- UK investors are moving faster than their US counterparts in handing over to a younger, tech-savvy generation, with a sharper decline in ‘very experienced’ participants.

- US portfolios still allocate more to fine wine on average, reflecting a greater appetite for alternative assets despite similar downward trends in allocation.

- Both markets are embracing digital tools and AI-driven insights, but the UK appears slightly ahead in integrating fine wine into a broader fintech-enabled investment strategy.

The fine wine investment market in 2025 is experiencing a paradigm shift on both sides of the Atlantic. While the United Kingdom and the United States share many overarching trends like the rise of a younger, tech-savvy investor base and the repositioning of fine wine as a strategic asset, the nuances in their trajectories highlight key cultural, financial, and strategic differences.

A shared generational shift at different paces

Both the UK and US reports depict a clear generational handover in fine wine investment. Baby boomers, once the stalwarts of the market, are selling off holdings accumulated over decades. In their place, a new cohort of Millennial and Gen Z investors is emerging – individuals who see wine less as a consumable luxury and more as a data-driven, alternative investment.

*UK

*UK

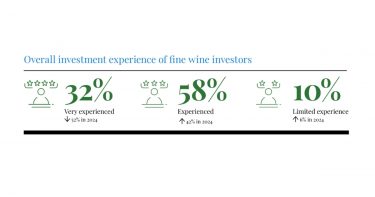

However, the pace of this transition is more pronounced in the UK. Only 32% of UK investors in 2025 are now classified as ‘very experienced’, a sharp drop from 52% in 2024. In contrast, the US market still holds a stronger base of experienced investors, with 44% falling into that category – a modest decline from 48% in 2024.

*US

*US

This suggests that while the UK is undergoing a more aggressive generational overhaul, the US market remains slightly more anchored in legacy investor behaviors. This could reflect cultural factors, such as the USA’s longer-standing tradition of wine collection, or structural elements like the greater maturity of digital investment platforms in the UK.

Diverging portfolio allocations

In both markets, fine wine is increasingly treated as a complementary asset class rather than a core holding. This shift is evident in declining portfolio allocations. In the UK, the average portfolio allocation to fine wine has dropped from 10.8% in 2024 to 7.8% in 2025. US investors have larger allocations overall, which have still declined from 13% to 10.7% on average year-on-year.

While both reductions are linked to recent price corrections and broader diversification strategies, the US still shows a greater willingness to commit higher portions of wealth to fine wine. Notably, 40% of US investors still allocate 11–20% of their portfolio to wine, compared to 18% in the UK.

This discrepancy may be driven by different attitudes toward risk, or a reflection of the US investor’s broader enthusiasm for alternatives – including crypto, art, and collectibles – where fine wine fits comfortably into a high-yield mindset.

Technology and the new investor toolkit

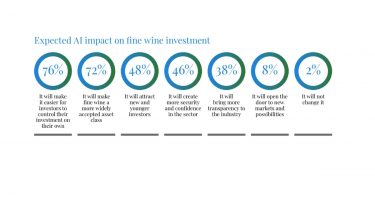

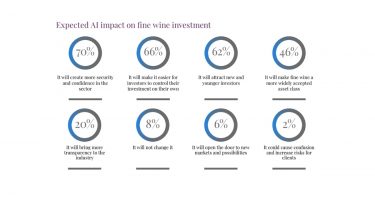

One unifying force across both markets is the use of AI, data analytics, and digital platforms. The new generation of investors is not relying on intuition; they’re using dashboards, price trends, and machine learning models to inform their trades.

*UK

*UK

This transformation is blurring the line between emotional and analytical investment, enabling fine wine to shed its image as a passion-led endeavor and gain legitimacy as a financial tool. However, the UK appears slightly more mature in this regard, perhaps due to a tighter integration between fintech and alternative asset platforms.

*US

*US

Market sentiment: recalibration, not retreat

Despite recent price softening, neither the UK nor US market is retreating. Instead, both are recalibrating. Experienced investors are taking profits, newer investors are entering at lower price points, and portfolio managers are redefining what role wine should play – most now agree it’s a diversifier, not a pillar.

Crucially, both markets anticipate that today’s corrections will lay the groundwork for tomorrow’s gains. Historically, fine wine has shown resilience and rebound capacity. The current dip may ultimately broaden participation and enhance long-term sustainability.

Two markets, one destination

The UK and US fine wine investment landscapes are converging in vision, yet diverging in pace and personality. The UK is evolving faster – more volatility-tolerant, more digitally advanced, and more dynamic in reallocating portfolios. The US, by contrast, remains a more anchored, cautiously progressive market, with higher average allocations but slower risk adoption.

Yet both markets are ultimately moving toward the same future: a fine wine investment world that is younger, smarter, more inclusive, and increasingly strategic.

As fine wine sheds its elitist past and embraces a tech-enabled future, investors on both sides of the Atlantic recognise fine wine’s growing potential.

Looking for more? See also: