- A diversified wine portfolio spreads the risk across different wines and regions.

- Each wine region has its own unique characteristics, and its performance is largely influenced by its own market dynamics.

- Investors can also diversify their portfolio by vintages, including older wines for stability and new releases for growth potential.

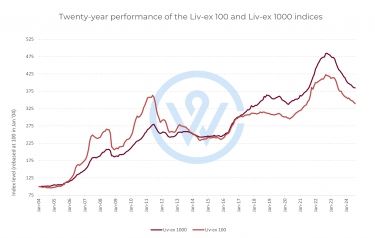

Fine wine is a popular investment for those seeking diversification and long-term growth. However, like any investment, building a successful fine wine portfolio requires strategic planning and a thorough understanding of the market.

This article explores key strategies for creating a balanced, diversified fine wine portfolio, and why it is important to include a variety of regions, brands and vintages.

Why diversification is key

As renowned economist Harry Markowitz put it, ‘diversification is the only free lunch in finance’.

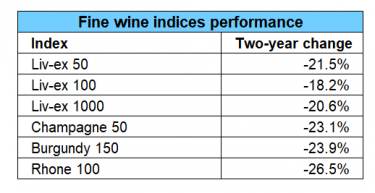

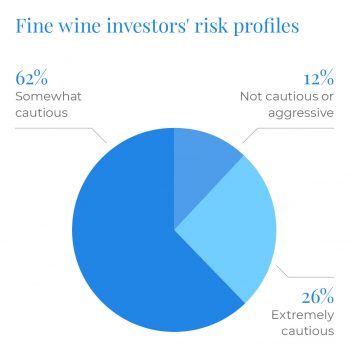

Diversification is fundamental to risk management in any portfolio, and fine wine investment is no exception. A diversified wine portfolio helps to reduce the impact of volatility, allowing investors to maximise returns by spreading risk.

While some wines may deliver higher returns, others can contribute to portfolio stability, as different regions tend to perform in cycles. This is why building a balanced fine wine portfolio requires selecting wines from a variety of regions, vintages, and holding periods.

Diversifying by regions

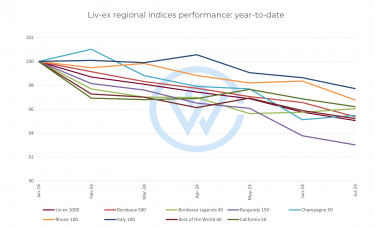

Wine regions around the world offer unique characteristics, each with its own market dynamics. Including wines from multiple regions can help balance and strengthen an investment portfolio.

Some primary regions to consider include:

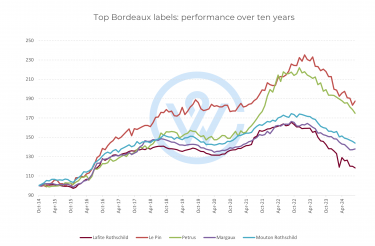

Bordeaux: Bordeaux is undoubtedly the leader in the fine wine investment landscape, taking close to 40% of the market by value. The First Growths are its most liquid wines. In general, the classified growths are a staple in investment portfolios due to their established reputation and consistent performance.

Burgundy: Burgundy, driven by scarcity and rarity, is an investors’ paradise that has been trending in the last decade. Prices for its top Pinot Noir and Chardonnay have reached stratospheric highs and the region consistently breaks auction records.

Champagne: A market that attracts both drinkers and collectors, Champagne has enjoyed rising popularity as an investment in the last five years, thanks to strong brand recognition, liquidity and stable performance.

Italy: Italy continues to provide a mix of value, growth potential, and great quality. Its two pillars, Tuscany and Piedmont, are often included in investment portfolios for their balancing act – if Tuscany provides stability, top Barolo and Barbaresco tend to deliver impressive returns.

California: Top Napa wines are among the most expensive in the market, while also boasting some of the highest critic scores, particularly from the New World.

Emerging investment regions: As the market broadens, wines from other well-established regions are gaining traction in the investment world. Germany, Australia, and South America are some of the countries bringing a new level of diversity that can sometimes lead to higher returns.

Choosing vintages strategically

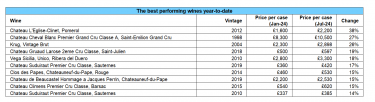

A well-diversified investment portfolio focuses on a range of vintages, as well as labels.

While older vintages offer stability and a more predictable market performance, younger vintages have a greater growth potential as they mature.

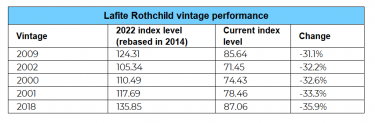

Older prime vintages: ‘On’ vintages, specific to each region, like Bordeaux’s 2000 or 2005, tend to have stable pricing due to their high quality and reputation. Including these in your portfolio can provide a foundation of reliability.

Younger vintages: Wines from recent years with high-quality (such as Bordeaux 2019) can offer growth potential over the long-term. As these wines age, their value often appreciates, providing long-term returns for investors willing to hold them.

Off-vintages: Investing in lesser-known or ‘off’ vintages can be worthwhile, particularly if the producer has a strong reputation. These wines are often priced lower but can perform well over time. Typically though not always they have a shorter holding period.

At the end, it is always a question of quality and value for money.

Balancing short-term and long-term holdings

Fine wines vary in their optimal holding periods. Some wines reach peak quality and market value sooner, while others require decades of ageing. Creating a mix of wines with different holding periods allows for both short-term liquidity and long-term growth.

Short-term hold wines: These are typically wines from lesser-known producers, high-demand recent vintages or off vintages bought during periods of market correction. These wines can be sold within a few years for a quick return.

Long-term hold wines: Wines from top producers, especially those known for longevity, are best held for 10+ years. For example, a Château Lafite Rothschild or Domaine de la Romanée-Conti can offer three figure returns if held over decades.

Active management for maximising portfolio success

Diversification is just one piece of the puzzle. Regular monitoring and occassional adjustments are essential for maximising returns in a fine wine portfolio.

Market conditions and wine values change over time, so staying informed and making adjustments ensures your portfolio remains aligned with your financial goals. Using tools like Wine Track or consulting with a wine investment advisor can provide valuable insights for rebalancing and enhancing your investment strategy.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.