- AI has emerged as a transformative force in investment management.

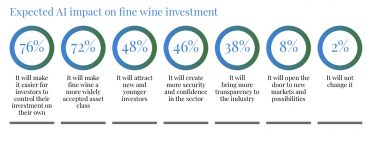

- 98% of UK wealth managers expect AI to have a significant impact on fine wine investment in the next five years.

- Key areas include greater investor control, wider market acceptance and improved transparency.

Artificial intelligence (AI) has emerged as a transformative force in investment management, reshaping industries through advanced data analysis, predictive modelling, and automation. From equities to property, AI-powered tools can process vast amounts of information, identify patterns, and spotlight opportunities with unprecedented speed.

The fine wine sector, traditionally reliant on expert opinion, historical market trends, and insider knowledge, is now at the cusp of a similar transformation. AI is set to redefine how fine wine is valued, traded, and perceived within investment portfolios. Only 2% of WineCap’s latest survey respondents believe AI will have no impact on fine wine investment in the next five years. This overwhelming consensus highlights the disruptive potential of AI and its role in increasing market efficiency, accessibility, and transparency.

So, how exactly is AI poised to reshape fine wine investment? Insights from industry participants highlight several key areas of transformation.

Greater investor control: A shift away from brokers?

The most significant impact predicted by 76% of respondents is that AI will make it easier for investors to control their investments independently.

Historically, fine wine investment has required expertise from brokers, consultants, and wine merchants who provide insights into market pricing, provenance, and expected returns.

However, AI-driven platforms might reduce reliance on intermediaries by offering investors real-time valuations based on live market transactions and historical performance, automated risk assessments and tailored portfolio strategies.

This shift means that both new and experienced investors will have more tools at their disposal to make informed decisions, potentially leading to a more democratised market.

Fine wine as a more widely accepted asset class

AI’s ability to provide data-backed insights is expected to enhance the credibility of fine wine as an alternative investment category. According to our survey, 72% of UK wealth managers believe AI will make fine wine a more widely accepted asset class.

Currently, one of the biggest barriers to institutional investment in fine wine is valuation inconsistency and market opacity. Unlike stocks, which trade on transparent exchanges, fine wine prices may vary across different auction houses and merchants.

AI can help solve this problem through improved risk modelling, more accurate valuation algorithms and enhanced demand forecasting to predict which wines will appreciate over time.

With these advancements, institutional investors and wealth managers will find it easier to allocate capital to fine wine, increasing its legitimacy alongside other alternative assets like gold and property.

Attracting a new generation of investors

Nearly 48% of our survey respondents believe AI will make fine wine investment more appealing to younger generations. This shift is critical as baby boomers – who have traditionally dominated fine wine collecting – begin to exit the market, and younger investors with a digital-first mindset step in.

AI-driven platforms might lower entry barriers for new investors by offering intuitive user interfaces similar to modern trading apps like Robinhood or Wealthfront and providing personalised investment recommendations based on user preferences and risk tolerance.

By enhancing accessibility, AI can help bring fine wine investment into the mainstream of digital wealth management, positioning it alongside equities and ETFs as a viable portfolio component.

Improved transparency in the fine wine market

Lack of transparency has long been a challenge for fine wine investors, making it difficult to track pricing trends, authenticate bottles, and assess liquidity risks. However, AI-powered analytics are poised to change this by introducing new levels of visibility and accuracy into the market.

According to the survey, 38% of respondents believe AI will bring greater transparency to the industry. Key improvements might include live tracking of historical price movements, enhanced authentication processes, and supply-chain analytics;

These improvements will increase investor confidence, reduce information asymmetry, and create a more efficient secondary market.

WineCap Wealth Report 2025: UK Edition

What does the future hold?

While AI is still in the early stages of adoption in fine wine investment, the technology is already proving its value by enhancing investor control, broadening market access, and increasing transparency. The next five years are likely to see even greater integration of AI into fine wine investment strategies. Potential developments include blockchain integration, predictive analytics, and automated trading platforms.

As the fine wine investment landscape evolves, those who embrace AI-powered insights will gain a competitive edge, benefiting from greater market clarity and data-driven decision-making. The fine wine sector is on the brink of a technological revolution – one that could reshape how investors interact with and perceive this centuries-old asset class.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.