As purchasing power slowly drains, investors with low-risk tolerances are feeling the sting. At the time of writing (May 2023), UK inflation sits at an uneasy 10.1%. With the average savings account interest at a flimsy 0.23%, cash is going backwards. Meanwhile, high inflation munches away the future value of bonds and debt like a deranged Pac-Man. This represents a real problem for wealth managers. In a constantly shifting sea of interest hikes, inflation, and market shocks, how can they maintain and strengthen lower-risk portfolios without going too overweight on equity? How can they keep the cautious risk profile intact without endangering returns?

This article examines five overlooked assets for cautious investors, which have a history of punching back against inflation.

Gold

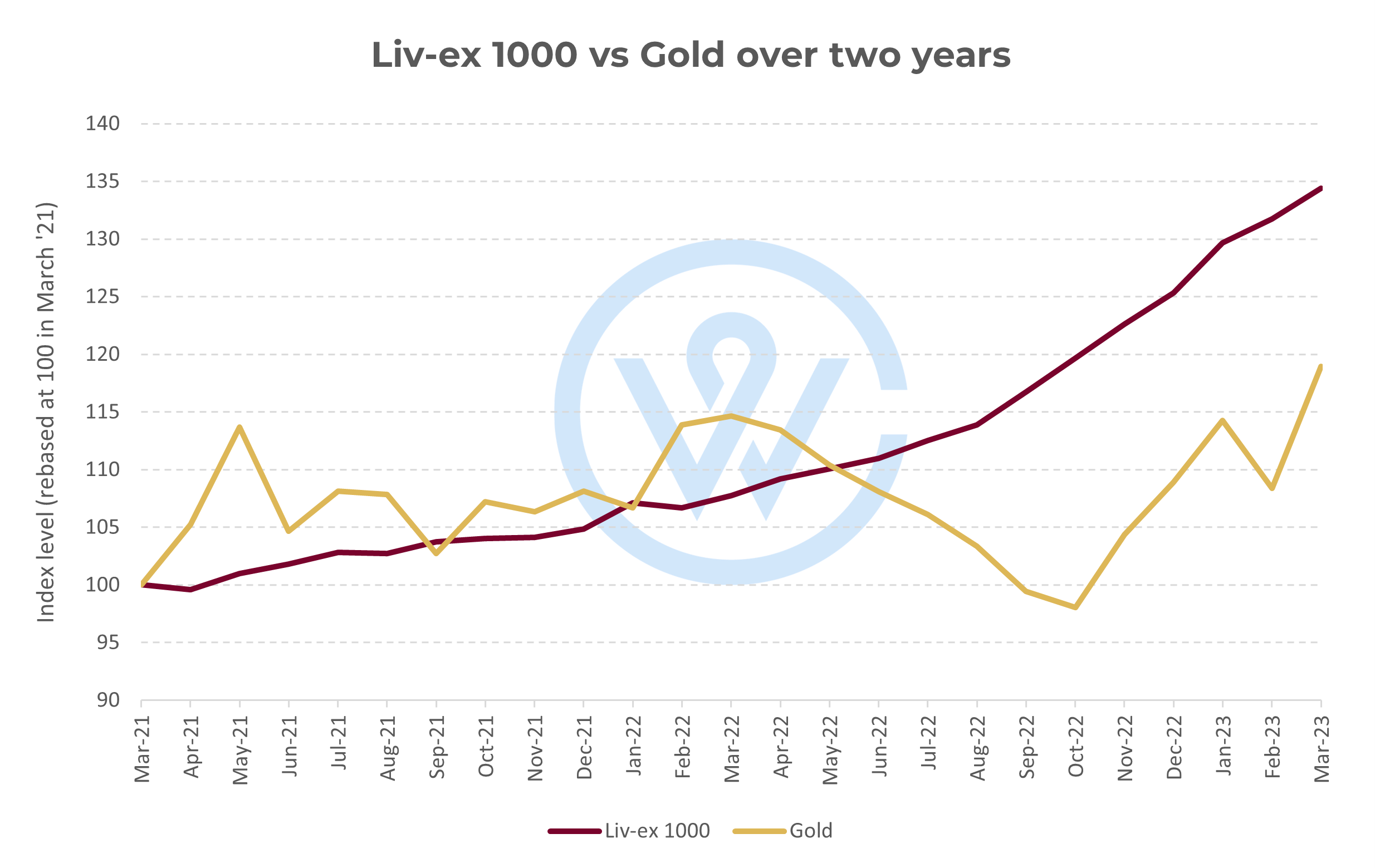

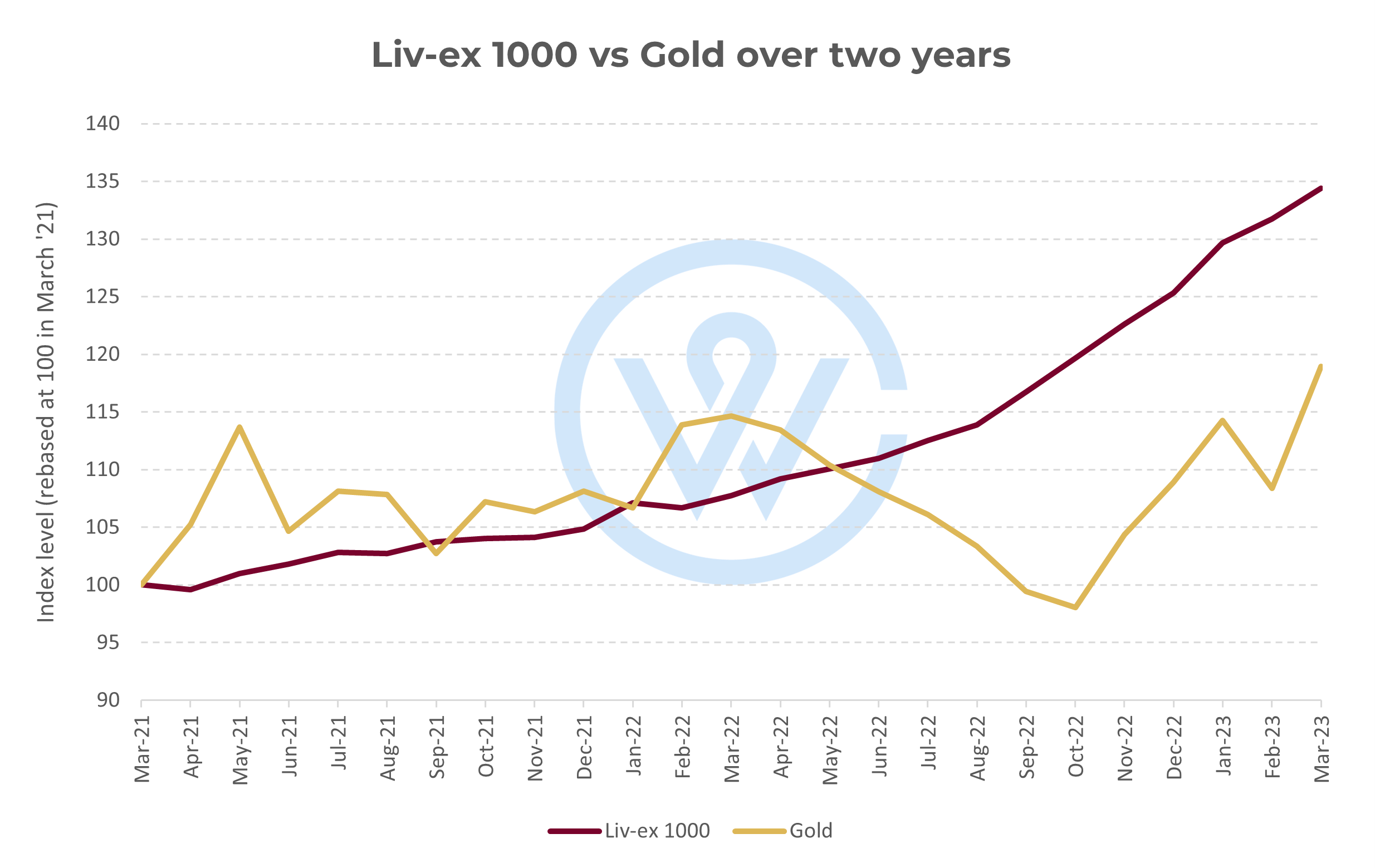

In the fight against inflation, physical gold is surely Mohammad Ali. Gold tends to increase in value as inflation rises. According to World Gold Council data from the past 50 years, when inflation is above 3%, the gold prices jump by 14%.

