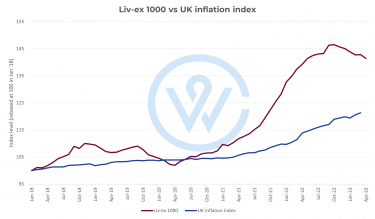

- Rising production costs and inflationary pressures in Champagne have raised concerns around its accessibility and its appeal to consumers.

- Higher interest rates pose challenges for financing grape supplies, potentially eroding profit margins for smaller Champagne producers.

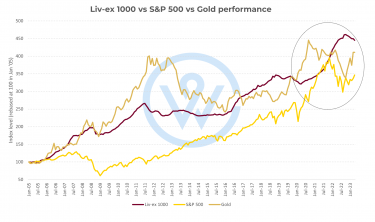

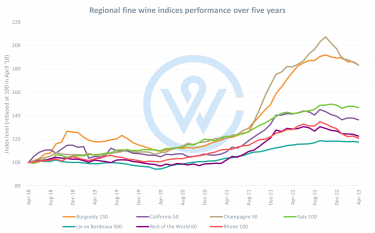

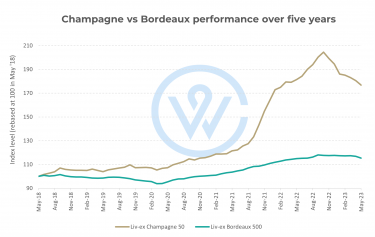

- Champagne’s investment market has also been undergoing a similar shift, which has diminished its relative affordability compared to other fine wine regions.

Champagne has experienced a period of remarkable success, with a new record turnover set for the region in 2022, The Drinks Business highlighted in an article this week. However, leading figures in the region have noted that inflationary pressures and rising production costs could potentially make Champagne too expensive. This is a particular concern at the lower end of the market where fixed costs make up a larger proportion of the value of the wine and the need to keep prices affordable is more pronounced. But prices have come under pressure in the secondary market too, which has shifted its dynamics.

Champagne’s rising costs spark concerns among smaller producers

The escalating prices of grapes, along with increasing costs of labour, energy, packaging materials, and glass, have placed significant financial pressures on some Champagne houses. According to the article, the price of grapes from the 2022 harvest rose by as much as 10% compared to the much smaller 2021 vintage.

Rising interest rates, which were sitting below 1% two years ago and have now reached 3% and higher, have added extra pressure on financing grape supplies, potentially eroding profit margins of smaller producers. Meanwhile, various packaging materials, including paper, foils, cases, and glass, are up by around 40%.

The rising production costs may lead to further price increases for Champagne. This situation raises concerns around Champagne’s accessibility and its appeal to consumers. Some producers fear that higher prices could deter customers and potentially drive them towards alternative sparkling wines.

The shifting dynamics of Champagne’s investment market

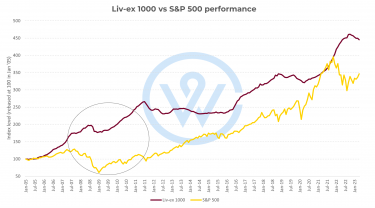

The dynamics of Champagne’s secondary market have also been undergoing a clear shift. Previously, everything seemed to work in Champagne’s favour: abundant stock, strong distribution, consistent demand, and relative value compared to other fine wines.

Speculators have taken advantage of Champagne’s strengths, fuelled by a string of excellent vintages that increased demand. This has altered the traditional rules of the Champagne market, as speculators often hold onto their stock without consuming it, resulting in potential oversupply. The sustainability of rising prices in the face of a potential stock overhang can present a challenge.

