Executive summary

- Q4 was marked by political developments, changing economic policies, and geopolitical events, including the re-election of President Trump.

- The strengthened US dollar boosted fine wine demand across the pond.

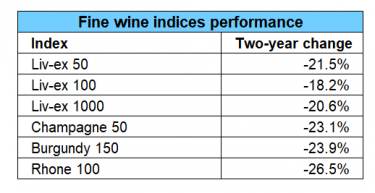

- Fine wine prices fell 11% across major regions in 2024, reflecting a continued market correction.

- Italy was the most resilient fine wine region, while Burgundy experienced the biggest adjustment.

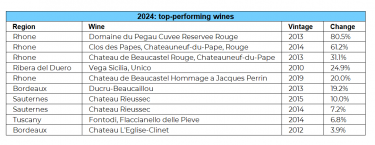

- Rhône wines dominated the list of the best performing wines in 2024, with Domaine Pegau Cuvée Réservée Rouge 2013 leading (80.5%).

- Older vintages (2010-2014) performed well, reflecting the market’s preference for mature, proven wines, while new releases struggled when not priced correctly.

- Optimism for market recovery is focused on premium regions like Piedmont, Champagne, and Burgundy.

- Economic uncertainties and mixed performance in Bordeaux are expected to persist, but continued interest in fine wine signals resilience and potential for long-term growth.

Q4 in context: political and economic drivers

Q4 was shaped by significant political and economic developments, most notably the re-election of President Donald Trump in November. Global markets reacted swiftly, with US equities rising on expectations of business-friendly policies and potential fiscal stimulus, particularly benefiting manufacturing and technology.

At the same time, renewed concerns over tariffs created uncertainty for multinational companies. Rising US Treasury yields attracted capital inflows, strengthening the US dollar but also raising fears around higher borrowing costs and a potential drag on global growth. Emerging market currencies came under pressure amid concerns about capital outflows and trade restrictions.

Geopolitical risks eased slightly toward the end of November following a US–France-brokered ceasefire between Israel and Hezbollah. While the agreement reduced immediate tensions after more than a year of hostilities, markets remained cautious, aware that stability in the region remained fragile.

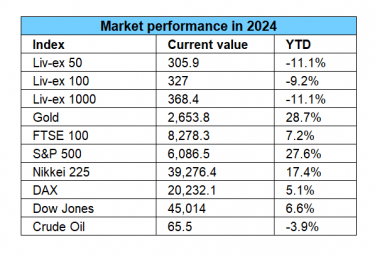

Markets in 2024: the year that was

Risk assets performed strongly in 2024. Bitcoin captured headlines by surpassing $100,000 for the first time, peaking at $104,000 on Coinbase. The rally was driven by optimism surrounding a more favourable regulatory environment under President-elect Trump, reinforced by pro-crypto policy signals and key appointments.

Equity markets also enjoyed a robust year. A resilient US economy, easing inflationary pressures, and a pause in aggressive interest rate hikes supported investor confidence. Strong corporate earnings — particularly in technology and AI — propelled the S&P 500 to another stellar performance.

Energy markets were more volatile. Concerns over slowing global growth, driven by weak demand from China and other developed economies, weighed on crude oil prices. While OPEC production cuts provided some support, they were insufficient to fully offset declining demand.

Gold once again reaffirmed its role as a safe-haven asset. Persistent geopolitical tensions, inflation concerns, and financial market volatility supported demand, underpinning gold’s strong performance throughout the year.

*Current values: 06/12/2024

The fine wine market in 2024

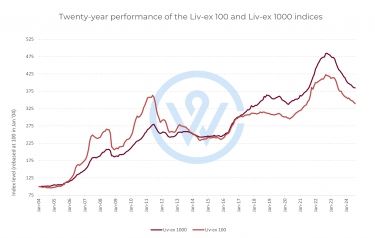

The fine wine market extended its downward trajectory in 2024, following declines seen in 2023. The Liv-ex 100 fell 9.2% year-to-date, while the Liv-ex 50, which tracks First Growth Bordeaux, declined 10.9%.

However, these headline declines masked important regional differences and emerging opportunities. Italy stood out as a pillar of resilience, while previously overheated regions — most notably Burgundy — underwent a necessary recalibration.

Crucially, falling prices were not driven by declining demand. Market activity remained strong, with the number of fine wine trades in 2024 exceeding 2023 levels by 7.9%, highlighting continued liquidity and engagement among buyers.

Regional fine wine performance

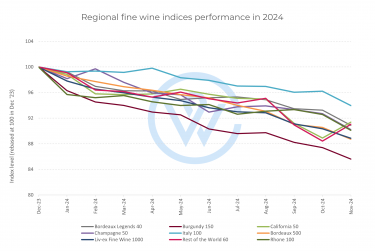

The fine wine market displayed mixed regional performance as the year drew to a close.

