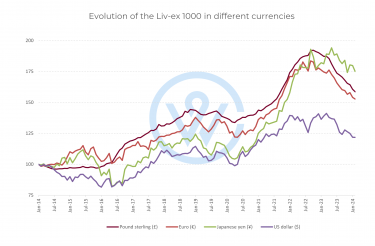

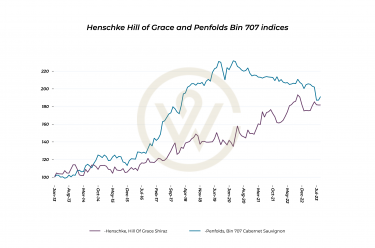

- We compare the price performance of Château Lafite Rothschild to other regions’ respective ‘First Growths’.

- The rising ratio highlights the increased value to be had in the Bordeaux First Growths.

- Today, one can get 29 bottles of Lafite for the price of Romanée-Conti and almost five for Pétrus and Screaming Eagle.

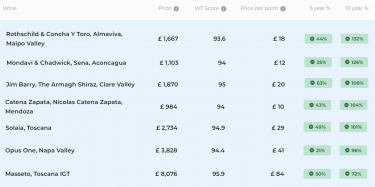

How many bottles of Château Lafite Rothschild can one get for the price of other regions’ respective ‘First’ wines?

With changing market dynamics at play that have seen the balance between Bordeaux and other regions change, we examine the price ratio between some of the most popular investment-grade wines.

Below we compare the performance of the Bordeaux First Growth Château Lafite Rothschild to Burgundy’s highest echelon Domaine de la Romanée-Conti, the Super Tuscan Sassicaia, the Right Bank Château Pétrus, the Californian cult wine Screaming Eagle, and the most in-demand Champagne, Dom Pérignon. These are all wines that symbolise and even transcend their geography. In the same way that Lafite has long been the mainstay of Bordeaux, the other wines are bellwethers for their regions.

The ratio between these wines is somewhat reflective of broader trends within their respective regions. Over the last decade, the ratio has risen consistently, highlighting the increased value to be had in the First Growths, as other regions gather momentum.

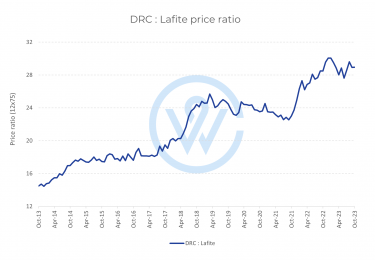

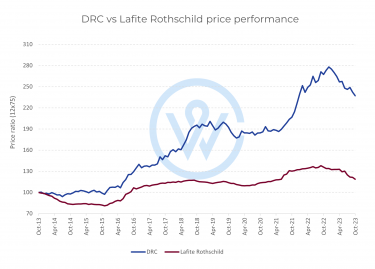

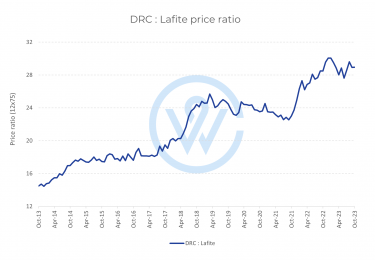

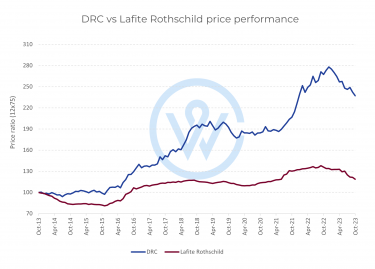

How many bottles of Lafite for the price of DRC?

Today, one can get on average 29 bottles of Lafite Rothschild for the price of Romanée-Conti. The ratio has risen considerably since 2013 when one could buy just 14 bottles of Lafite for one DRC. It peaked in December 2022, when it stood at 30:1.

As the chart below shows, the Domaine de la Romanée-Conti index hit a record high in December last year. Meanwhile, the Lafite index has not seen any of the price volatility witnessed by DRC. Year-to-date, prices for both labels have dipped but the fall has been sharper for DRC.

The DRC:Lafite price ratio is somewhat reflective of broader trends within their regions. In the last decade, Burgundy emerged as Bordeaux’s main contender. After Bordeaux peaked at the end of the China-led bull market in 2011, buyers started to seek out other corners of the fine wine world and it was Burgundy that attracted the greatest attention. The allure of rarity and quality meant that demand quickly outstripped already tight supply. Prices for Burgundy peaked, while Bordeaux ran quietly in the background.