This asset class has the added benefit of being universally accepted. Unlike interest-generating assets or fine wine, precious metals can be included in Shariah portfolios.

Not only is gold inflation-resistant, but it is also classed as a low-risk asset, which must be a welcome relief for low-risk investors. Arguably, gold is even less risky than cash, as its value is intrinsic.

However, that doesn’t mean that there aren’t bubbles and market corrections. Over the past years gold’s performance has shown more volatility alongside the public markets.

Fine wine

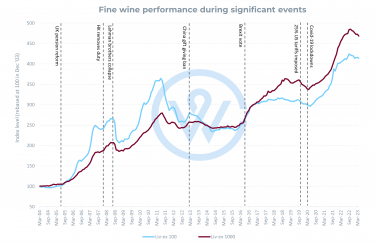

There are several reasons why fine wine kicks back against inflation. It’s a physical asset. The market is global and wealthy, often relatively unaffected by market shocks. Plus, buyers are usually passionate, so they are unlikely to panic-sell. Perhaps most importantly, bottles are unique, and they deplete over time.

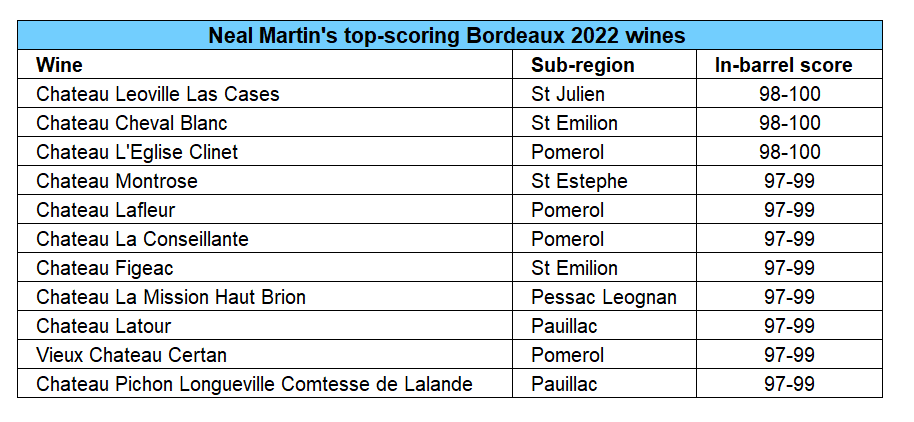

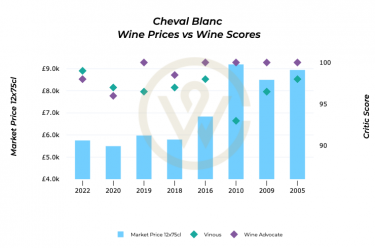

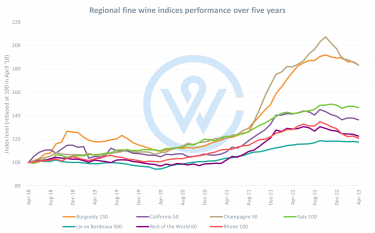

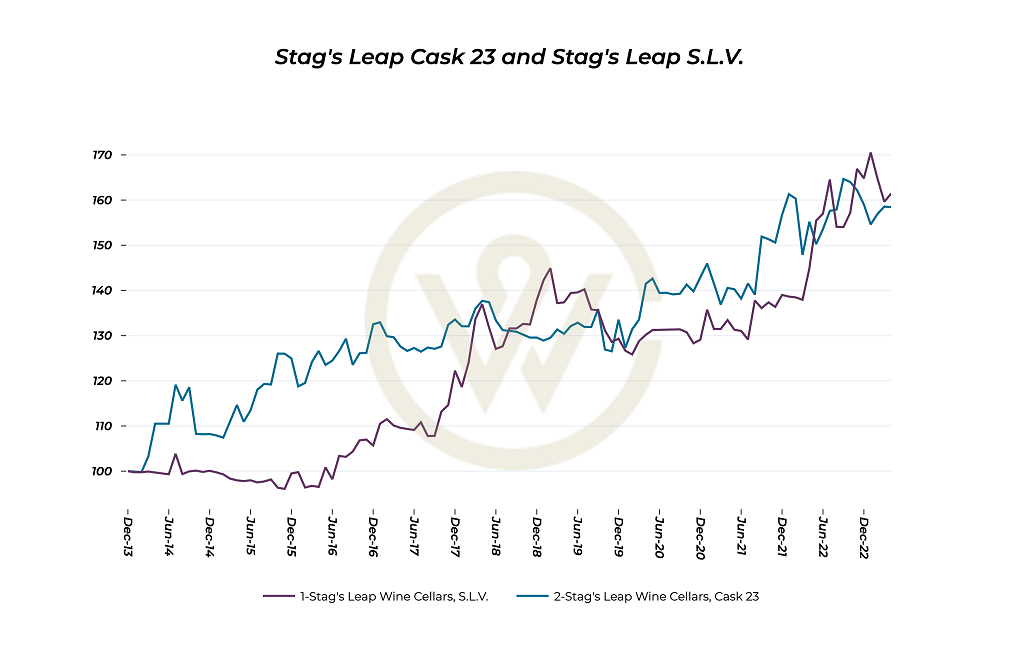

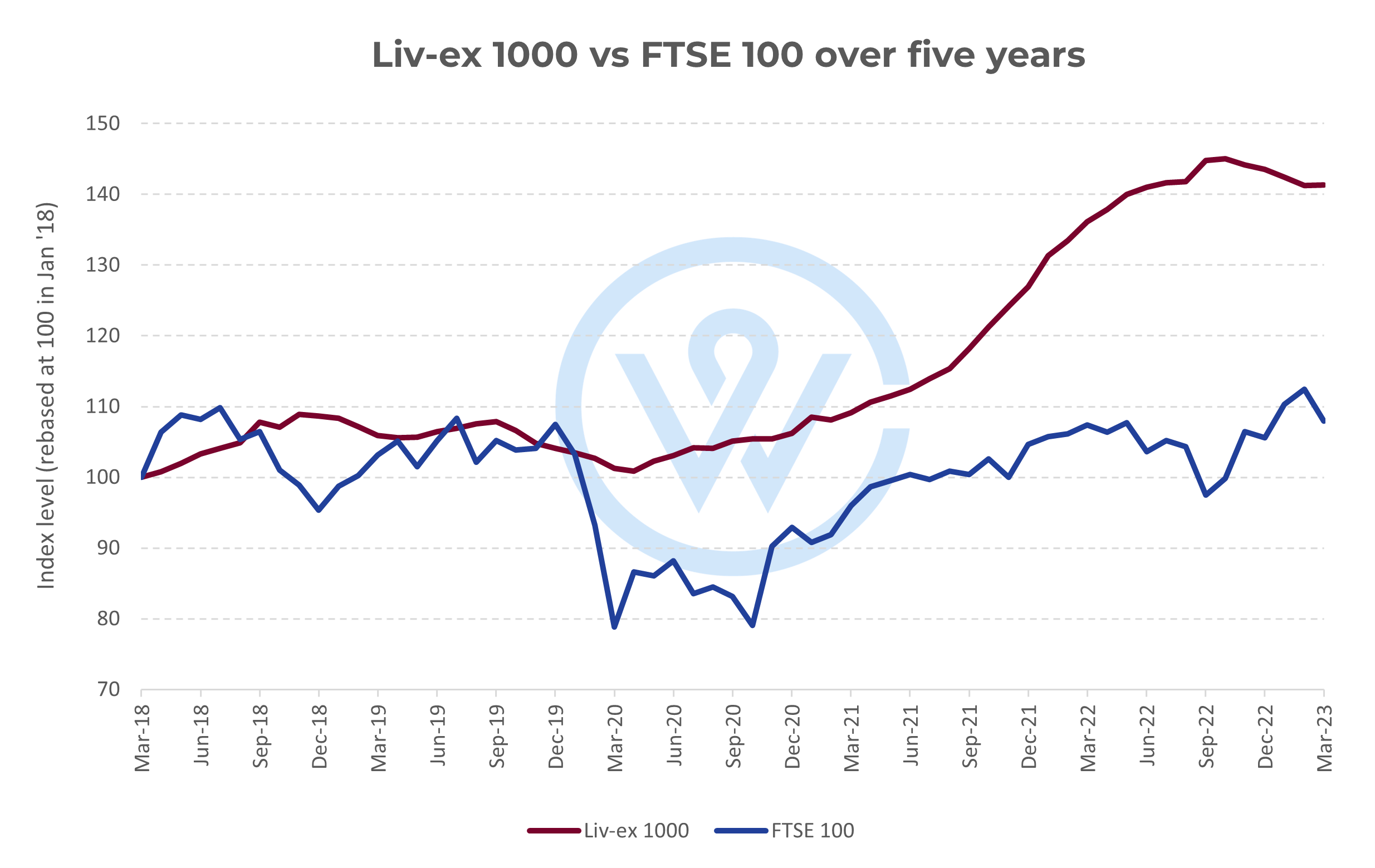

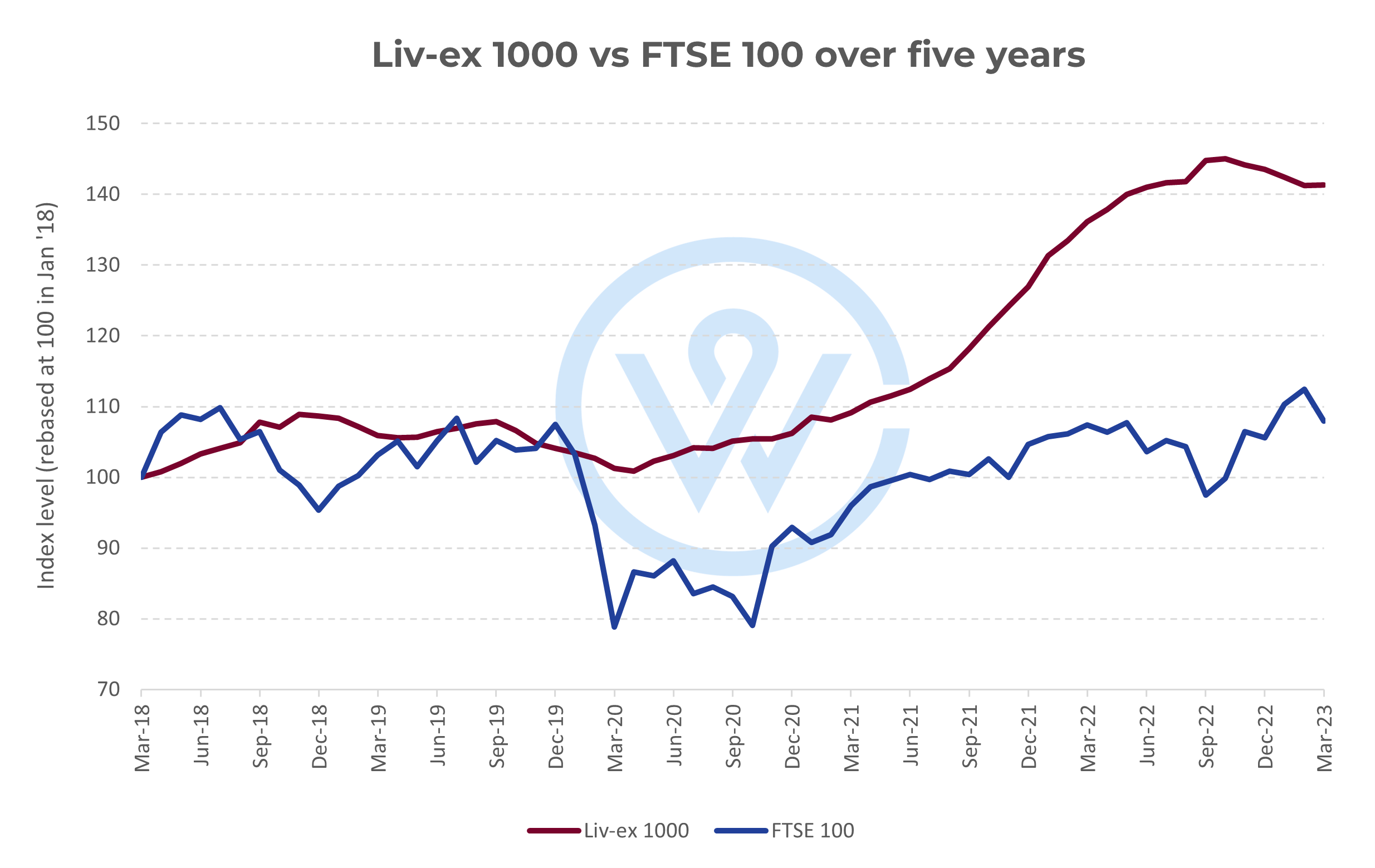

The steady returns can help to smooth overall portfolio volatility and reassure clients. According to an index that tracks the performance of 1,000 fine wines from different regions (Liv-ex 1000), investors have benefited from average returns of 40.3% over the past five years. By contrast, the FTSE 100 delivered just 4.8%. You can see the performance of your preferred wines here.

However, there are downsides. Although wine shields against inflation, it can be difficult to sell quickly. For clients who need to urgently access funds, this asset might not be ideal. What’s more, clients only realise returns after they sell. Unlike with bonds and shares, investors cannot enjoy gains and stay invested.

One solution for wealth managers could be to offer a mix of assets with different liquidity. For example, by combining fine wine, gold and inflation-linked bonds in one portfolio.

Sustainable energy

As the prices of raw materials tend to be the first to rise, commodities are often used to predict and hedge against inflation.

Traditionally this asset class includes oil and non-renewable energy sources. But with the rising regulations and scientific warnings, this may not be a wise or future-proof investment anymore. The EU, for example, is in the process of amending the Energy Efficiency Directive so that 45% of all European energy will be renewable by 2030. The Green Deal also imposes carbon taxes on dirty providers. Already, around 29% of the world’s energy comes from clean sources, and that figure is likely to increase over the long term.

While green energy can be higher risk, it’s not as precarious as non-renewables. In the same way that whale oil plummeted in 1860, investors left holding fossil fuel stocks in twenty years’ time could find themselves with stranded assets.

Inflation-linked bonds

Unlike other debt instruments, inflation-linked bonds are pegged to the recorded inflation levels. So, even in high-inflationary environments, they should retain their value.

A huge advantage of inflation-linked bonds is that they can usually be traded quickly. This could be helpful for wealth managers looking to balance out the illiquidity of fine wine or property.

However, the success of these assets hinges on the accuracy of the indices. Sometimes the consumer goods selected and measured can lead to artificial results. For example, the UK index contains DVD players and MP3 players. These are probably cheaper than they would have been a decade ago, but it is not because inflation is lower.

Affordable property

Property is a classic inflation-resistant investment. But what kind should today’s cautious investors go for? Property addressing the UK’s housing crisis could be fruitful. Despite strong demand, there is currently a shortage of over 4 million homes.

Another interesting area for low-risk investors to consider could be affordable student accommodation. Applications to universities tend to rise during recessions. After 2008, they increased 31% in the UK. And since 2020, they have reached record-levels. KPMG anticipate a 16% increase in the number of undergraduates searching for rooms by 2030.

The risk is relatively low, as in many cases, the accommodation will be handled and managed by the university itself. Yields for investors average at around 5% for London-based lets and 4% for accommodation outside the capital.

But a word of caution, the buy-to-let market is becoming less lucrative every day, with high interest rates and increasing regulations. In the current climate, some are wondering if the money would be better placed elsewhere.

Chartering a new course

Record-levels of inflation are transforming the investment landscape. What made sense yesterday no longer adds up today.

This article aims to help spark ideas for wealth managers. It presents five potential lower-risk investments, that also have famous inflation-shielding qualities.

As wealth managers re-balance portfolios and seek new assets, they can also make the world a better place. Now is the ideal time to incorporate social and environmental factors into the investment strategy. After all, to truly future-proof portfolios, we need a healthy planet.

Discover five ways fine wine investments are good for the environment.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.