Italy was the most resilient major region, with prices falling just 6%, compared to an 11.1% decline in the Liv-ex 1000 index. High-scoring releases supported secondary market demand, while the country’s breadth was reflected in strong performers such as Antinori Brunello di Montalcino Vigna Ferrovia Riserva (+38%). Italy’s growing influence was further underlined by its 22 entries in the 2024 Power 100 — nine more than last year — narrowing the gap with Burgundy and Bordeaux.

Burgundy experienced the most significant adjustment, with prices declining 14.4% year-to-date. After years of exceptional growth, the correction reflects a market recalibration rather than a loss of relevance. Importantly, the pullback has reopened opportunities to acquire rare and prestigious labels at more accessible price levels, reinforcing Burgundy’s long-term appeal as a cornerstone investment region.

Champagne faced a challenging year, with prices down 9.8%, though signs of stabilisation emerged toward year-end. Older vintages led the recovery, with wines such as Taittinger Brut Millésimé (+29%) highlighting enduring demand for high-quality, mature Champagne.

Bordeaux, the largest and most liquid fine wine region, declined 11.3%. While liquidity remains a key strength, it no longer guarantees downside protection. Recent vintages struggled in particular, with many trading below release prices, reinforcing the market’s growing selectivity.

California wines fell 8.6%, but momentum improved in November. Rising interest in producers such as Dominus, Joseph Phelps, and Promontory continued to strengthen California’s position within the fine wine investment landscape.

Spain benefitted from strong US demand, with Vega Sicilia Único ranked as the most powerful fine wine brand of 2024. The inclusion of Dominio de Pingus and R. López de Heredia in the rankings further highlighted Spain’s growing investment credibility.

The best-performing wines in 2024

The Rhône dominated the list of top-performing wines in 2024, claiming four of the top ten positions. Domaine de Pegau Cuvée Réservée Rouge 2013 led the field with an exceptional 80.5% rise, supported by strong performances from Clos des Papes Châteauneuf-du-Pape Rouge 2014 (+61.2%) and Château de Beaucastel Rouge 2013 (+31.1%).

Beyond the Rhône, Spain’s Vega Sicilia Único 2010 (+24.9%) demonstrated the growing strength of Ribera del Duero as a serious player in the wine investment market. Vega Sicilia’s position as the most powerful wine brand in the 2024 Power 100 reinforced this trend.

Bordeaux and Sauternes also featured among the top performers. Château Rieussec secured two spots with its 2015 (+10%) and 2014 (+7.2%) vintages, while Ducru-Beaucaillou 2013 (+19.2%) and Château L’Église-Clinet 2012 (+3.9%) showed that established Bordeaux names continue to attract interest where value is evident.

A clear theme emerged: older vintages outperformed. Wines from 2010 to 2014 dominated the rankings, with only two younger vintages — 2015 and 2019 — making an appearance, and no new releases. This reflects a strong market preference for mature wines with proven track records and immediate drinkability.

2024 takeaways

-

The market correction reopened access to rare and prestigious wines, creating compelling entry points for long-term investors.

-

Established, older vintages consistently outperformed newer releases, reinforcing the value of provenance and track record.

-

Bordeaux’s liquidity remains vital, but value is increasingly selective rather than region-wide.

-

2024 proved a strategic buying year for investors willing to look beyond short-term volatility.

Bordeaux En Primeur continued to struggle, with the 2023 vintage failing to attract widespread interest — particularly where older, proven vintages offered superior value. Economic uncertainty further reinforced the appeal of classic wines.

Iconic Bordeaux vintages such as 2000, 2005 and 2009, alongside Italy’s Super Tuscans, stood out as stable portfolio anchors. Declining prices also brought previously inaccessible wines back into circulation, allowing for strategic acquisitions at attractive levels.

Beneath the surface of falling prices, 2024 emerged as a pivotal buying year, whether for investors entering the market or enhancing existing portfolios.

2025 market outlook

The outlook for the fine wine market in 2025 is cautiously positive, with optimism focused on premium regions including Piedmont, Champagne and Burgundy. Insights from the 2024 Golden Vines Report show that 64% of industry professionals expect market growth, particularly for high-end Italian wines such as Barolo and Barbaresco, which are increasingly viewed as alternatives to Burgundy.

Sustainability and terroir-driven wines are expected to play a growing role in investment decisions. Piedmont leads growth expectations (20%), followed by Champagne (17%), Burgundy (14%) and Tuscany (12%). Bordeaux faces more mixed prospects, with 27% of respondents anticipating further declines.

While economic and geopolitical uncertainties remain, sustained global interest in fine wine underscores its resilience as a long-term asset class. Celebrated for its diversification benefits, sustainability credentials, and ability to perform across market cycles, fine wine remains the most popular collectible with a unique position within alternative investments.

See also – WineCap Wealth Report 2024: UK Edition

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.