- Grape quality and winemaking are central to vintage calibre.

- The importance of the vintage varies according to the region.

- An ‘average’ vintage can also increase in value.

‘A year of extremes’, ‘good yields’, ‘a cool start and wet finish’, ‘poor’, ‘outstanding’. These are typical phrases that describe the character of a particular vintage – but how do they, ultimately, translate into quality? Anyone interested in wine investment needs to be aware of the vintage impact on price and performance.

This article explores the factors that shape a ‘great vintage’ – from vineyard conditions to winemaking methods. Key figures at Bordeaux estates also weigh in with their comments on their preferred vintages from their châteaux.

What does vintage mean?

The vintage indicates the year grapes were harvested. The wine made from such fruit reflects the weather conditions that the vine growth cycle experienced. Features like terroir and winemaking methods also impact the quality and character of a wine. However, winemakers often comment that wine is made in the vineyard meaning that the condition of the fruit is the dominant factor in a wine’s profile, cellar-worthiness and, ultimately, value.

Is vintage always important?

The vintage year is of vital importance in some regions but of little significance in others. This depends on the local climate.

If a climate features variable weather conditions each season, the resulting wine will display different traits every year. For example, in one particular year, grapes could contain higher or lower acidity than in previous vintages, more or less fruit concentration, or different sugar levels. Such factors affect the quality and identity of the wine, its age-worthiness, its valuation and the potential for this valuation to grow.

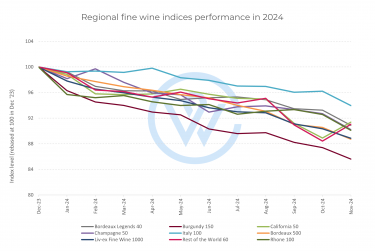

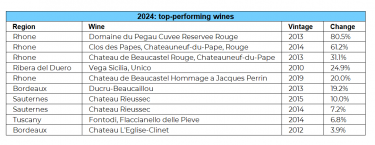

Regions where weather conditions are inconsistent year-on-year include Bordeaux, Burgundy, Champagne, the Rhône Valley, Napa Valley, Tuscany, and parts of Australia. This is why vintages from these areas frequently feature in discussion on drinkability, ageing potential and wine investment opportunities.

In places where climate and weather are more stable and wine character more uniform, vintage is, generally, less important. Such wine-producing countries and regions include Argentina, Chile, Spain, parts of California and New Zealand.

What factors influence a vintage’s quality?

The natural factors that contribute to the quality of a particular vintage include optimal weather conditions. Throughout the growth cycle of the vine, a balance of adequate rainfall, warm and dry conditions during the growing season, and cool nights aid the development of quality fruit. This means that the harvested berries contain an ideal balance of acidity, sugars, and tannic potential for the style of wine being made. Extremes like frost, hail, heatwaves and heavy rain can negatively impact the delicate equilibrium of these features, influencing the calibre of the wine.

On the occasions when all environmental conditions line up harmoniously, the result is exceptional fruit and what is often referred to as a ‘legendary’, ‘exceptional’ or ‘outstanding’ vintage. Such years are rare and, therefore, memorable with resulting wines much sought after.

The human influence on vintage quality encompasses a wide spectrum of vineyard practices that are utilised whenever necessary to mitigate unfavourable weather. Skilled vineyard management includes:

- Protection against frost with vineyard heating strategies.

- Organic and/ or biodynamic practices that can affect wine quality and potential.

- Disease pressure tackling to help prevent damaging vine ailments like rot or mildew.

- Hydric stress or excess rainfall management implemented at key stages to ensure balanced grape flavour concentration.

- Canopy management and foliage thinning to enhance grape quality.

- Timely harvest for optimal flavour and ripeness balance.

These vineyard approaches are the outcome of years, decades and even centuries of vinicultural experience and constitute part of the heritage of each wine region, adding to a vintage’s esteem and worth. Winemaking expertise similarly contributes to enhancing the value of a vintage.

Can vintage value evolve?

In wine investment, the value of a vintage is not necessarily fixed. While great vintages tend to enjoy ongoing value growth, other years can also display value development potential.

In short, while vintage is an anchor for a wine’s value in regions where it is a factor, it does not bear the sole influence on valuation. Other important determinants include:

- Provenance

- Age-worthiness

- Producer/ winemaker/ brand reputation

- Critic scores

- Storage conditions

- Scarcity

- Market trends

The Bordeaux perspective

WineCap asked Bordeaux winemakers which of their own vintages they would purchase and why. The replies illustrated some of the elements that make a great vintage.

Stéphanie de Boüard-Rivoal, co-owner and CEO of Château Angelus spoke of cellaring potential. ‘I would get a 2016,’ she said. ‘It is an incredible vintage, particularly for its depth, its complexity, and 100 years plus aging potential’.

Nicolas Audebert, winemaker and General Manager of Second Growth Château Rauzan-Ségla in Margaux mentioned how a vintage with a small crop led to an unexpectedly notable wine. ‘The concentration, the roundness, juiciness and intensity of the fruit in the 2018 is fantastic. It is a little bit outside of the classic, elegant style of Rauzan and Margaux, but so interesting in the reflection of the climate we had that year’.

Aline Baly, co-owner of Château Coutet, in the Barsac appellation highlighted excellent conditions and vineyard management for her choice: ‘The 2009 vintage is a combination of exceptional weather and exceptional work in the vineyard’.

For General Manager of Saint-Émilion Grand Cru Classé, Château La Dominique, Gwendoline Lucas, provenance and reputation were key to her vintage selection. ‘That would be 2019, because it’s the first vintage we created with Yann Monties, the technical director and also it is the 50th vintage for the Fayat family because they bought the château in 1969. So it is a very good vintage in terms of quality, but also full of history’.

Rarity and value-for-money drove the choice for Stéphane von Neipperg, owner of Château La Mondotte, a Premier Grand Cru Classé house in Saint Emilion. ‘It is very difficult to find 2009 of La Mondotte, but a very outstanding vintage if you want to invest in it in the future. Also, it is not so expensive’.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.