- Fine wine’s value tends to increase when stock markets fall, making it a great hedge option for investors.

- Fine wine is proving to be a better portfolio hedge than gold which is showing greater correlation with the stock market in recent years.

- As a precious and depleting asset, wine tends to rise above local shocks and is generally less impacted by cost-of-living pressures.

- Fine wine has outpaced inflation since 2021, making it a resilient asset to hold in turbulent times.

There is a lot going on in the economy, and most of it is not good. Major financial institutions buckle under high interest rates. Central banks are forced to rethink policies. Inflation continues to flirt with double digit levels. And the stock market lurches from one position to another as world events unfold. According to JPMorgan’s Q2 outlook, ‘2023 looks overwhelmingly likely to be a year of disappointing growth and ongoing adjustment’. Yet, fine wine is generally standing tall, experiencing little to zero negative performance.

In many situations, the value of fine wine has even climbed. As CityAM recently reported, ‘while it might not usurp stocks as the backbone of investors’ portfolios anytime soon, wine is providing some stability and solace amid the turmoil’.

In this article, we’ll uncover how fine wine is reacting to today’s tense economy and why.

The value of fine wine tends to increase as markets go down

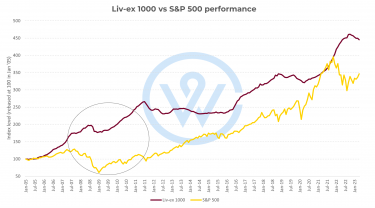

Fascinatingly, the value of wine tends to increase as the stock markets fall. One of the most notable examples was during the financial crisis of 2008. Over autumn, the world economies went into shock. Within six months, the great S&P 500 had plunged by 52%.

Source: Yahoo Finance

Yet, while the world’s stock prices zig-zagged downwards, one asset class held up remarkably well. Fine wine (shown in the graph below in red) did not suffer any major downturns. On the contrary, it seemed to have a negative correlation to the stock market. Fine wine prices soared.

Time and time again, fine wine has outperformed when the stock market is sinking. This is because of four essential characteristics.

Most recently, fine wine delivered investors double digit returns over the COVID-19 pandemic and global lockdowns. Between April 2020 and September 2022, the asset shot up a staggering 43.5%.

This makes fine wine an extraordinary hedging option for investors. When stocks are tumbling, a reasonable allocation to wine can help to smooth out the overall performance and absorb losses.

Today, fine wine is a better portfolio hedge than gold

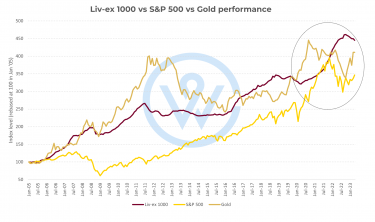

The current economic environment is unsteady. Understandably, global asset managers are now looking to buffer against some of the market shocks by increasing their allocations to alternatives and hedging instruments.

One of the most popular choices is gold. According to UBS’ latest report, ‘we are also most preferred on gold and recommend holding it as a portfolio hedge in the current uncertain times’.

However, over the past couple of years, fine wine has started to beat gold at its own game. Since Covid-19, the prices of gold have become more correlated to the prices of the stock market. Looking at the graph below, the performance of gold (in orange) is becoming increasingly aligned to the stock market (for example, the S&P 500 shown in yellow). By contrast, the value of fine wine (red) is the least aligned.

When it comes to hedging against a turbulent economy, wine is coming out on top. Some economists are now beginning to question if fine wine is the new gold.

Since 2021, the performance of fine wine has outpaced inflation

The US inflation rate is gradually coming back to an almost-reassuring level. At the time of writing (May 2023), it sits at 4.98%, down from 8.54% in 2022. But it’s more than double the target rate.

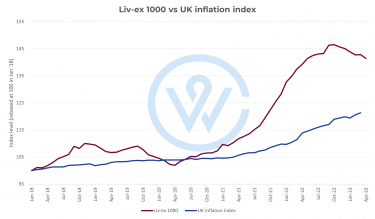

In the UK, it’s not looking so good. Inflation now sits at a nerve-wracking 10.06%, meaning that purchasing power is rapidly draining from the pound. At times like this, it’s generally better to hold long-term wealth in assets rather than cash. Physical assets like property, precious metals and fine wine are especially resilient to inflation risk.

Below is a graph showing the UK’s inflation rate over the past five years. Since 2021, it has soared to double digits.

If we compare this to the average performance of fine wine in the same time frame (using the Liv-ex 1000 index), wine hasn’t just kept up with inflation. It has beaten it more than three-fold. Between 2021 and 2023 UK inflation rose by just under 10%. By contrast, the average performance of fine wine has increased by 33%.

There are several reasons why wine is so good at outpacing inflation. Firstly, it’s a global asset so it tends to rise above local shocks. When the pound loses value, Asian or American investors tend to step in. The wine markets are generally private too. This means that the groups of buyers tend to be very wealthy and sophisticated investors, who are less impacted by the cost of living pressures. They’re generally less swayed by rumors or economic turbulence too.

Perhaps most significantly, wine is a precious and depleting asset. It grows in value and scarcity over time, which will almost always outpace inflation levels.

Overall, wine is a useful asset in a turbulent economy

There are so many reasons for turbulence in the economy. Wars, pandemics, political tensions, inflation or the climate crisis to name a few. Yet, the last few years have shown us that fine wine tends to increase in value during these historical moments.

Global demand for investment grade wine outstrips supply more and more every day. As our CEO Alex Westgarth recently explained for Forbes Business Council, wine investors are younger, edgier, and more international than ever. Whichever way you look at it, wine and economic turbulence tend to pair well.

As the markets continue to stride forward into uncertainty, it’s a good moment to reconsider alternative assets and hedging strategies.

Discover seven more delicious benefits to investing in fine wine

WineCap’s market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.