- Burgundy prices continued to spiral downwards in January, falling 3.7%.

- This created a challenging backdrop for the unfolding Burgundy 2022 campaign, which saw about 10% of producers reduce pricing year-on-year.

- The current market dynamics offer investors a unique window to enrich their collections with both new gems and proven performers.

Burgundy took the spotlight at the beginning of the year with the unfolding 2022 En Primeur campaign. Already in our Q4 2023 report, we questioned the potential of the new releases to stimulate an otherwise dormant market. On the one hand, there was the excitement of the new mixed with high quality and quantity playing to the campaign’s advantage; on the other, much depended on pricing.

Market conditions and pricing challenges

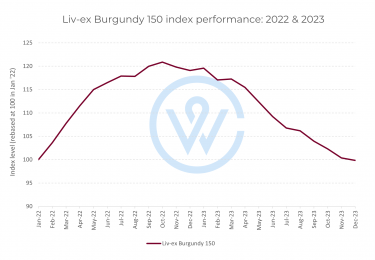

Burgundy prices continued to spiral downwards in January, with the Liv-ex Burgundy 150 index starting the year with a 3.7% decrease. To say that this created a challenging backdrop for the new releases would be an understatement. Prices at release had to come down.

And partially they did. According to Liv-ex, about 10% of the top producers ‘lowered their prices year-on-year’. However, ‘about 40% raised their prices, even if only modestly’. Thanks to greater quantities, allocations were mostly restored.

Burgundy 2022 – ‘a treasure trove’

As the first releases landed, Burgundy 2022 enjoyed a positive reception from critics and trade. Neal Martin (Vinous) advised that ‘if your favourite growers’ price tags seem fair, then I would not hesitate diving in’. He described the 2022 vintage as ‘Burgundy’s latest trick: a treasure trove of bright ‘n bushy-tailed whites and reds in a season that implied such wines would be impossible, wines predestined to give immense drinking pleasure’.

Investment perspective and older vintages

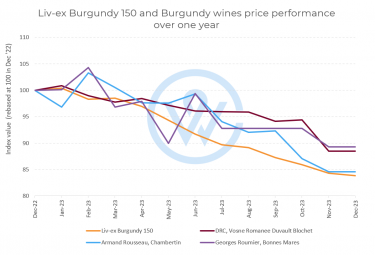

However, prices for older vintages remain under pressure, creating buying opportunities for already physical and readily available wines. For instance, three of Burgundy’s outstanding long-term wine performers have all seen dips between 15% and 10% in the last year. Over the last decade, however, DRC Vosne-Romanée Cuvée Duvault Blochet is up 388%; Georges Roumier Bonnes Mares – 339%, and Armand Rousseau Chambertin – 279% on average.

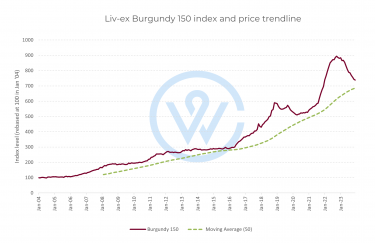

Meanwhile, the Burgundy 150 index has decreased 16% in the last year. Still, the overall long-term index trajectory remains upwards, as the chart below shows.

Searching for value

The current market dynamics offer investors a unique window to enrich their collections with both new gems and proven performers across older physically available vintages.

When it comes to the latest, the Burgundy 2022 En Primeur campaign presents a complex tapestry of quality, quantity, and pricing amidst challenging market conditions. Despite initial price pressures, the adjustments made by producers and the positive critical reception underscore the potential of the new releases. Neal Martin’s endorsement further elevates the vintage, suggesting that for the discerning buyer, Burgundy 2022 provides not just immediate drinking pleasure but also long-term investment opportunities.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.