It has been a volatile start to the year, with President Donald Trump’s return to the White House unsettling global markets. The fine wine market continued its measured slowdown, yet optimism persists: wealth managers increasingly view fine wine as a strategic diversifier, with demand expected to rise in 2025. Q1 saw a cautiously successful Burgundy 2023 En Primeur campaign and a mixed round of spring La Place releases – headlined by the highly anticipated, 6×100-point Latour 2016.

This report explores the key trends that shaped Q1, from geopolitical tensions and shifting market sentiment to the top-performing wines and regional highlights.

Executive summary

- Mainstream markets faltered:

At the time of writing, the S&P 500 has fallen 7.2% year-to-date, Nikkei 225 dropped 20.5%, and crude oil is down 13.2%. - Fine wine prices dipped:

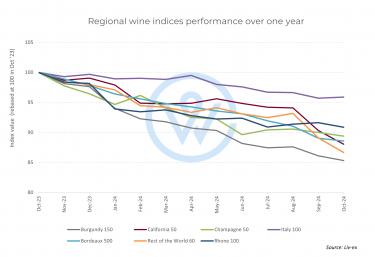

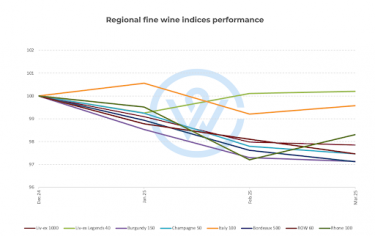

The Liv-ex 100 declined 2.0% in Q1 2025. The broader Liv-ex 1000 index is down 2.1%. - Regional performance:

Bordeaux and Burgundy were the weakest regions in Q1, each falling 2.9%. Italy continued to show resilience, down just 0.4%. - Top performer:

The best performing wine was Vieux Telegraphe La Crau Rouge 2021, which surged 22.7%. - La Place spring campaign:

Expanded further with new entrants. The Latour 2016, backed by six 100-point scores, stood out as one of the most successful and talked-about releases. - Looking ahead:

The Bordeaux 2024 En Primeur campaign, the key fine wine event of Q2, faces heightened price pressure and buyer caution amid broader economic headwinds.

The trends that shaped the fine wine market

Escalating trade war tensions

One of the most disruptive forces in Q1 2025 has been the re-escalation of global trade tensions, largely stemming from President Donald Trump’s newly announced tariffs. The dramatic return to tariffs has created significant headwinds for global markets, and fine wine has not been immune.

Tariffs fluctuated rapidly. In early April, Trump declared 54% tariffs on Chinese goods imported into the US, a figure he raised to 125% just days later. In the same breath, he confirmed 20% tariffs on European goods, before abruptly announcing a 90-day pause on April 9th, during which tariffs for all non-Chinese countries were lowered to 10%. While this provided short-term relief to EU producers, the volatility has caused widespread uncertainty.

One thing seems clear: the coming months will be pivotal, with trade developments likely to dictate sentiment and demand in key markets.

Markets under stress

In Q1 2025, mainstream financial markets experienced significant volatility, largely driven by the abrupt changes outlined above. The S&P 500 entered correction territory, declining over 10% from its February 19th high, before partially recovering in late March. The energy sector mirrored this instability. Oil prices plunged to a four-year low amid recession fears and heightened tariffs, only to rebound following announcements of tariff pauses. The rapid succession of policy shifts has led to a climate of uncertainty, making it difficult for investors to anticipate market movements.

Fine wine in Q1 2025

The fine wine market similarly felt the pressure. Prices fell 2% on average over the last three months. The broader Liv-ex 1000 index declined 2.1%, highlighting continued softness across the board. Regionally, Bordeaux and Burgundy were the weakest performers, each down 2.9%. Italy once again stood out for its resilience, declining 0.4%, thanks to consistent demand for top names and relatively stable pricing. The top performing wines in Q1 included Bruno Giacosa Barolo Falletto Vigna Le Rocche Riserva 2014 (72.1%), Château Léoville Barton 2021 (30.9%), and Château Rieussec 2019 (22.8%).

Pressure on En Primeur

The ongoing trade war comes at a particularly sensitive time for the Bordeaux 2024 En Primeur campaign, which is about to launch. The system has been under increasing scrutiny in recent years, with release prices often failing to offer meaningful value versus back vintages. The threat of added import costs, even if delayed, puts further pressure on producers and négociants to rethink pricing strategies. With confidence in En Primeur already eroding, this year’s campaign faces a delicate balancing act: justify pricing amid broader market weakness, or risk alienating already-cautious buyers.

Regional fine wine performance in Q1

Since the start of the year, fine wine prices across major regions have fallen 2.1% on average. While some regions experienced temporary increases – the Rhône bounced back by 1.1% in March – the majority were in consistent decline. Burgundy and Bordeaux – the two dominant market forces – fell the most, down 2.9% in Q1.

Despite falling prices, Liv-ex noted that trade activity is rising – total trade volume and value were up on Q1 2024.

The best-performing wines

Q1’s top performers comprised a varied group from across Bordeaux, Piedmont, the Rhône, and Burgundy. The best performing wine was Vieux Telegraphe La Crau Rouge 2021, which surged 22.7%. Pichon Baron 2013 followed with a 22.6% rise.

Two vintages of Guigal La Landonne also appeared in the rankings, the 2012 (11.1%) and 2014 (10.6%).

From Barolo, the 2001 Bruno Giacosa Serralunga d’Alba made the top ten with a 21.2% rise in value over the past three months.

The spring La Place campaign

March saw just over 50 wine releases via La Place de Bordeaux, including new Burgundies, grower Champagne and big names like Promontory 2020, Ao Yun 2021 and Latour 2016.

The latter was particularly notable as the first prime release to hit the market since the château abandoned the En Primeur system. The wine boasts a number of 100-points from major critics including Neal Martin, Antonio Galloni, Lisa Perotti-Brown MW, Jane Anson, Jeff Leve, and Tim Atkin.

The comparisons being made – to 1961, 1982, and 2010 – suggest the wine is already being framed within the estate’s historic lineage. What’s more, while the price reflects its stature, its positioning below recent back vintages like 2009 and 2010 suggests value for money.

In a campaign that highlighted the growing breadth of La Place, Latour served as a reminder of Bordeaux’s enduring ability to dominate the conversation, when it chooses to.

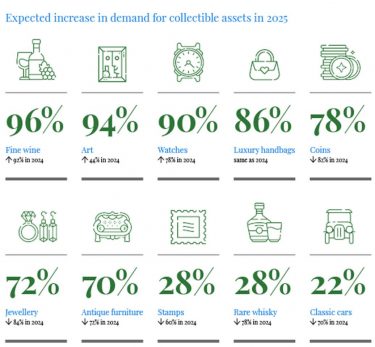

Fine wine enjoys resilient fundamentals and growing confidence

Beneath the surface of a softening market, confidence in fine wine as a long-term investment continues to strengthen. Our recent Wealth Reports released in Q1 revealed a clear trend in investor attitudes: 96% of UK wealth managers expect demand for fine wine to increase in 2025, underscoring its growing role in diversified portfolios.

This optimism is rooted in fine wine’s defining characteristics – low correlation to mainstream markets, long-term price appreciation, and intrinsic scarcity. While short-term volatility and trade disruptions have created a subdued environment, many see this as an attractive entry point. With prices off their peak, the market now offers a rare opportunity to access top names at more favourable levels.

Fine wine is increasingly viewed as a maturing asset class – one that rewards patience rather than speculation. As macroeconomic uncertainty continues to rattle equities and bonds, fine wine’s stability and resilience are drawing renewed attention from high-net-worth individuals and wealth advisors.

Q2 2025 market outlook

All eyes now turn to the Bordeaux 2024 En Primeur campaign – the most significant event in the fine wine calendar and a litmus test for buyer confidence in a fragile market. After a lacklustre few years, the system finds itself at a crossroads. Pressure is mounting for producers and négociants to reset expectations, as past campaigns have struggled to offer compelling value compared to back vintages already available on the secondary market. Adding to the challenge is the uncertain tariff environment.

At the same time, there is cautious optimism. While prices across Bordeaux have softened, trade volume has increased – a signal that buyers are still engaged, albeit more selective. If producers respond with competitive pricing and clear value propositions, 2024 could mark a turning point for the campaign.

Beyond Bordeaux, Q2 is expected to bring continued price sensitivity, but also renewed interest from investors who see current levels as a buying opportunity. The long-term fundamentals remain intact: scarcity, brand equity, and an increasing role for fine wine in diversified portfolios. In short, while the market remains in a momentary phase of recalibration, Q2 may offer the first signs of recovery if the right tone is struck.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.