The “60% stocks and 40% bonds” rule is outdated. While this approach may have offered stable and diversified returns several decades ago, in today’s difficult economic climate it’s not enough. This is where collectable assets come in.

To preserve and grow wealth, strategic investors must hedge their portfolios with alternative sources of value. One way to do this is with collectable assets. As a unique form of asset class, collectables offer investors extraordinary diversification and inflation-shielding properties – perfect for today’s economic storm. What’s more, many of these assets – like jewellery, classic cars, and art – can be enjoyed while they hold their value.

In this article, we’re looking at the six most popular collectable assets globally[1], and what to consider as you explore your options.

Art

As with most collectables, original art is about more than simply the financial return. Art is a passion asset – it represents a unique timestamp in our history, emotions, and popular culture. But there are great investment benefits too.

Original art is unique, and – just like with fine wine – rarity is highly prized. Famously, Leonardo di Vinci’s “Salvatore Mundi” was auctioned for a record-breaking $475 million[2].

Importantly, original art is also inflation-resistant. This is an excellent quality for the current economic climate. Unlike cash or bonds, the investment return will not erode over high-inflation periods because it has intrinsic value. Instead, market demand is driven by the artist, story, quality of the work, whether it represented a new technique, mindset or time, the materials and of course, the way it looks.

However, this doesn’t mean art is immune to volatility. The art market has trends and bubbles too. In 2018, for example, the resale market for art by Damien Hirst was declared a “bloodbath” as the hype ended and investors lost millions[3]. Before diving in, pay close attention to any potential risks in the market.

Research from Unbiased found that overall contemporary art has delivered annualized returns of 7.5% to investors since 1985[4]. Another index, created by Masterworks suggests blue-chip paintings (the crème de la crème of art) increased in value by 13.8% each year since 1995[5]. However, each artwork is unique and so individual returns vary significantly.

In today’s market, NFTs (non-fungible tokens) and sustainable processes are trending strongly in the art world. The average collector invested $46,000 in digital art last year and would be willing to pay more for environmentally-friendly works[6].

Whisky

As well as an appreciation for the craft and heritage, there are compelling investment benefits to whisky. Firstly, like all the collectable assets on this list, it is a great hedge against inflation. This helps to offset some of the losses from cash, debt, and bond instruments.

Secondly, it’s a booming market, as whisky has become popular. Just like fine wine, this has largely been fuelled by younger investors. In 2021, the Knight Frank Luxury Index even named this liquid gold as its best-performing asset class[7]. Over the previous decade, Scotch whisky racked up impressive returns of 428% on average. In July 2022, one rare bottle pulverised all records, going for a whopping £16 million at auction.

Thirdly, whisky is increasingly perceived as reliable. Since Brexit and the war in Ukraine, many investors have turned to whisky as a more dependable and palatable choice of beverage. Naturally, the ingredients come from Scotland, so global grain and raw goods shortages should not hinder production. What’s more, the whisky trade looks set to increase, as the UK government draws up new deals with India.

Just like fine wine, one of the greatest benefits of whisky is that it is classed as a “wasting asset” and is not subject to capital gains tax. If you’d like to find out more about this tax break, you can download our free guide.

To get an idea of the financial returns of whisky, we can look at two indices. The BC20 index reported 14.36% returns for the asset in 2021[8]. And the SWI’s year-on-year historical performance sits at 12.5%[9]. Of course, whisky is a buy-and-hold asset, meaning that investors should not try to “flip” it, but rather hold the asset for years.

Classic cars

Of all the passion investments, classic cars are probably among the most loved. Collectors are often people who would tack magazine cut-outs of Ferraris, Maseratis and Bugattis to their walls as teenagers, and dream of buying the car one day. They tend to be looking to fulfil a lifelong dream as well as investing. Perhaps for this reason, the price tags are usually emotional, and they can make for uncertain investments.

The factors which make a car a worthwhile collectable asset closely mirror the art market. The historic significance of the model, rarity, beauty, racing history or associations with celebrities all add to the value.

HAGI (Historic Automobile Group International) tracks the market with several indices. Their findings show that between 2008 – 2021 the average price increased by 264.49%[10]. However, this doesn’t appear to factor in the cost of repairs, renovations, or storage. Even if you plan to restore a classic car yourself, the associated costs can exceed the end-value.

As you plan your investment strategy, scrutinise the financials of classic cars, including tax implications. For example, selling a classic car for a profit will incur capital gains tax, as well as road tax and MOT. Certain countries also have combustion engine regulations and low-emission zones that could make it difficult to drive your car. What’s more, incoming legislation around petrol cars may affect the desirability of the vehicle.

Diamonds

They’re forever, they’re a girl’s best friend … but are diamonds really a good investment asset? Looking at the Idex Diamond Index, on average, the precious stones have delivered returns of 8% over the past five years[11]. Natural blue diamonds have particularly fared well, with one rare 15-carat blue diamond selling for $57.5 million in April 2022[12].

As with most collectable investments, quality, rarity, historical significance and whether it was owned by a notable person, all make a difference to the value. For jewellery, connections with royalty can especially add lasting value[13]. When considering diamonds, scrutinize the following “Cs”: Carat, clarity, cut, colour and certificate[14].

However, there are some risks for diamond investors too. The market is notorious for its bubbles. Between November 1st 2021 and March 7th 2022, for example, prices suddenly jumped by 17% and then fell back down.

Investors should also be aware that this asset – while not directly impacted by inflation – does tend to stumble following a crisis, although it usually bounces back quickly. This indicates that during a recession is a good time to buy. As the prices tend to drop in the rough diamond market first, investors may be able to use this information to predict trends and inform their selling strategy on the secondary market.

Watches

Watches are a relatively new investment vehicle, and the market is white-hot. They really began to take off during the first months of the pandemic. Between January 2020 and April 2022, the value of used luxury watches jumped by around 115%[15]. According to the Watch Charts Market Index, prices surged from $25,420 on average to $54,461 in less than two years[16].

Today, however, the market is cooling. Prices have dipped back down to $39,397 on average[17]. After this burst, it is also extremely difficult now to access an investment-grade watch unless you have exceptional contacts or a broker. However, with patience and research, it is still possible.

For investors looking for a wearable investment, a classic brand like Rolex, Patek Philippe, Audemars Piguet or Breitling could be a good inflation-resistant option.

