- 2023 marks a notable slowdown in the fine wine market, with price corrections shadowing the bullish trends of previous years.

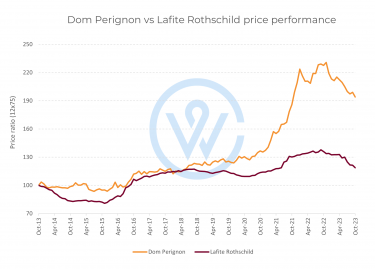

- Burgundy and Champagne which led the market to its peak in 2022 are suffering the most.

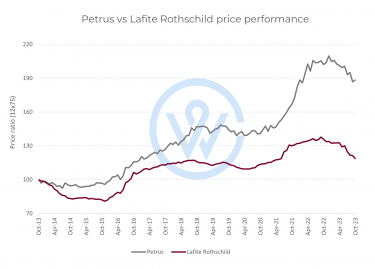

- Bordeaux has become a beacon for investors, gaining renewed interest due to its stability and reliability.

As the 2023 Liv-ex Power 100 unveils, a significant shift is evident in the fine wine market. This year marks a notable slowdown, with price corrections shadowing the bullish trends of previous years. Amidst this changing landscape, Bordeaux emerges as a beacon for investors, gaining renewed interest due to its stability and reliability. This article delves into the dynamics of the 2023 fine wine market, highlighting the rise of Bordeaux against a backdrop of global risk aversion.

Understanding the 2023 market slowdown

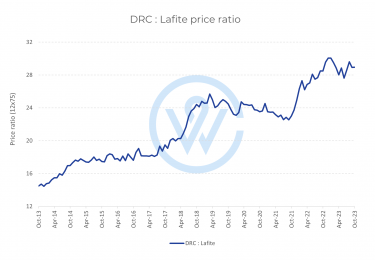

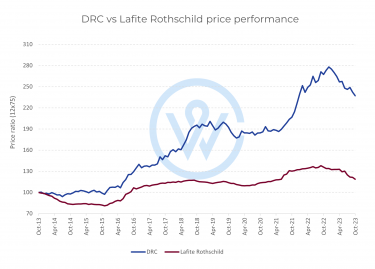

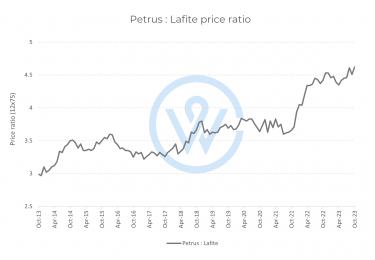

The fine wine market in 2023 has departed from the spirited activity of past years. After prices across many regions reached stellar levels in 2022, 2023 was a year of corrections. Trade by value and volume also fell, according to the 2023 Liv-ex Power 100 report. Despite more wine labels being traded, the overall number of individual wines traded (on a vintage level) has seen a decrease. This trend points towards a strategic shift towards higher quality wine investments, reflecting a more discerning market behaviour.

The softening of the fine wine market in 2023 can be attributed to a range of factors. Economic uncertainties and global financial market fluctuations have instilled a sense of risk aversion among investors. Inflationary pressures and rising interest rates have also played a role, impacting disposable incomes and investment capabilities. This economic climate has prompted a more cautious approach in luxury investments like fine wine. Additionally, changing consumer behaviours and preferences, along with geopolitical tensions and trade disputes, have further contributed to the market’s softening.

Regional patterns in 2023

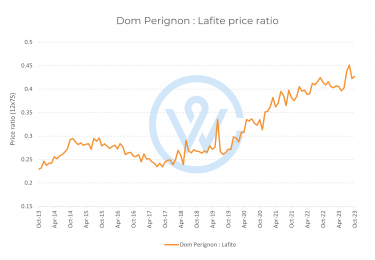

In 2023, regional patterns in the wine market have become more pronounced. Burgundy and Champagne, which previously led the market to its peak, are now facing significant corrections. Burgundy has seen a reduction in its presence in the Power 100, while the Burgundy 150 index has fallen 15.4% year-on-year. Similarly, Champagne’s market has also softened, with the Champagne 50 index dipping 19.4%.

