- Neal Martin recently reviewed Bordeaux 2014 ten years on.

- The critic noted that many of the wines have evolved faster than expected.

- He declared it a Left Bank vintage and gave his highest score to Mouton Rothschild.

Vinous recently published Neal Martin’s assessment of Bordeaux 2014 following two consecutive tastings, including the annual Southwold 10-years-on event.

Martin’s overall impression was that the wines were ‘more unpredictable than other vintages’, and ones to ‘approach with modest expectations’. For him, many of them deserve drinking in the near future, but some are yet to deliver more.

On the question of Left vs Right Bank, the critic noted that the Left Bank has proven to be more consistent. When it comes to best-performing appellations, his pick was Saint-Julien.

Bordeaux 2014 ageing potential

Ten years on, the 2014 vintage has ‘evolved faster than envisaged’, according to Martin. The critic said that ‘it twinkled brightly in its youth, but many of its alumni were not predisposed toward longevity’. He further noted that ‘it certainly lacks the legs of, say, 2010 or 2016, perhaps even 2012 or 2017’.

Martin singled out wines that still have a life ahead of them and will be ‘intriguing to revisit at 15 years’, including Léoville Poyferré, Mouton Rothschild, Lafleur and Grand-Puy-Lacoste.

Favourite wines

For Martin, the wines that have ‘much more to offer’ and sit ‘up the hierarchy’ were Cheval Blanc, Figeac, Ausone and Pavie. ‘L’Eglise-Clinet, Lafleur and in particular, Vieux Château Certan, excel over in Pomerol, likewise Petrus and Clos l’Eglise,’ the critic added.

However, he warned that ‘none of the aforementioned ranks among their best wines’.

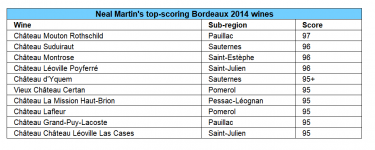

A personal favourite from Pessac-Léognan was Domaine de Chevalier. He also liked Pape-Clément and Haut-Bailly. His top-scoring wines can be seen in the table below.

Mouton Rothschild received the highest score of 97 points. Martin argued that it was ‘contender for wine of the vintage’ and ‘one of a handful of wines that transcends the limitations of the season, partly due to the skills of former winemaker Philippe Dhalluin’.

The critic also said that ‘the 2014 Grand-Puy-Lacoste is outstanding and performed neck-and-neck with the First Growths’.

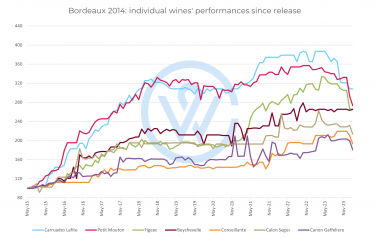

Bordeaux 2014 – performance since release

While the vintage may not sit up with the very best like 2010 or 2016, many of the wines offer relative value and a lower-than-average entry point into Bordeaux’s top brands.

Moreover, some have delivered handsome returns since release. Beyond the obvious performers of Carruades de Lafite (208.3%) and Petit Mouton (173.1%) and wines like Figeac (164.5%) which have benefited from changing classification, there is considerable growth to be found in some 2014s. For instance, Beychevelle has risen 165.4%, Calon Ségur – 113.4%, La Conseillante – 93.0%, and Canon-La Gaffelière – 80.3%. To see overall brand performances, visit Wine Track.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.