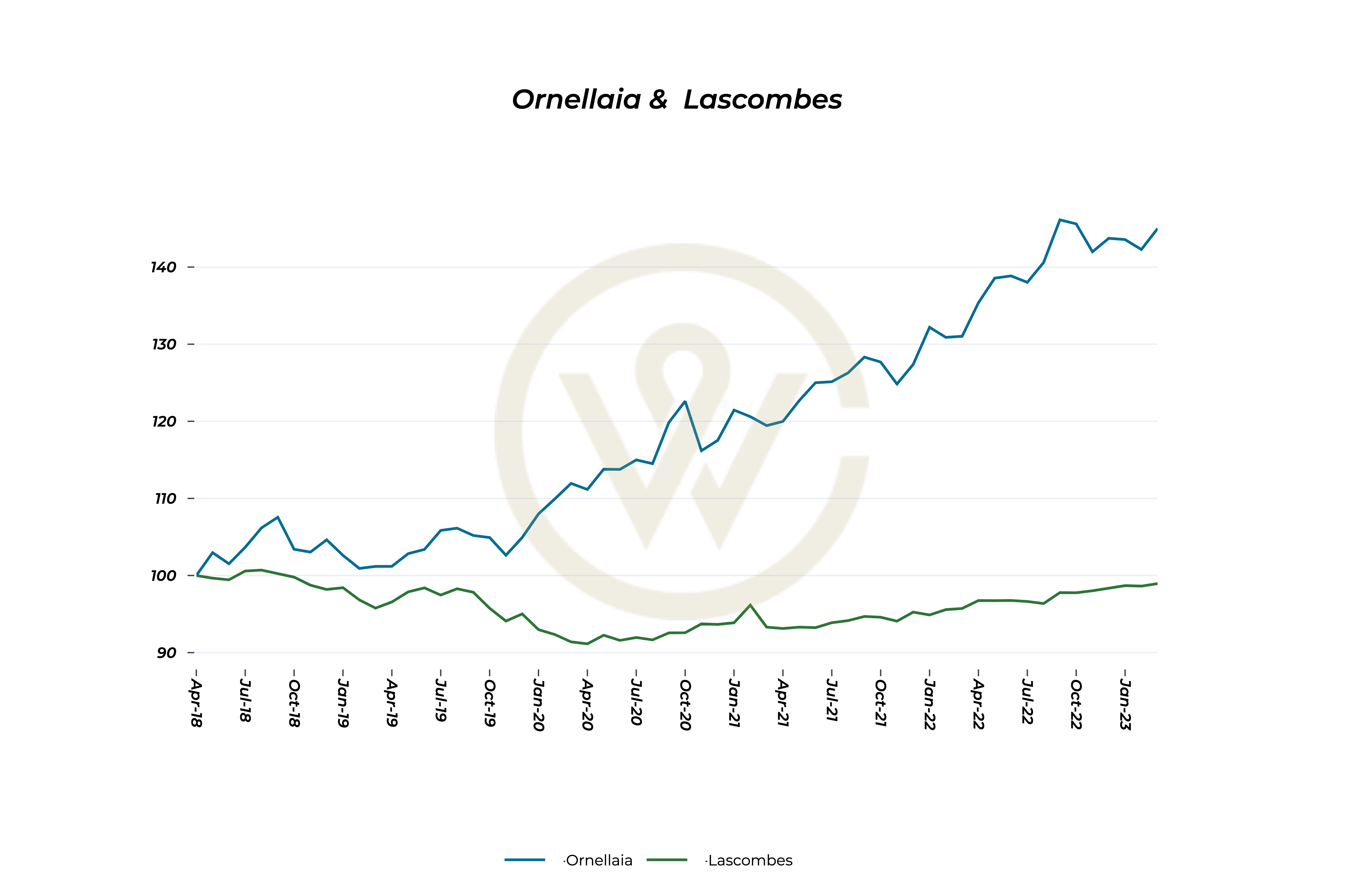

Fine wine

Of course, our favourite collectable asset to preserve and grow wealth is fine wine. Unlike diamonds, the value of fine wine does not tend to dip with recessions. On the contrary, after the 2008 financial crisis and the 2020 pandemic, it soared. From April 2020 until September 2022, prices steadily increased by over 40%[18].

Like whisky investments, fine wine also benefits from a generous tax break. Investors are exempt from capital gains tax, meaning they can keep significantly more of their profits. This tax perk applies to very few investments, and certainly none on the publicly traded stock market. It helps investors to preserve, reinvest and grow their wealth faster.

Like all the collectable assets on this list, fine wine is also extremely inflation-resistant. As the market is quite closed and determined by passionate investors, it is not directly impacted by the ebbs and flows of the wider economy.

Better still, unlike newer whisky and watch trends, fine wine is one of the oldest investment assets. Over centuries wine has proved its place as a valuable source of wealth growth and preservation. Today, it is even more stable than gold.

Invest with passion

Perhaps most importantly of all, fine wine is a revered and much-loved product. Who could imagine a world without a sparkling Moët Hennessy Champagne, or a beautifully bold Bordeaux?

When you invest in collectable assets, you are not simply making a financial decision. You’re helping to preserve and cherish that which you love about life. Whether it’s a vintage Porsche or a stand-out piece from your favourite artist, your wealth can revive your most meaningful moments in history. With investments like fine wine, you can also help to preserve and nurture the planet for future generations too.

If you’d like to discover more, getting started with WineCap is simple and straightforward.

[1] Source: Knight Frank

[2] Source: Art in Context

[3] Source: Art History News

[4] Source: Unbiased

[5] Source: Masterworks

[6] Source: Art Basel

[7] Source: Knight Frank

[8] Source: Braeburn

[9] Source: Insider

[10] Source: Investopedia

[11] Source: Idex Online

[12] Source: Forbes

[13] Source: Bloomberg

[14] Source: New Bond Street Pawn Brokers

[15] Source: Watch Charts

[16] Source: Watch Charts

[17] Source: Watch Charts

[18] Source: Liv-ex