 vintage has shown that even in challenging growing conditions, wines of interest and value can be produced. The vintage offered a lower entry point into Bordeaux, resulting in several significant performers. The legacy of the Bordeaux 2013 vintage may well be seen as a fascinating anomaly – an unexpected opportunity for wine collectors and investors.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.