For Bordeaux, the period between 2013 and 2015 saw contraction at the tail end of the Chinese correction. The market turned again in October 2015, and since then, Lafite Rothschild has been the second-best-performing First Growth, with some vintages doubling in value. However, it has not managed to catch up with Burgundy’s stellar rise.

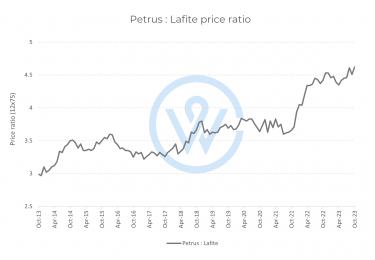

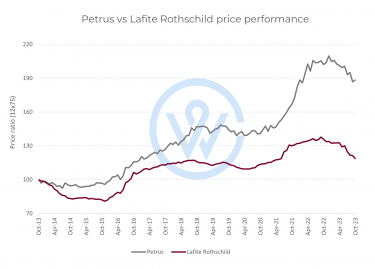

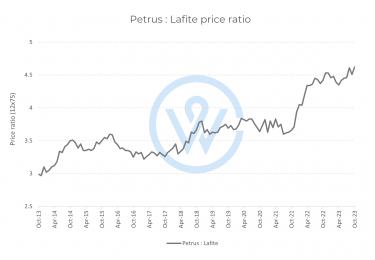

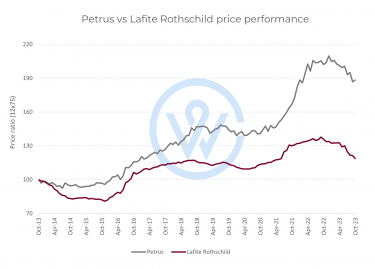

Left vs Right Bank

It is also interesting to compare performance within Bordeaux’s Left and Right Bank. Today 4.6 bottles of Lafite gets you a bottle of Château Pétrus, up from 3, ten years ago.

As the chart below shows, Lafite and Pétrus have followed a similar trajectory up to September 2021, when prices for the First Growth flattened while Pétrus continued its rise.

Similar to Burgundy, rarity plays a key role in Pétrus’ appeal and investment performance. Pétrus is produced in much smaller quantities (around 3,000 cases per year) compared to Lafite (around 25,000 cases). Despite commanding a higher price tag, the wine has considerably outperformed Lafite in the last decade.

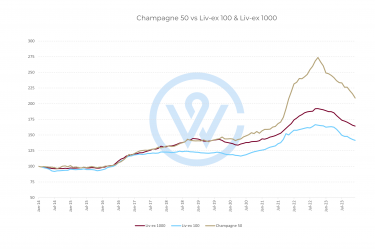

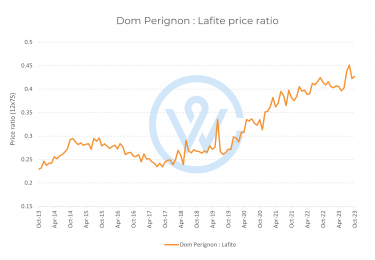

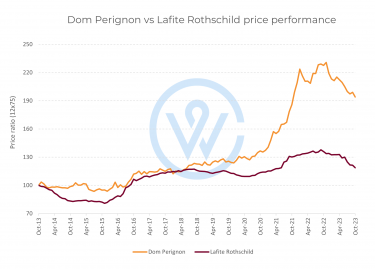

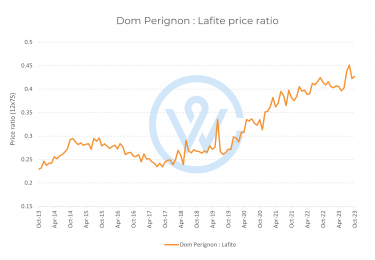

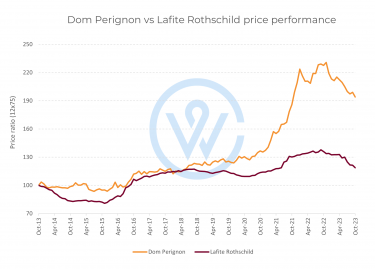

Dom Pérignon vs Lafite Rothschild

Recent years have seen a surge in Champagne’s market share and price performance. This has been reflected in the performance of its most traded label – Dom Pérignon.

