- Bordeaux and Burgundy are the pillars of fine wine investment portfolios, together offering stability and price performance.

- One of the clear contrasts between the two regions lies in their production volumes, which lead to very different market behaviour: Bordeaux is the more liquid market and Burgundy is more volatile.

- In recent years, Burgundy has increasingly captured Bordeaux’s market share and challenged its dominance as the most important fine wine region.

In the world of fine wine, two regions dominate both conversation and investment portfolios: Bordeaux and Burgundy. While they share France as a homeland, their histories, winemaking philosophies, and market trajectories are strikingly different. For investors, the choice between Bordeaux and Burgundy is not just about taste preferences, but about risk appetite, strategy, and long-term goals.

This article explores the history, styles, secondary market performance, and investment potential of both regions.

A brief history of winemaking

Bordeaux

Bordeaux’s history as a trading hub dates back to the 12th century, when Eleanor of Aquitaine’s marriage to Henry II of England opened English markets to its wines. This commerce played an important role in the region’s development over the following centuries. By the 1855 Classification, Bordeaux had codified its top estates, cementing its position as the epicentre of fine wine commerce. The prestige of First Growths – Lafite, Latour, Margaux, Haut-Brion, and later Mouton Rothschild – has underpinned Bordeaux’s dominance in the secondary market. Their Second Wines, which provide a lower entry point into the best brands, are often among the market’s most reliable performers.

Burgundy

Burgundy’s winemaking dates back even further, with monastic orders (Cistercians and Benedictines) mapping out terroirs as early as the Middle Ages. Unlike Bordeaux, Burgundy did not rely on grand châteaux but on small, family-run domaines. The Napoleonic Code fractured vineyards into tiny parcels, resulting in an extraordinarily complex patchwork of holdings. This fragmentation still defines Burgundy today, where a single vineyard such as Clos Vougeot may have dozens of owners, with each case commanding a different price.

Wine styles

Bordeaux

Known for blends dominated by Cabernet Sauvignon (Left Bank) or Merlot (Right Bank), Bordeaux produces structured, powerful wines built for ageing. Acclaimed, age-worthy sweet wines like Sauternes produced by esteemed names such as Château d’Yquem add another layer of prestige.

Burgundy

Focused almost exclusively on Pinot Noir for reds and Chardonnay for whites, Burgundy is about terroir expression. Each parcel conveys subtle differences in soil and microclimate, producing wines celebrated for finesse, balance, and aromatic depth.

Production levels and volumes

The sheer difference in production scale between Bordeaux and Burgundy is one of the sharpest contrasts between the two regions – and a key factor for investors.

Bordeaux has over 110,000 hectares under vine, producing on average 500–600 million bottles each year. Even its most prestigious estates typically release several thousand cases annually. This volume underpins Bordeaux’s liquidity and accessibility in the secondary market.

Burgundy, by contrast, is far smaller, with around 30,000 hectares of vineyards and total production closer to 150 million bottles annually. At the pinnacle, many grands crus yield only a few hundred cases. This extreme scarcity amplifies price pressure whenever global demand rises, making Burgundy both highly desirable and more volatile.

The wine investment market: A journey from Bordeaux to Burgundy

Bordeaux: The original pillar

Bordeaux was the foundation of the global secondary wine market. In 2010, Bordeaux accounted for a staggering 96% of trade by value. The En Primeur system, global brand recognition, and high production volumes made it the natural gateway for collectors and investors.

Bordeaux remains:

- The most liquid market: Wines trade frequently, with transparent pricing.

- Stable: While not immune to downturns, Bordeaux prices show less volatility.

- Accessible: Entry-level investment opportunities exist at lower price points than Burgundy, especially among rising stars like Rauzan-Ségla and Beauséjour-Bécot, which have undergone major capital improvements and now outperform peers.

See also: WineCap Bordeaux Regional Report

Burgundy: The new destination

Following the China-led boom of the late 2000s and early 2010s, Bordeaux’s dominance began to wane. Chinese buyers initially focused almost exclusively on the region’s First Growths, driving rapid price escalation, but as demand cooled, the market corrected sharply. Investors, collectors, and sommeliers then began to look elsewhere, sparking what has since been described as the ‘Burgundy moment’.

Between 2016 and 2018, and again from 2020 to 2022, Burgundy prices climbed dramatically. Burgundy prices surged ahead of broader fine wine benchmarks, reflecting growing international recognition of the region’s scarcity and quality. Burgundy’s appeal was further amplified by global trends toward terroir-driven, artisanal wines, contrasting Bordeaux’s image of large-scale production.

