- The La Place de Bordeaux campaign is in full swing, with releases from Chile, Italy, USA, France and more.

- A recurring theme in the campaign has been the price increases for the new releases, compared to their previous vintages.

- While La Place remains an exciting global marketplace for New and Old World wines, the ultimate value of the releases should be judged in a broader context.

The La Place de Bordeaux autumn campaign has gathered momentum over the past two weeks, with releases from Chile, Italy, USA, France and more.

The campaign kicked off with Paul Jaboulet Aîné’s Hermitage La Chapelle 2021, along with the re-release of some of its library vintages, namely 2013, 2011 and 2006. Napa Valley’s Opus One also re-released its 2018 and 2019 vintages, which led to heightened demand for the brand. Below we take a look at some of the recent New World releases from the campaign so far, examining their pricing and investment potential.

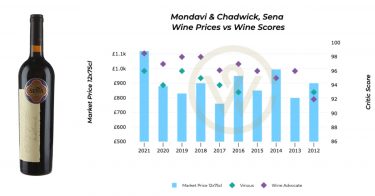

Seña 2021

The newly released 2021 vintage of Mondavi & Chadwick’s Seña is the highest priced wine across recent vintages from the brand.

Seña 2021 was released at €90 per bottle ex-négociant, up 5.9% on the 2020. The wine came with a recommended retail price of £1,344 per 12×75, representing a 30.6% increase on last year.

The 2021 Seña received 98+ points from The Wine Advocate’s Luis Gutiérrez, who described it as ‘one of the finest vintages’. Meanwhile, Joaquín Hidalgo (Vinous) gave it 96-points and said that ‘it will grow in the bottle’.

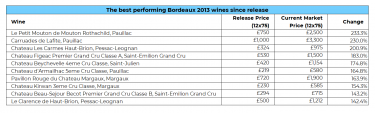

Other more attractively priced but similarly scored vintages include 2019 and 2018. Over the last ten years, Seña prices have increased 90% on average.

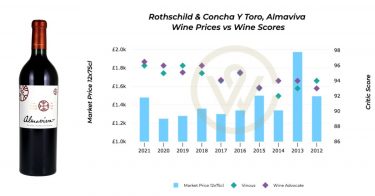

Almaviva 2021

Another release from Chile, Almaviva 2021, was offered via La Place at €122 per bottle ex-négociant, up 5.2% on the 2020. The wine was released internationally for £1,448 per 12×75. It received 96+ points from Luis Gutiérrez, and another 96-points from Joaquín Hidalgo, who praised its ‘enticing nose’ and ‘velvet texture’.

However, some back vintages such as the 2020, 2019 and 2018 offer better value. Our Almaviva index has recorded positive performance both in the short and the long term. Over five years, prices have risen 41%, and over ten – 147%.

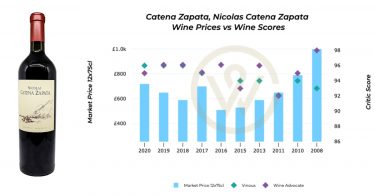

Nicolás Catena Zapata 2020

The Argentinian wine Nicolás Catena Zapata 2020 was released at €53.30 per bottle ex-négociant, up 1.5% on the 2019. It has been offered internationally at £720 per 12×75, down 1.6% on the 2019’s opening price.

It received 95-points from Gutiérrez and 96-points from Hidalgo, who observed that this ‘meticulously crafted red achieves perfect balance in a warm vintage’. However, there are plenty of good value buying opportunities in back vintages, notably 2019, 2018 and 2016.

Nicolás Catena Zapata has enjoyed a positive performance over the last five (33%) and ten years (104%).

A recurring theme in the campaign has been the price increases for the new releases, compared to their previous vintages. Similar to the spring Bordeaux 2022 campaign, often back vintages available at a discount hold better investment potential. While La Place continues to showcase the diversity of fine wine, and remains an exciting global marketplace for New and Old World wines, the ultimate value of the releases should be judged in a broader context.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.