Produced in much larger quantities than Lafite and more widely available, Dom Pérignon has started to catch up with the First Growth. In the last decade, the ratio between them has doubled – from 0.2 to 0.4.

Champagne prices, with Dom Pérignon at the helm, have made considerable gains since the early 2020s. In the last decade, our Dom Pérignon index is up 120%, compared to 20% for Lafite.

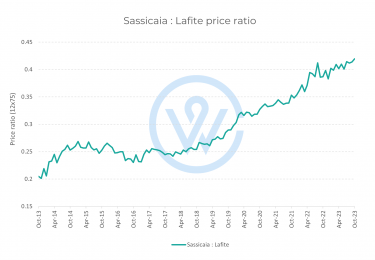

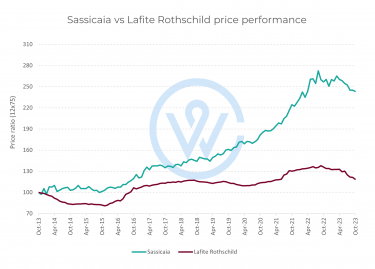

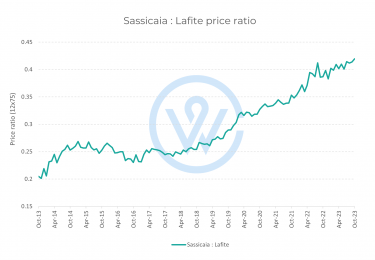

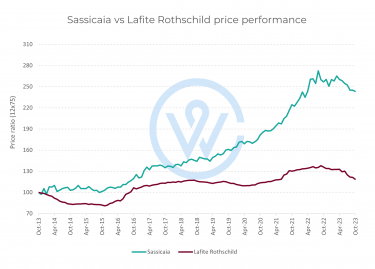

Sassicaia vs Lafite Rothschild

Similarly, the Super Tuscans have been getting more expensive. The most liquid and heavily traded group of Italian wines, their performance has been further boosted by critical acclaim and brand strength, with Sassicaia at the helm.

The ratio between Sassicaia and Lafite has risen from 0.2 ten years ago to 0.42 today.

As the chart below shows, Sassicaia has seen stable and consistent growth. 2019-2022 was a period of upheaval for the brand, which benefited from excellent vintages that captured investors’ interest.

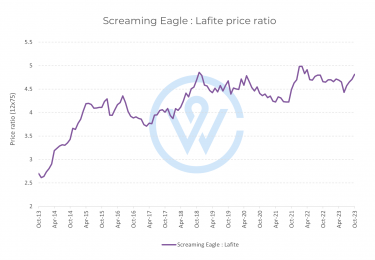

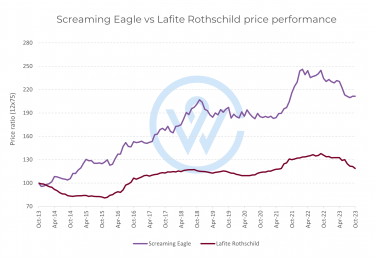

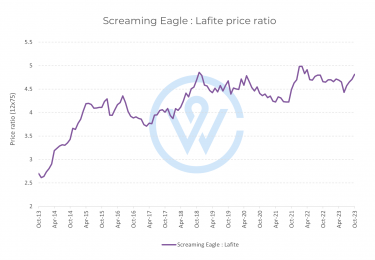

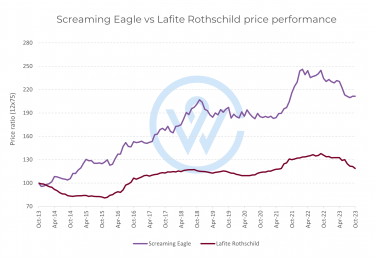

Screaming Eagle vs Lafite Rothschild

The price ratio between Screaming Eagle and Lafite Rothschild tells a story of increased volatility, which can largely be ascribed to the Californian cult wine. Screaming Eagle has seen bigger price rises, followed by sharper falls.

Today one can now get 4.8 bottles of Lafite for the price of Screaming Eagle, up from 2.7 a decade ago. The ratio peaked in February 2022, when it stood at 5:1.

California has enjoyed serious investment interest which has been reflected in its market share. Today the region holds around 7% of the fine wine trade by value and is the most important New World player.

While Lafite has come to represent better value when compared to other top wines, this is largely due to shifting regional market dynamics. The First Growth continues to entice buyers with brand strength, high-quality releases and returns on investment.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.