- Recent LVMH Champagne releases offer a combination of high quality and relative value for money.

- Dom Pérignon 2013 has been the most in-demand wine so far this year.

- The current market environment has created plenty of Champagne buying opportunities, among which Krug 2006 stands out.

A name synonymous with luxury and quality, Louis Vuitton Moët Hennessy’s (LVMH) wines have become mainstays of any serious wine investment portfolio. Owners of iconic brands like Krug, Dom Pérignon, Ruinart, Veuve Clicquot and Ace of Spades, LVMH has set unparalleled standards in Champagne production.

Not only have their wines delivered quality, as affirmed by critic scores, but they have brought greater liquidity to the Champagne market. A common theme uniting some of their recent releases is the outstanding value they offer compared to back vintages.

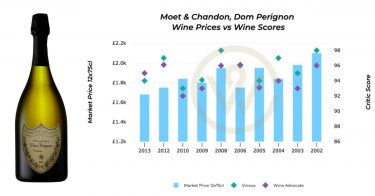

Dom Pérignon 2013 – the most wanted wine this year

Dom Pérignon 2013 is the latest release from the most in-demand Champagne brand. The wine boasts 95+ points from the Wine Advocate’s William Kelley, who called it ‘a lovely wine, defined by the long, cool growing season’.

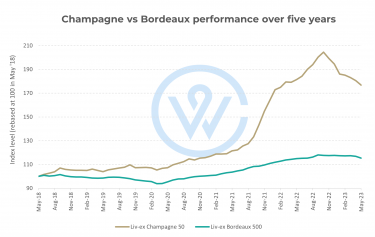

The remarkable value it offers – as the most affordable Dom Pérignon vintage in the market today – has led it to become the most traded wine by both value and volume this year. The wine’s price has fallen slightly since release (-7.1%), in line with the recent reconciliation in Champagne prices. The Champagne 50 index has dipped 13.1% year-to-date.

However, the brand’s overall trajectory is upwards, with Dom Pérignon prices rising 64% on average in the last five years, and 133% over the last decade, making it an opportune time to buy.

Latest Krug Grande Cuvée editions

The crowning jewel of LVMH, Champagne house Krug, also introduced its latest Grande Cuvée earlier this year. The 171st edition, blended meticulously from 30 different vintages dating back to 2000, represents the lowest-priced Krug GC.

Magnums of the 168th edition are also new to the market, with the hallowed 2012 as the base vintage. Older releases of such magnums are hard to find and command a hefty premium, once again underlining the value to be had here.

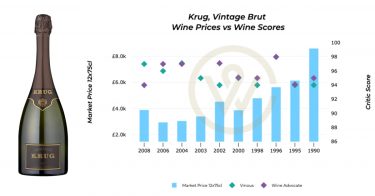

Opportunities in Krug

The recent decline in Champagne prices has created buying opportunities for some of the top names. The latest Krug vintage, the 2008, has become more affordable after dipping 29.0% year-to-date. The wine received 97-points from Antonio Galloni (Vinous) who described it as a ‘nervy, electrifying Champagne, the likes of which has not emerged from Krug’s cellars since the magical 1996’.

However, the 2006 presents an even better investment opportunity. While it is the lowest-priced Krug vintage, its scores align with pricier alternatives such as 2002. The 2006 boasts 96-points from Neal Martin, 97-points from Galloni and 98-points from Kelley, making its value proposition even more evident.

Krug prices have risen 71% on average in the last five years (see more on Wine Track).

Buyers can find plenty of opportunities in LVMH’s Champagnes. Despite the recent dip in the Champagne market, the long-term trajectory of these illustrious brands indicates a steady and impressive rise. The value on offer in some of the most recent offerings makes them an even more lucrative acquisition.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.