- Salon Le Mesnil Blanc de Blancs 2013 has enjoyed heightened demand shortly after release.

- The 2013 offers good value compared to similarly scored back vintages, which come at a significant price premium.

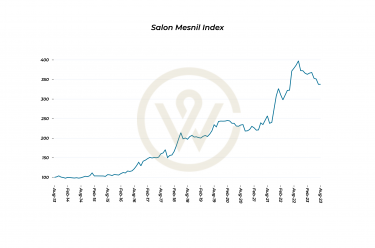

- Salon has delivered higher returns (71%) than the Champagne 50 index (62.8%) over the last five years.

The latest release from Champagne house Salon has already been met with heightened demand. Salon Le Mesnil Blanc de Blancs 2013 came to the market at the end of September, and featured among the most traded wines on Liv-ex shortly after. Below we examine the reasons behind this increased interest and the wine’s investment potential.

The ‘magnificent’ 2013 Salon release

The 2013 was the first vintage release following two unusual releases: the 2012 which the Champagne house initially said they would not offer, and the 2008 of which only 8,000 magnum bottles were released (about 1/3 of their normal production).

The wine received 99-points from Antonio Galloni (Vinous), who declared it ‘the most powerful, dense young Salon I have ever tasted’. The critic further noted: ‘Champagne of mind-bending complexity, the 2013 possesses tremendous mid-palate intensity and power from the very first taste’.

Meanwhile, the Wine Advocate’s Yohan Castaing awarded the wine 97-points, saying that 2013 is ‘more complex and incisive than the 2002 and exhibits similar power to the 2012 at this early stage’.

In terms of value, the 2013 stands out among other Salon vintages available in the market today. The only higher-scoring scoring wine is the 2008 at nearly twice the price. Other similarly scored back vintages such as the 1996, 1995, and 1990 also come at a significant premium to the 2013.

Salon brand performance

Perhaps the most coveted of all Champagne brands, Salon is certainly one of the rarest. Only around 50,000-60,000 bottles are made in most years, and fewer than 50 vintages in the last 100 years.

Salon is a wine defined by its singularity, representing a single vintage expression from one grape and one village. The wine was originally conceived as a private label for the consumption of its founder Eugène-Aimé Salon at a time when the making of Champagne was characterised by blending.

Salon’s exclusivity has been reflected in its investment performance. The wine has delivered higher returns (71%) than the Champagne 50 index (62.8%) over the last five years.

Even in the current climate that has seen prices fall across the board, Salon has fared better than average, down 7% compared to a 12.9% decrease for the broader index, which includes the likes of Krug and Cristal.

The long-term prospects for a wine as rare and highly regarded as Salon are more than promising. There is significant space for Champagne prices to rise in the medium term, and a wine like Salon is especially well placed to benefit.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.