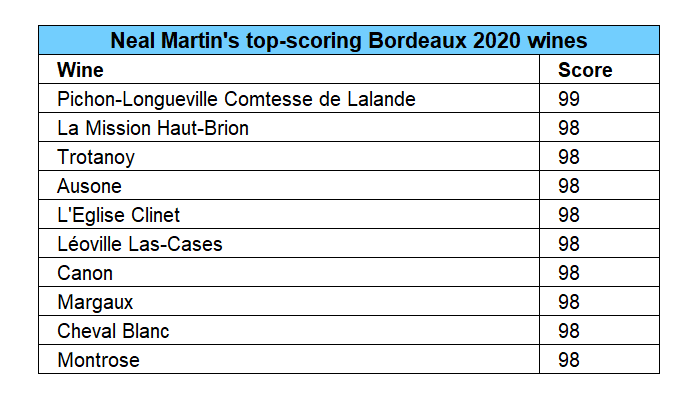

- Vinous published Neal Martin’s assessment of Bordeaux 2020 from the annual Southwold tasting.

- Martin placed the 2020 vintage ahead of the 2018 but behind 2019 and 2022.

- With 99 points, Pichon-Longueville Comtesse de Lalande was Martin’s top-scoring wine.

The annual Southwold tasting presents major critics with the opportunity to blind taste a Bordeaux vintage four years on in peer groups, mostly within appellations.

Last week, Vinous published Neal Martin’s assessment of Bordeaux 2020 – a vintage ‘born in a tumultuous world,’ due to the onset of the Covid-19 pandemic. Despite the challenges, the critic argued that it bestowed ‘Bordeaux-lovers with a bevy of outstanding wines that should stand the test of time.’

Neal Martin’s thoughts on Bordeaux 2020

Martin described the dry whites as a ‘little hit-and-miss’ and the Sauternes as ‘very good rather than excellent.’ When it comes to the reds, however, the critic said that they ‘are going to give a great deal of pleasure.’

In terms of vintage comparisons, Martin placed 2020 ahead of 2018 but behind 2019 and 2022, which were more ‘crammed with legends in the making’. He wrote: ‘Perhaps 2020 doesn’t quite possess the vaulting ambition of those two vintages, though in some cases, it surpasses the best of both.’

His favourite appellation was Saint-Julien, which ‘raised the bar with a cluster of outstanding wines.’ The critic argued that this flight ‘solidified 2020 as a bona fide great vintage on the Left Bank.’ He described Margaux as ‘solid,’ with the ‘real superstar’ being the First Growth.

From Saint-Estèphe, Martin highlighted Montrose as ‘the standout of the appellation,’ with the biggest surprise being the 2020 Phélan Ségur, ‘one of the best values given its reasonable price.’

Neal Martin’s top-scoring Bordeaux 2020 wines

Due to the nature of the Southwold blind tasting – wines grouped by appellation – Martin’s scores were ‘a little lower than when [he] encountered these wines at the end of 2022’.

His top-scoring wine, Pichon-Longueville Comtesse de Lalande, received 99 points. He described it as ‘a fabulous Pauillac that flirts with perfection.’

The rest of the wines in the top ten received 98 points. The highest-scored First Growth was Margaux, which the critic claimed was ‘among the greatest wines of the 2020 vintage.’ The ‘captivating’ and ‘mesmerising’ Cheval Blanc also scored among the best wines from the vintage. So did Trotanoy (‘an outstanding Pomerol’), and Canon (‘God made wine so it can taste as good as this’).

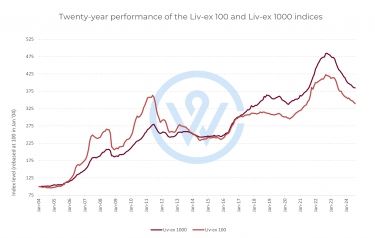

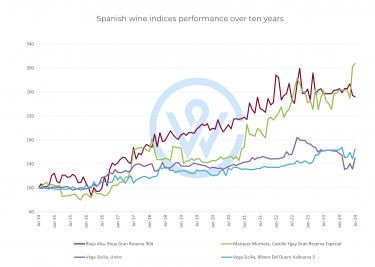

Investing in Bordeaux 2020

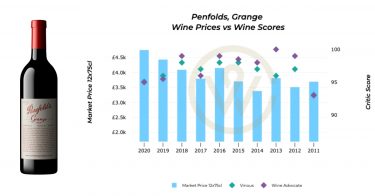

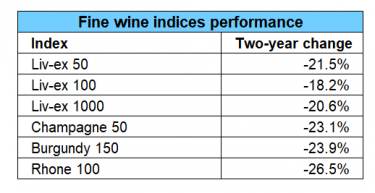

All of Martin’s top 2020 wines have fallen in value since release, apart from Trotanoy.

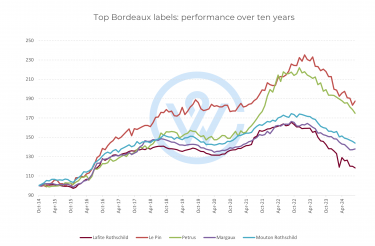

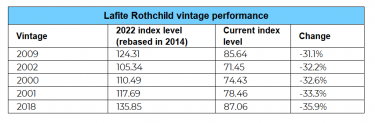

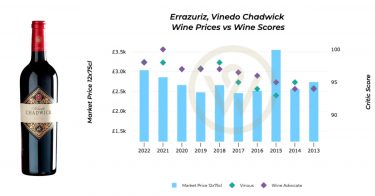

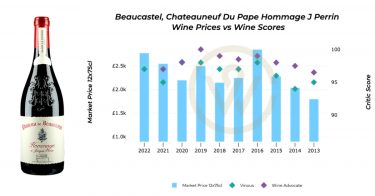

This is partly because of the overall market direction in the last two years, but also due to the availability of older and in some cases higher-rated vintages available at a discount.

As Martin rightly noted, ‘the top wines in this report not only compete against each other, but also with themselves in terms of alternative available vintages.’

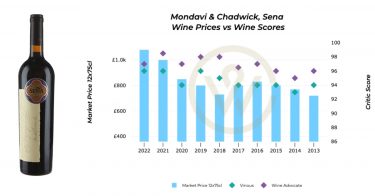

The lower-than-average prices at the moment, however, present great buying opportunities, especially for brands with a positive long-term performance.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.