Scarcity remains Burgundy’s greatest market driver. Many grands crus produce fewer than 500 cases annually, which means that even modest increases in demand create significant price pressure. As a result, blue-chip producers such as Domaine de la Romanée-Conti (DRC) and Domaine Leroy now command astronomical valuations, cementing Burgundy’s role as fine wine’s most exclusive frontier.

See also: WineCap Burgundy Regional Report

Market share shifts

- In 2012, Bordeaux held 87.5% of market share, while Burgundy represented just 4.2%.

- By 2025, Bordeaux is down to 36%, while Burgundy has climbed to 24%.

This data underscores Burgundy’s emergence as a true rival to Bordeaux’s dominance.

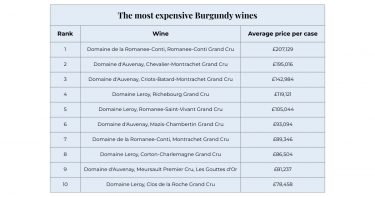

The most expensive Burgundy wines

The most expensive Bordeaux wines

As the tables above show, Bordeaux’s most prestigious names remain far more affordable than Burgundy’s icons, even as they maintain global popularity.

Also see The most expensive wines in the world (2025 edition).

Investment considerations

Bordeaux

Pros:

- Deep liquidity and stable pricing

- Lower entry points for investors

- Consistent branding and global recognition

Cons:

- Slower appreciation compared to Burgundy

- Susceptible to cyclical demand booms (e.g., China-driven surge)

The best Bordeaux vintages

The top Bordeaux vintages are admired for their balance, structure, and cellaring potential, with particular years becoming winemaking benchmarks. Against this background, there are two vintage categories that are relevant for wine investors: “on” years and “off” years.

“On” years are legendary vintages with ideal weather conditions. They include years like 2000, 2005, 2009, 2010, 2015, 2016, 2018, 2019, 2020, and 2022. Such years appear consistently on lists of the best Bordeaux vintages for their fruit purity, elegant tannins, and notable longevity. However, while impressive, they are not necessarily the best years of Bordeaux wines for investment, with lower-priced alternatives (“off” years) potentially offering more favourable opportunities.

So-called “off” years, for example, 2008, 2011, and 2013, don’t always receive the same attention as more critically-acclaimed Bordeaux, but they often present excellent investment opportunities. They can be especially ideal for newcomers seeking good vintages from Bordeaux without the premium prices. Such more accessible releases can perform well over time and, especially when they hail from highly-esteemed châteaux, deliver impressive returns.

Worth noting is that there is no single formula for selecting the right vintage for investing. Producer reputation, terroir expression, critic scores all need to be taken into consideration.

Burgundy

Pros:

- Exceptional price appreciation potential

- Extreme scarcity drives prestige and value

- Global demand from collectors, sommeliers, and investors

Cons:

- Very high entry points for blue-chip domaines

- Lower liquidity and fewer trading opportunities

- Greater price volatility

The best Burgundy vintages

The best Burgundy vintages are sought after for their elegance, purity, and terroir expression, with certain years representative of the region’s ability to produce a pinnacle expression of Pinot Noir and Chardonnay.

Standout “on” years include 1999, 2002, 2005, 2009, 2010, 2015, 2019, 2020 and 2022. These vintages benefited from favourable growing conditions and are, as such, frequently highlighted among the best Burgundy years for their complexity and outstanding ageing potential. However, high quality and price do not always have a direct correlation with long-term investment performance.

So-called “off” years, or vintages that don’t grab the headlines, include 2007, 2011, 2013 and 2017. These years can offer attractive value, especially from well-regarded domaines that are known for consistency regardless of weather challenges. Since Burgundy production is limited and highly appellation-specific, it can be misleading to be guided by broad vintage generalisations, with in-depth domaine-by-domaine analysis often offering a better approach.

Both great Burgundy vintages and overlooked years can be the source of exceptional investment potential, reflecting the diversity and subtlety of the region. In such a granular environment, it is worth aligning investment research and strategy accordingly.

Balancing stability and scarcity

For newcomers to wine investment, Bordeaux remains the most sensible entry point. It is affordable, liquid, and stable, offering opportunities to build a solid foundation in fine wine. Rising stars such as Rauzan-Ségla, Troplong Mondot and Beauséjour-Bécot highlight how estate-level improvements can translate into market outperformance.

For seasoned investors, Burgundy provides the high-risk, high-reward play. While volatile and scarce, the region offers unparalleled potential for price appreciation. The allure of owning rare bottles from DRC or Leroy is both emotional and financial.

Ultimately, a balanced portfolio should include both. Bordeaux provides the security and breadth of a bedrock investment, while Burgundy offers the exclusivity and upside that can truly elevate a collection.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.