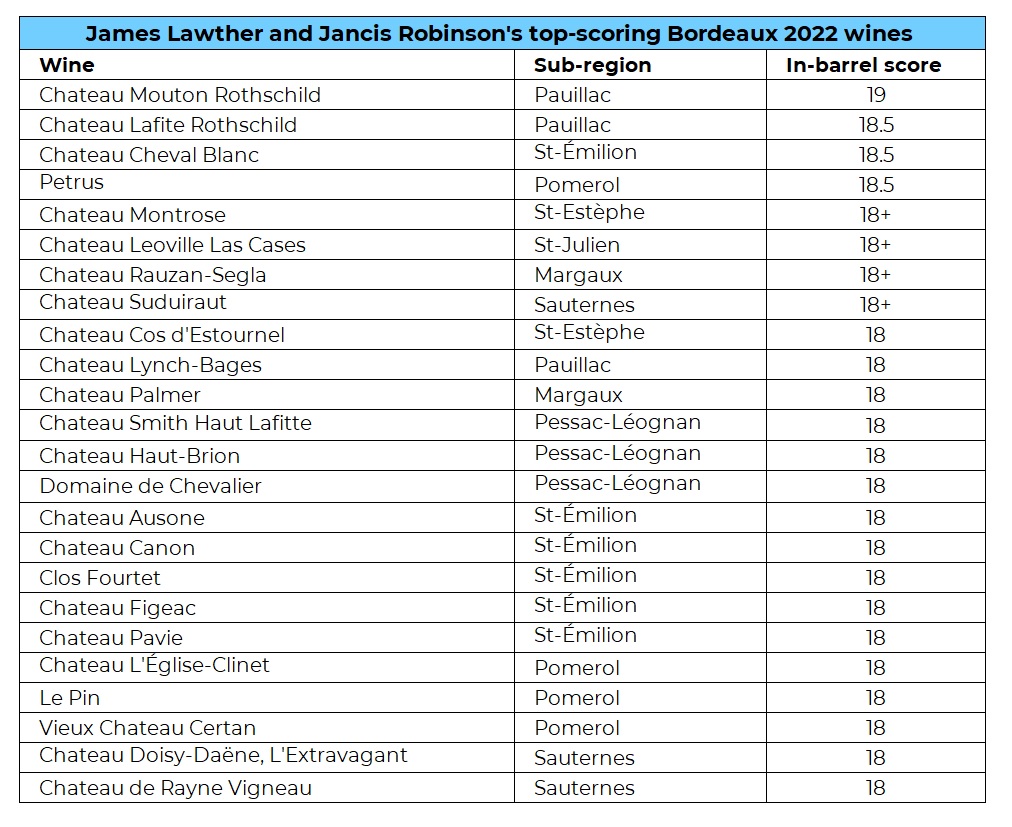

Meanwhile, the rising price of Champagne has diminished its relative price advantage compared to other fine wine regions. Previously considered an affordable entry point into the world of fine wine, Champagne’s average prices now rival those of Bordeaux. For instance, the average case price of Krug Vintage Brut (£5,001) is higher than that of the First Growth Château Haut-Brion (£4,802).

