- New releases from Italy have led to increased secondary market activity for the region.

- Italian fine wine prices rose in February with some wines enjoying double-digit returns.

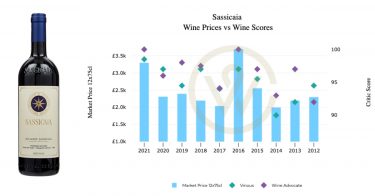

- The 100-point Sassicaia 2021 has traded with a premium since its release last month.

Italian wine is currently in the spotlight amid a flurry of new releases, including the high-quality Brunello 2019 vintage and the 2021 vintage of the Super Tuscans Sassicaia and Ornellaia.

Brunello 2019 enters the market

The 2019 Brunello vintage is shaping up to be exceptional, potentially surpassing the subsequent vintages of 2020, 2021, and 2022, which were characterised by significantly higher temperatures. In terms of quality, critics have placed it on par with 2016, 2010 and 2006.

While Brunello may not dominate the fine wine market as prominently as the Super Tuscans, it has potential for attractive investment returns, especially from producers like Biondi Santi, Poggio di Sotto, and Casanova di Neri. These wines often come at more appealing price points compared to their counterparts.

For instance, Biondi Santi Brunello di Montalcino has risen 73% in value over the last five years, outperforming the likes of Sassicaia and Masseto. Poggio di Sotto’s performance has been equally impressive, rising 187% in the last decade, while Casanova di Neri Tenuta Nuova has been up 126%. At the top end, the more expensive and highly sought-after Soldera Casse Basse has returned 237% over the same period.

The historic performance of these brands strengthens the case for buying in vintages where the quality is high, and where the releases offer relative value.

Super Tuscan releases

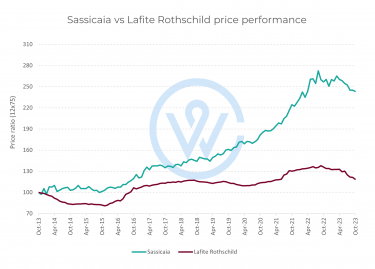

In the world of fine wine, the most talked about Italian releases have been Sassicaia and Ornellaia 2021.

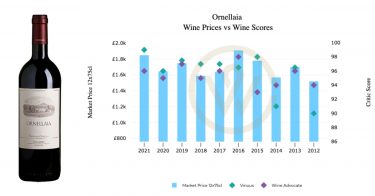

Ornellaia 2021 was released at £1,850 per 12×75, the same price as the 2020 release. At this price, the wine is the most expensive recent vintage on the market since 2016. Antonio Galloni (Vinous) awarded it 99-points and said that it ‘captures all the magic of this sensational vintage on the Tuscan Coast’. Meanwhile, Monica Larner (Wine Advocate) gave it 96-points and described it as ‘a very open-knit and exuberant Tuscan red’.

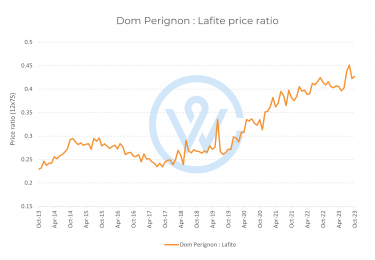

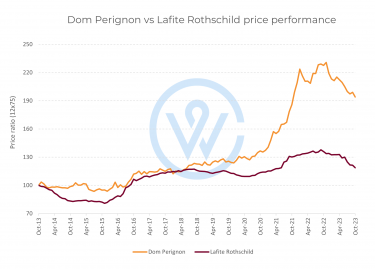

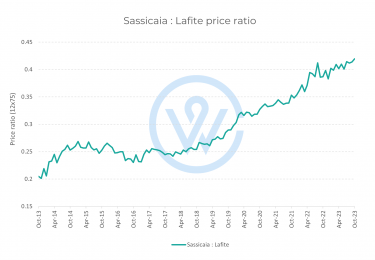

Sassicaia 2021 was released last month at £2,500 per case, up 4.2% on the 2020‘s release price. The wine has since traded at a premium on the secondary market. It received 100-points from Monica Larner who called it ‘a quintessential Sassicaia that represents the excellence of the vintage and also respects the unique taste profile of this distinguished Tuscan blend of Cabernets Sauvignon and Franc’. Galloni gave it 98+ points and noted that it was ‘one of the best young Sassicaias I can remember tasting’. ‘In a word: magnificent’, said the critic.

Italy gathers momentum

Recent releases have stimulated the secondary market for Italian wine. The region has been the best performing fine wine market segment over the last two years, as well as in the last few months. In February, the Liv-ex Italy 100 index posted a modest rise of 0.1%, but some vintages of Fontodi Flaccianello delle Pieve Colli della Toscana Centrale, Tignanello and Giacomo Conterno Barolo Monfortino Riserva enjoyed double-digit returns.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.