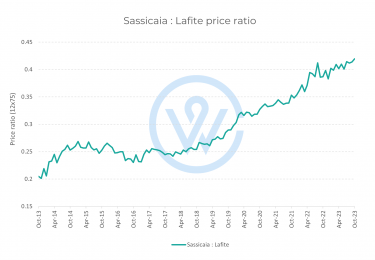

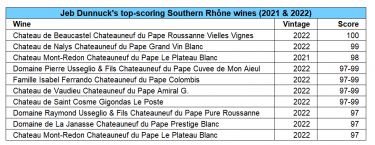

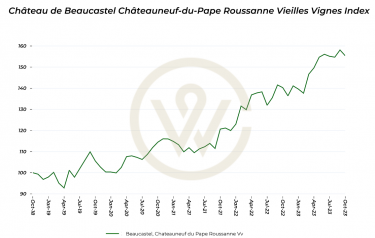

The rankings reveal a trend towards stability, liquidity, and relative value, which are prominently found in Bordeaux. This region has emerged as a beacon of resilience in the fine wine market, adding five wines to the Power 100 and benefiting from its reputation for consistent quality and reliable investment.

Conversely, California, while losing five wines in the ranking, managed to maintain its trade share, indicating a selective but sustained interest in its wines. This shift reflects a broader market inclination towards established regions and brands, suggesting a cautious approach by collectors and investors in a turbulent market.

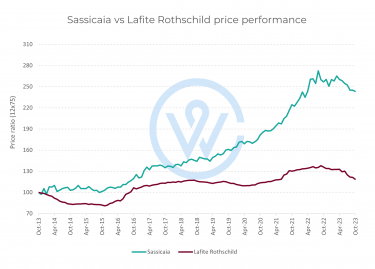

As market dynamics evolve, regions like Italy and Spain are gaining traction, with brands like Vietti and Dominio de Pingus showing positive growth, further diversifying the landscape of investment-worthy wines. These regions are increasingly seen as offering valuable investment-worthy wines, attracting attention for their unique qualities and potential for growth.

The most powerful brands of 2023

In the realm of individual brands, certain names have demonstrated remarkable resilience and adaptability amidst the market downturn. Bordeaux’s Château Climens, for instance, has made an impressive leap in the rankings, rising from 353rd place in 2022 to 98th this year. This is a testament to its successful brand repositioning under new ownership.

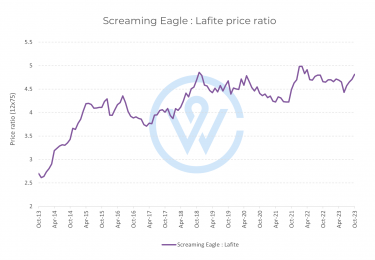

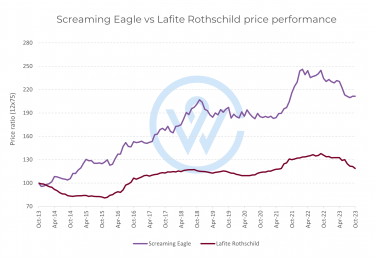

Similarly, in California, brands like Opus One and Screaming Eagle continue to hold strong positions. Opus One, in particular, has risen dramatically, from 82nd in 2022 to 4th this year, signifying continued interest in top-tier wines from this region despite broader market challenges.

Despite facing a pullback Burgundy still has powerful players like Kei Shiogai, which took the top spot in terms of price performance, with its Market Price rising 185.7% year-on-year.

The strength of these brands lies not just in their historical significance or quality but also in their ability to retain high liquidity and trading volumes, essential in a market that is increasingly focusing on safer investments. This trend suggests that while the market is retracting in some areas, there remains a robust demand for wines that represent the pinnacle of their respective regions.

Adapting to the evolving wine market dynamics

As we navigate through the evolving dynamics of the fine wine market, it is clear that understanding and adapting to these changes is crucial for future investing. The trends of 2023, from the renewed interest in Bordeaux and the resilience of powerful brands, provide valuable insights into the market’s direction.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.