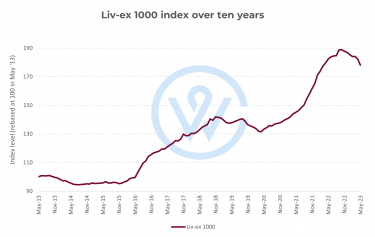

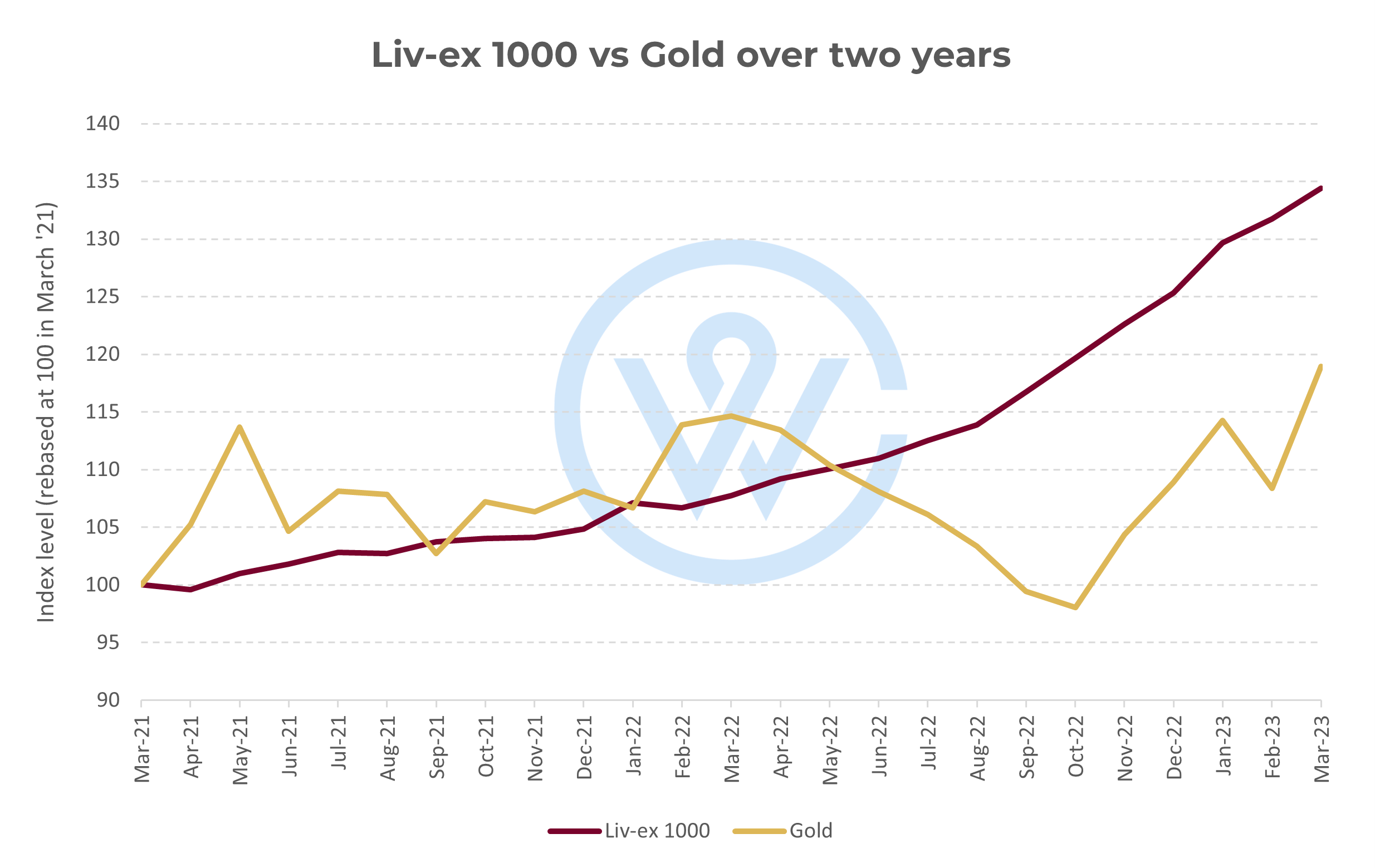

*Over the last five years, Champagne prices are up 76.8%, compared to 15.3% for Bordeaux. Champagne experienced stellar price performance between mid-2021 and the end of last year. Year-to-date, its index is down 9.1%.

Some producers have also displayed an ambition to raise prices. Notable brands, such as Philipponnat’s Clos des Goisses and Lanson’s Le Clos Lanson, have joined La Place de Bordeaux, signaling their intent to push their brands. Last year, François Pinault’s Artemis Group acquired a majority stake in Champagne Jacquesson. While this highlighted Champagne’s investment potential, it also indicated a departure from offering wines at entry-level prices.

All of this presents a complex landscape for Champagne’s future pricing and market positioning; particularly, for smaller more affordable producers, less able to spreads costs over multiple products and absorb the rising costs. Is the era of affordable Champagne over?

