- Sterling strength against the US dollar, combined with Californian fine wine prices down 11.4% year-on-year create prime buying conditions for European investors.

- From Screaming Eagle and Opus One to Bond Melbury and Aubert Chardonnay, select Californian wines are showing resilience and strong returns.

- US wines are not subject to the same tariffs as European wines entering America, amplifying the current opportunity.

Currency tailwinds meet market softness

With pound sterling trading near its strongest levels against the US dollar in almost a decade, European fine wine buyers are enjoying a rare currency advantage. In addition, prices for Californian fine wine have fallen 11.4% on average in the last year – a steeper drop than Burgundy, Champagne, Italy and the Rhône. And while European exports are now subject to a 15% tariff in America, American wines enter the EU with only minimal import duties.

For those looking west, this means more than just favourable exchange rates – it’s a window of opportunity to acquire some of California’s top investment-grade wines at effectively lower prices. The combination of market softness in the US and a relatively strong pound has created a buying climate that hasn’t been so compelling in years.

California’s investment appeal

California has long been America’s fine wine powerhouse, with its top labels regularly commanding global attention alongside Bordeaux First Growths and Burgundy Grand Crus. The state offers remarkable diversity, from the cult Cabernet Sauvignons of Napa Valley to the elegant Chardonnays of the Sonoma Coast.

Yet it is also a market where fine wines have historically been harder to acquire in Europe. Limited allocations, strong domestic demand, and brand-loyal followings have often kept supply tight. In the current environment, however, these barriers have eased slightly. Some of California’s most iconic names are trading at multi-year lows, as part of the wider correction in the global fine wine market.

Screaming Eagle: The US investment benchmark

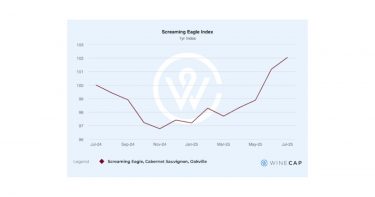

Screaming Eagle remains the top traded US wine by value, with a market history as intense as its scarcity. With six perfect 100-point scores in just 13 vintages, it sits in a league of its own among American wines. Over the past two decades, Screaming Eagle’s prices have climbed more than 200%, making it one of the most lucrative long-term holds in the fine wine market.

That said, the past few years have been volatile. After peaking in 2022, prices fell as broader market sentiment cooled, particularly in the ultra-high-end segment. The Screaming Eagle index has since shown signs of stabilisation, rising more than 5% year-to-date. For investors, this is often the sweet spot – when a correction has bottomed and momentum begins to turn.

The 2021 vintage is especially compelling. A 100-point release, it remains the most affordable among the perfect-score cohort. For those seeking a rare combination of topmost quality, brand prestige, and relative value, this vintage offers an unusually attractive entry point.

Other Californian fine wines to watch

While Screaming Eagle often dominates the conversation, California’s investment landscape is far broader. Several names have shown resilience or are quietly building momentum:

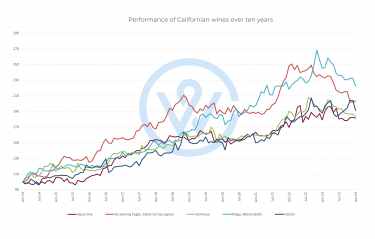

- Opus One – This Franco-American collaboration has traded in higher volumes this year on Liv-ex than European stalwarts such as Léoville Las Cases, Ornellaia, and Pol Roger Sir Winston Churchill. Year-to-date, our Opus One wine index is up 4%, with healthy liquidity that makes it attractive for active traders.

- Joseph Phelps Insignia – A model of consistency, Insignia’s prices have risen through the broader market downturn. The index is up 7% over the past six months and has appreciated more than 70% in the last decade. Its track record makes it one of the most reliable US names for long-term investment.

- Dominus – Known for its Bordeaux-style Napa blends, Dominus has declined just 1% in the past year. More recently, it has begun consolidating, with a 2% rise since January 2025, suggesting a potential base is forming for the next move higher.

These examples highlight an important point: not all Californian wines follow the same market rhythm. While the ultra-luxury segment can be more volatile, there are pockets of stability and even steady growth available to more risk-conscious investors.

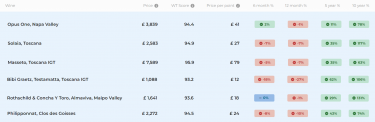

Top-performing US wines over the past year

According to Wine Track, several Californian labels have posted double-digit gains despite general market challenges and political uncertainty. This once again underscores the value of selective buying, even in a cooling market.

Bond Melbury and Screaming Eagle The Flight lead the field, each posting gains of 30% or more – an impressive performance given the overall market softness. Both wines share similar investment traits: small production, critical acclaim, and established brand prestige.

The appearance of Aubert Chardonnay and Occidental Pinot Noir on this list also highlights a growing trend: high-quality Californian whites and Pinot Noirs are attracting more collector attention, offering diversification beyond Cabernet Sauvignon and Bordeaux-style blends.

Investment takeaways

The combination of currency tailwinds and a market correction presents a rare opportunity for European buyers. For investors, the strategy is twofold:

- Target icons at cyclical lows: Screaming Eagle, Opus One, Harlan Estate, and Dominus are trading below peak levels, offering the potential for recovery-driven gains.

- Diversify with proven mid-tier performers: wines like Bond Melbury, Aubert Chardonnay, and Chappellet have delivered strong recent returns and often come with lower volatility than the ultra-cult names.

With sterling strong and US prices still subdued, this is a moment where timing and selectivity could translate into meaningful portfolio gains. California may be half a world away, but for European investors, the opportunity has rarely felt closer.

For more, read our United States Regional Report.