Fine wine has evolved from a niche passion into a recognised alternative investment asset, attracting collectors, high-net-worth individuals, and professional wine investors alike. While many are initially drawn in by the romance and heritage of wine, the financial case for buying wine for investment is compelling in its own right.

Unlike traditional financial markets, fine wine offers a combination of strong historical performance, low volatility, and tangible value. It also benefits from unique structural factors – finite supply, rising global demand, and favourable tax treatment – that are rarely found together in other asset classes.

Below, we explore seven key reasons why fine wine deserves serious consideration as a long-term investment and portfolio diversifier.

A high-performing asset class

Fine wine has been one of the strongest-performing alternative assets over the past three decades. Since January 1988, the compound annual growth rate of leading fine wine indices has averaged around 12.6%, outperforming many mainstream assets over the long term.

Notably, fine wine has demonstrated resilience during periods of market stress. During the Covid-19 pandemic, while equities experienced sharp volatility, fine wine prices continued to rise. In 2021, the fine wine market delivered record-breaking performance, surpassing global equity benchmarks.

Even more recently, the contrast remains striking. Over the past year, the Liv-ex 1000 index – the broadest measure of the fine wine market – rose significantly, while major indices such as the FTSE 100, S&P 500, and Nasdaq either lagged or declined. For long-term investors seeking steady appreciation rather than short-term speculation, fine wine has proven its credentials.

Tangibility and intrinsic value

One of fine wine’s most attractive features is its tangibility. Wine is a physical, tangible moveable property – often referred to legally as a chattel – rather than a paper asset or digital entry.

Unlike shares or cryptocurrencies, fine wine does not disappear in a market crash. It exists independently of financial systems, monetary policy, or central bank decisions. This intrinsic value places it in the same category as other tangible assets such as art or property, but without the high maintenance costs, regulatory burdens, or reliance on a single national economy.

Additionally, fine wine is globally traded through established wine merchants and international exchanges, making it far more liquid than many people assume.

A stable, low-risk investment

Fine wine has historically exhibited low volatility compared to equities and commodities. Prices tend to move gradually rather than reacting sharply to short-term news or sentiment.

As a physical asset with proven demand, fine wine has also acted as an effective hedge against inflation and economic uncertainty. During periods of rising prices or recession, investors often rotate into real assets with limited supply – an environment in which fine wine has consistently performed well.

For investors prioritising capital preservation alongside growth, this stability is a key advantage.

Finite supply and rising demand

Investment-grade wine is fundamentally scarce. Each wine is produced in limited quantities, tied to a specific vintage, and subject to strict production rules. Once bottled, supply can only ever decline as wines enter their drinking windows and are consumed.

At the same time, demand continues to grow. The global fine wine market has expanded beyond its traditional European base, with increasing participation from Asia, North America, and emerging wealth centres. This imbalance – finite supply paired with rising demand – is a powerful driver of long-term price appreciation and is relatively unique within the wine industry.

An effective portfolio diversifier

For investors looking to diversify their portfolios, fine wine offers a compelling solution. Numerous studies have shown that fine wine prices have little correlation with traditional financial markets such as equities and bonds.

This low correlation means that when stock markets fall, fine wine often holds steady or even appreciates. As a result, wine investors use fine wine to reduce overall portfolio risk while maintaining return potential.

In an era where traditional diversification has become harder to achieve, alternative assets like fine wine are playing an increasingly important role in long-term wealth strategies.

Tax efficiency and CGT exemption

Fine wine also benefits from favourable tax treatment in many jurisdictions. In the UK, most fine wine qualifies as a “wasting asset” with a predictable life of less than 50 years, making it exempt from Capital Gains Tax (CGT) when sold.

This wasting asset exemption – sometimes referred to as the chattels exemption – means that when investors sell their wine, gains are typically exempt from CGT. Importantly, fine wine is also not subject to income tax, provided it is held for capital appreciation rather than trading as a business.

While fortified wines may fall outside this exemption due to their longer lifespan, the vast majority of investment-grade wines benefit from this tax-efficient structure, allowing investors to retain more of their returns over the long term.

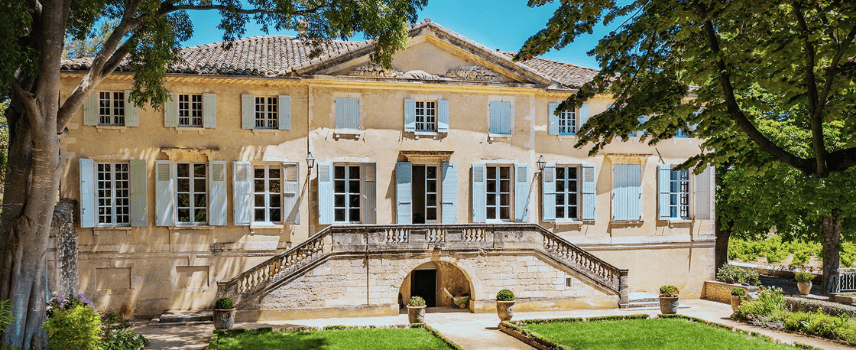

Passion investment

Finally, fine wine occupies a rare space where financial return and personal enjoyment intersect. Many wine investors are drawn to the market through their interest in wine itself, only later recognising its investment potential.

Unlike most assets, fine wine offers a unique optionality: you can buy, hold, sell your wine – or drink it. Even in the unlikely event that market conditions change, the asset still delivers intrinsic enjoyment, reinforcing its appeal as a passion investment.

Working with a reputable wine merchant ensures proper storage, authentication, and market access, allowing investors to participate professionally while remaining connected to the culture and heritage of wine.

Final thoughts

Fine wine is no longer simply a collector’s indulgence. It is a proven, long-term investment asset with a strong track record, tangible value, low volatility, and compelling tax advantages. For those looking to diversify their portfolios, protect wealth, and invest in something with real-world substance, buying wine for investment offers a rare combination of performance and pleasure.

As global demand continues to grow and supply remains finite, fine wine’s role in sophisticated investment portfolios is only set to expand.

Ready to get started now you know more about investing in wine? Speak to one of WineCap’s investment experts to discover the next steps on your wine journey.