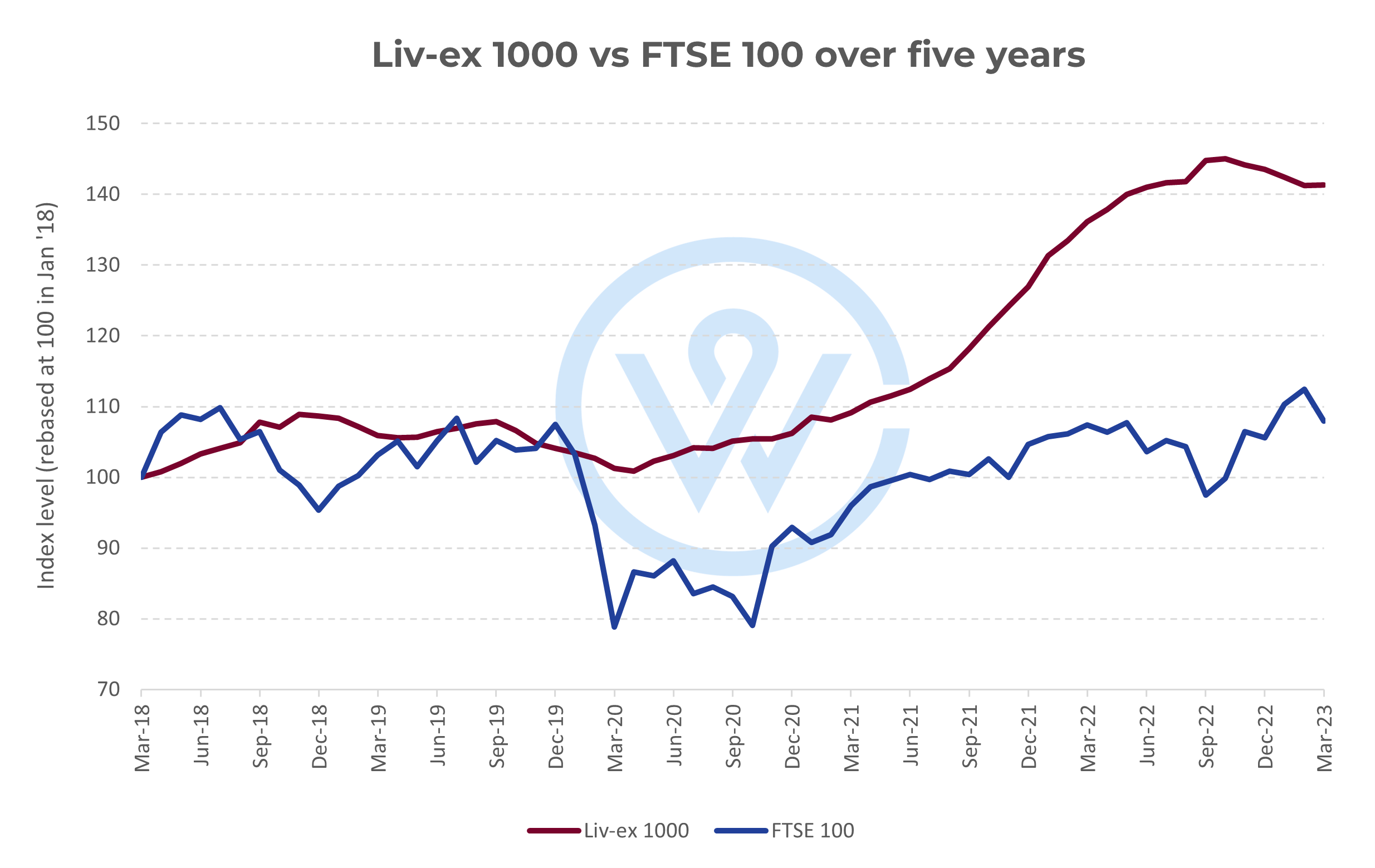

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.